Interest Rate Cuts Urged Amid Soaring Mortgage Costs

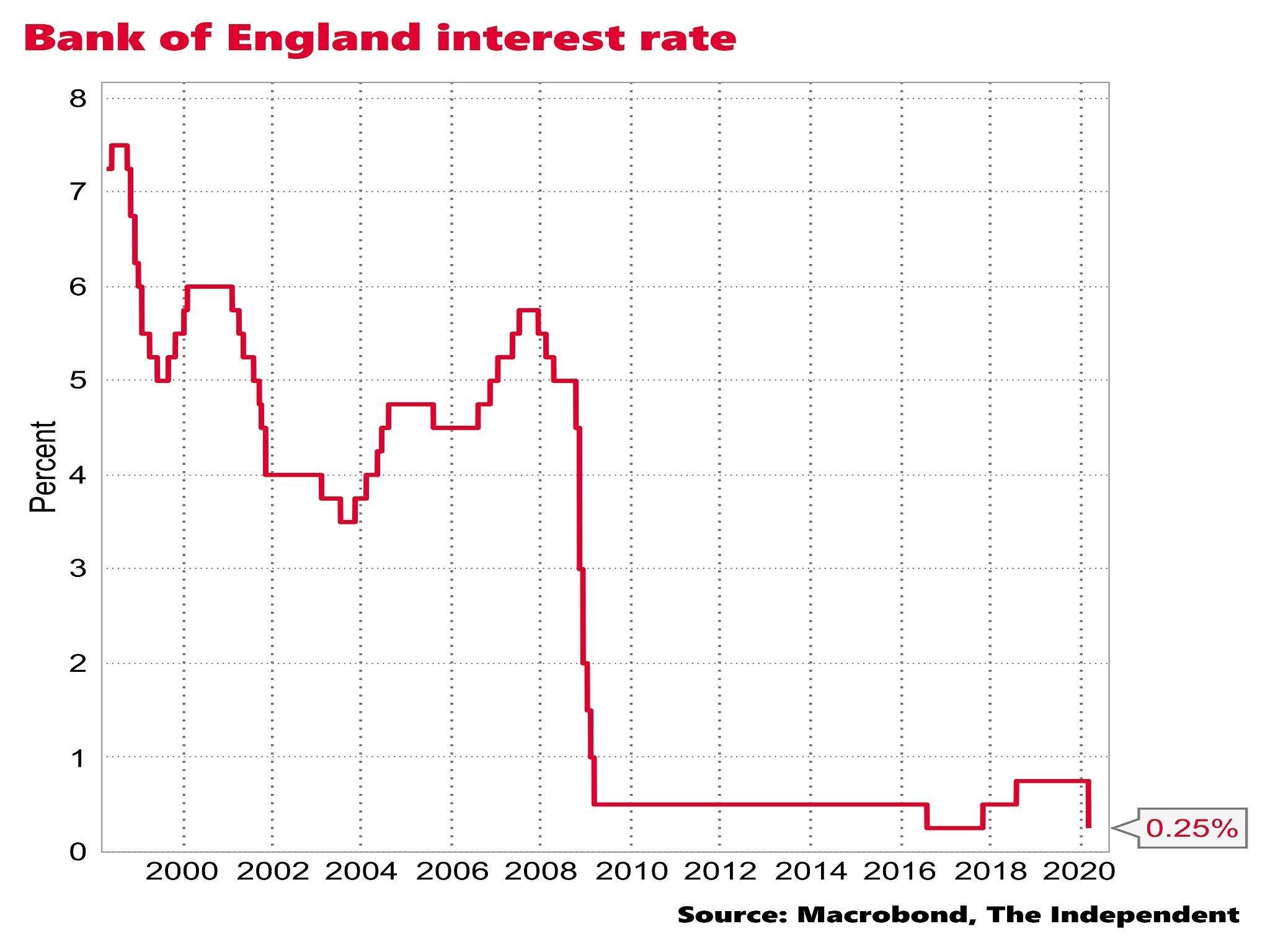

The Bank of England is under pressure to cut interest rates following a surge in mortgage costs over the past month. A group of independent economists, known as the Shadow Monetary Policy Committee, has called for interest rates to be cut substantially and immediately.

UK interest rates have been held at 5.25% since August last year.

UK interest rates have been held at 5.25% since August last year.

The high interest rates have resulted in soaring mortgage repayment costs for homeowners. According to Rightmove, the average five-year fixed mortgage rate is now above 5% for the first time since January, while the average two-year fixed mortgage rate currently stands at 5.41%, up from 4.84% a year ago.

“The Bank of England was too slow raising rates when inflation was rising because it missed the clear message from rapid growth in the money supply data. It has made a similar mistake in recent months but in the opposite direction: money supply has contracted or grown only far too slowly for many months, yet the Bank has failed to cut rates.” - Dr Andrew Lilico, chair of the Shadow Monetary Policy Committee and executive director of Europe Economics.

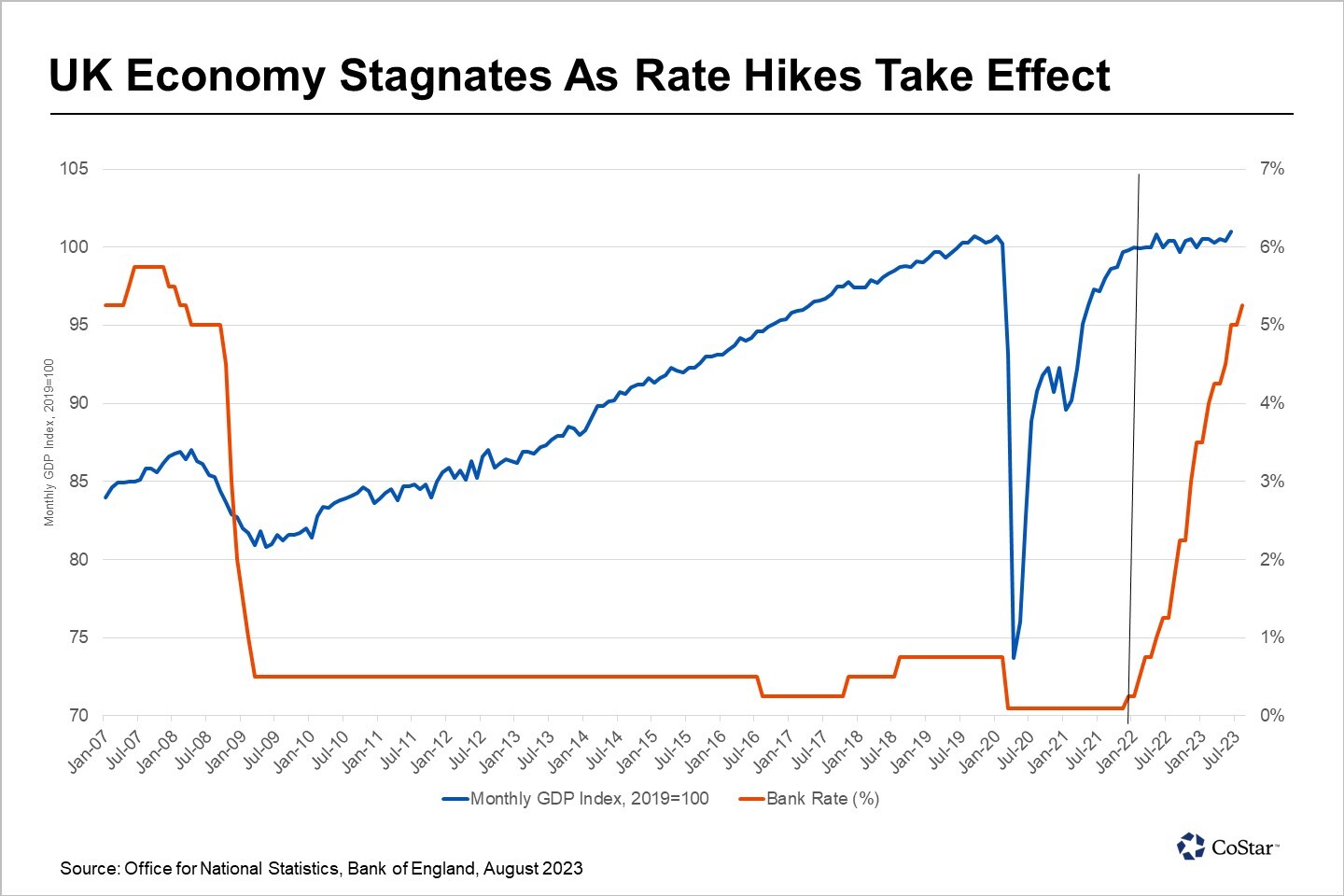

The Shadow Monetary Policy Committee argues that the UK faces a period of weak growth or even recession if the Bank fails to cut rates aggressively. The committee believes that having successfully curbed inflation, the Bank risks doing serious economic damage by keeping rates too high for too long following a slowdown in the money supply.

Mortgage repayment costs have soared in recent months.

Mortgage repayment costs have soared in recent months.

The committee expressed concern that the Bank of England has not adequately responded to inflation rates, which are considerably below the Bank’s expectations and set to fall below the Bank’s 2% target imminently. The slowdown risk is driven by the lack of growth in the broad money supply (M4), which turned negative last year, indicating a contraction in credit availability.

To boost money supply growth to a stable 4-5% level, members also urged an immediate end to Quantitative Tightening – the process of selling bonds to shrink the money supply and push up long-term interest rates.

The consensus view is that the Bank of England needs to shift its monetary policy stance without delay to support the economy and prevent a damaging undershoot of the inflation target.

The UK economy faces a period of weak growth or even recession if the Bank fails to cut rates aggressively.

The UK economy faces a period of weak growth or even recession if the Bank fails to cut rates aggressively.

The Bank of England’s decision to keep interest rates at 5.25% could severely hurt the UK’s growth prospects. The Shadow Monetary Policy Committee’s call for an immediate rate cut is a warning to the Bank to take action to prevent a damaging slowdown in the economy.