Bank of England’s Outgoing Deputy Governor Hits Back at Critics

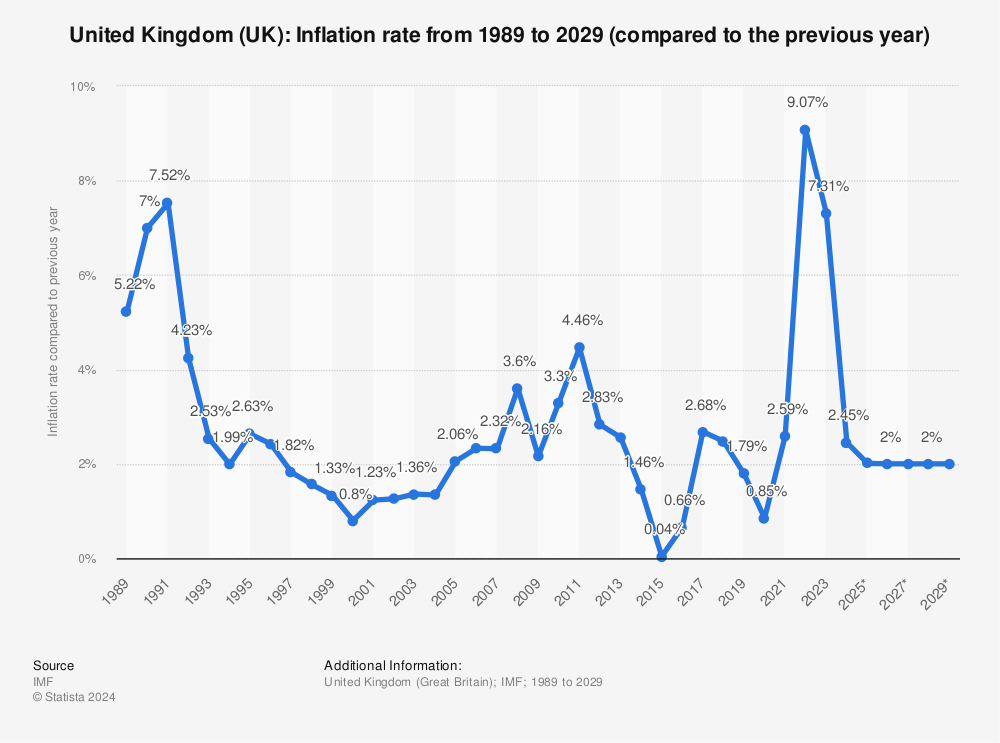

The Bank of England’s outgoing deputy governor, Ben Broadbent, has dismissed claims that the central bank failed to tackle inflation, calling such accusations “absolute tripe.” Broadbent’s comments come as the UK’s inflation rate continues to fall, with the latest figures showing a rate of 2.3% in April.

Inflation rates in the UK have been steadily decreasing

Inflation rates in the UK have been steadily decreasing

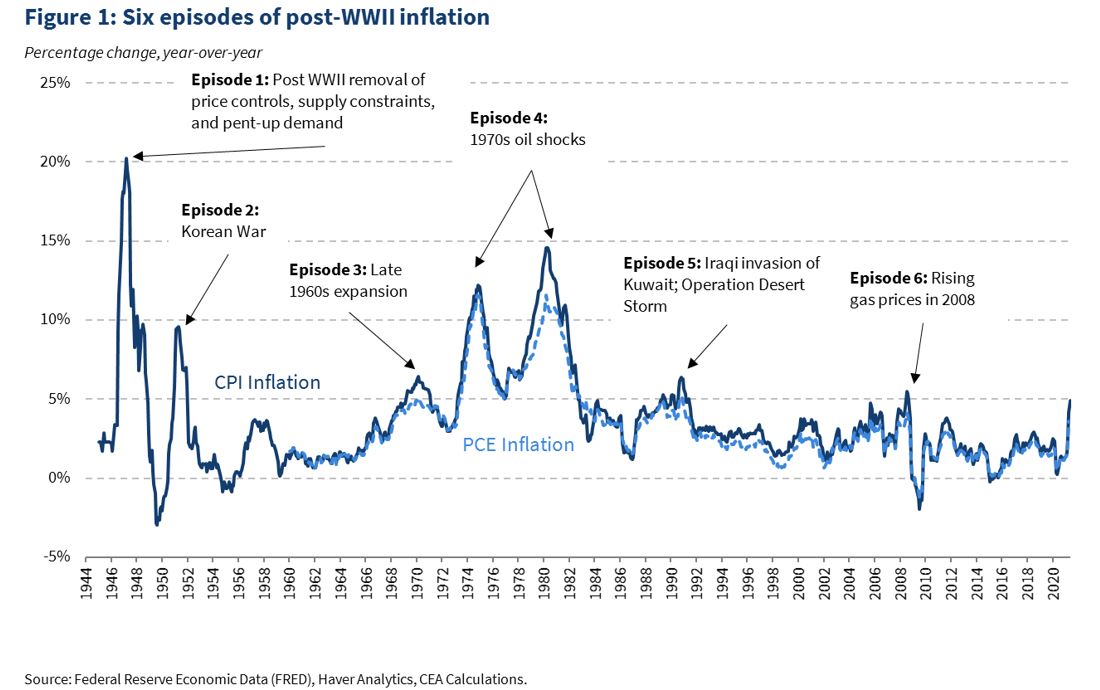

Broadbent’s defense of the Bank of England’s monetary policy committee (MPC) comes amidst criticism that the committee’s members, who share similar backgrounds, failed to foresee surging inflation over the past three years. However, Broadbent argues that the economic hibernation caused by the pandemic exposed the limits of normal macroeconomics, making it difficult for forecasters to predict the surge in inflation.

The pandemic’s impact on the economy

The pandemic’s impact on the economy

Furthermore, Broadbent points out that Russia’s invasion of Ukraine provided a second unforeseen inflation shock, which further complicated the economic landscape. Despite these challenges, Broadbent notes that the UK’s inflation rate is “getting there” and nearing the Bank of England’s 2% target.

The UK’s inflation rate is nearing the Bank of England’s 2% target

The UK’s inflation rate is nearing the Bank of England’s 2% target

However, Broadbent cautions that this does not necessarily mean that rate cuts need to be made immediately. His comments come as he prepares to leave the MPC after 13 years, with Clare Lombardelli, the chief economist at the Organisation for Economic Co-operation and Development, set to replace him on July 1.

Ben Broadbent, outgoing deputy governor of the Bank of England