A Promising Future for First-Time Buyers in the UK Housing Market

The UK housing market is gearing up for what many analysts predict will be a remarkable year in 2024 for potential homeowners, particularly first-time buyers. Recent data reveals a significant increase in the total value of homes currently in the sales pipeline, now reaching £113 billion, indicating a buoyant market ready for a resurgence.

The surge in the housing market is evident in recent sales data.

Rising Sales and Increased Affordability

The latest House Price Index from Zoopla highlights that the combination of rising incomes and lower mortgage rates has sparked the highest level of new sales since late 2020. Notably, the average time it takes for terraced houses to secure a buyer is currently just 51 days, underscoring the swift pace of activity in the market. The sustained rise in new sales means that, as of now, there are an impressive 306,000 homes undergoing the buying process, which is 26% higher compared to last year.

This uptick in activity is supported by the recent dip in mortgage rates, which are at their lowest in two years. With the cost of renting rising by 5%—now averaging £1,170 per month—many first-time buyers are discovering that owning a home is not only feasible but also significantly cheaper than renting. Indeed, mortgage repayments are currently 17% lower than renting costs, making homeownership more accessible than ever.

House Prices: A Slow But Steady Climb

While the overall growth of house prices has seen a modest uptick of 1%, the landscape varies widely across different regions. For instance, areas like the North-East, Yorkshire & Humberside, and Northern Ireland are witnessing above-average price increases, while regions such as Eastern England and the South-East are seeing slight declines. This regional disparity means potential buyers have varied opportunities depending on their location, making timely decisions crucial.

First-time buyers are increasingly driving the market’s momentum.

First-Time Buyers: The Market’s Driving Force

The most striking aspect of the current property landscape is the emergence of first-time buyers as the largest segment in the market, predicted to account for 36% of all sales in 2024. This shift reflects not only changing economic conditions but also a shift in buyer sentiment as more individuals opt to step into homeownership amidst rising rents and stabilizing mortgage rates. The average monthly mortgage payment now stands at £972, a significant reduction that enhances affordability and encourages homeowners. However, potential buyers still need to contend with market dynamics and the challenge of saving for a hefty deposit, which remains a barrier for many.

The Impact of Stamp Duty Changes

An important topic on the horizon is the potential return of stricter stamp duty regulations in the upcoming Budget, which could pose challenges for first-time buyers. Currently, 80% of first-time buyers enjoy relief from stamp duty on homes priced up to £425,000. However, if thresholds revert to previous levels, an additional 20% of first-time buyers may find themselves liable for stamp duty payments. This policy change could result in thousands of pounds extra to pay in areas where property prices have surged, particularly in southern regions, including London.

Richard Donnell, Executive Director at Zoopla, emphasizes the importance of supporting first-time buyers. He notes, “While it’s positive to see sustained sales activity, any potential changes in stamp duty relief will only increase barriers for those already struggling with affordability.”

Balancing Growth with Economic Stability

As the market gears up for what appears to be a promising year ahead, experts caution that policies should not disrupt the equilibrium that has recently been established. The focus should instead be on creating economic growth that fosters job creation and rising incomes. This approach would not only benefit buyers but also contribute to the overall health of the housing market.

The landscape ahead may indeed be favorable for first-time buyers and existing homeowners alike, provided that future economic policies support ongoing stability. The secondary market, which includes homeowners who have delayed selling, could also see increased activity as mortgage rates continue to remain attractive.

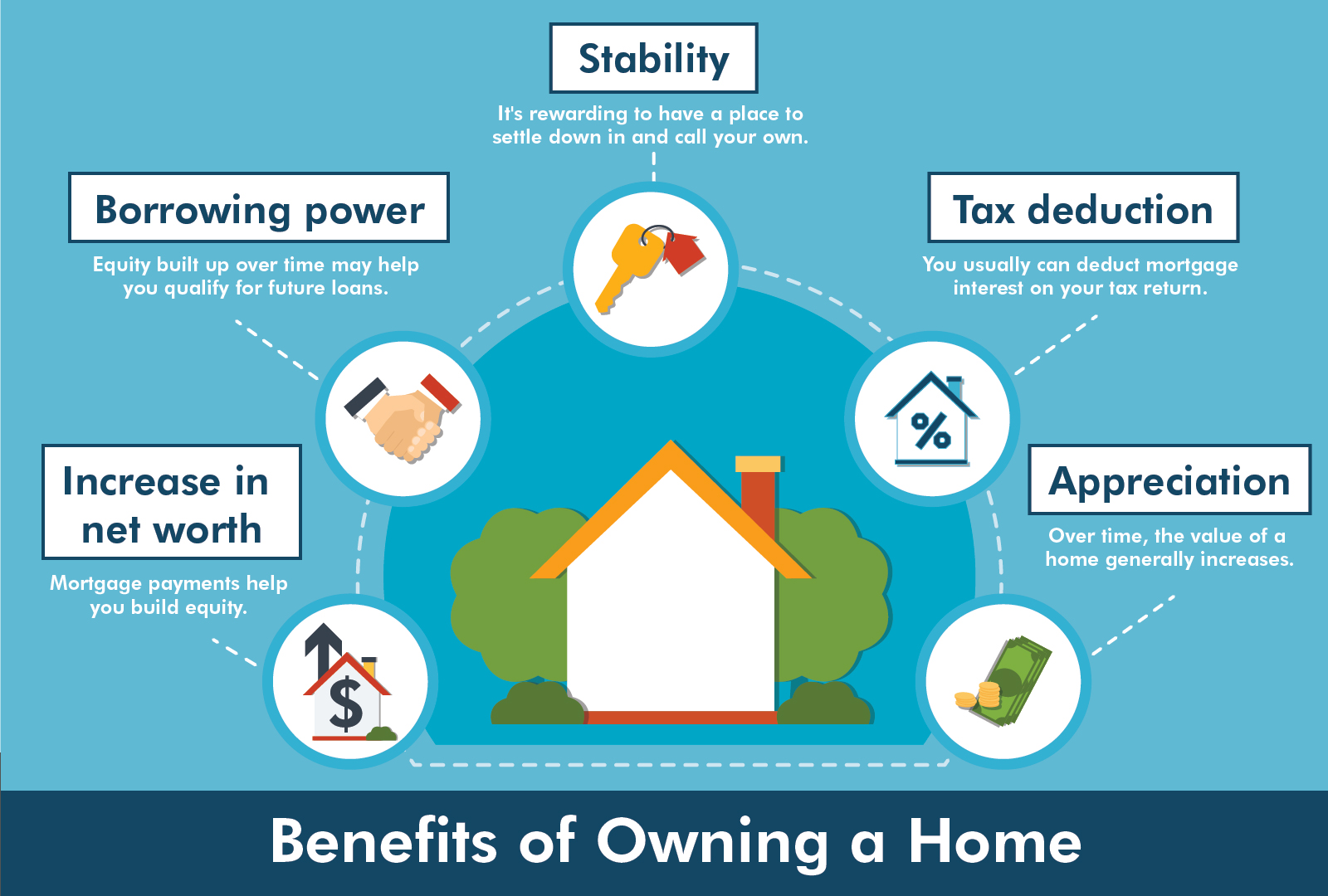

Homeownership brings not just financial benefits but also personal fulfillment.

Homeownership brings not just financial benefits but also personal fulfillment.

Conclusion

In summary, 2024 is shaping up to be a noteworthy year for the UK housing market, especially for first-time buyers. With the right economic policies and a continual shift towards affordability, the prospect of homeownership is gradually becoming a reality for many. However, vigilance against possible regulatory changes is essential; the focus should be on facilitating home buying, not hindering it through taxation. As more individuals look to achieve the dream of homeownership, the evolving market provides a fertile ground for growth and opportunity for all.

For more insights on navigating the housing market, check out best savings rates tables or use a Mortgage Calculator to understand your options better.