Bank of England Cuts Interest Rates to 4.75%

The Bank of England has officially reduced interest rates to 4.75%, in a move anticipated by many market analysts. This serendipitous timing follows a significant drop in inflation, which has now fallen below the Bank’s target of 2% for the first time in more than three years. With this recent cut, the Monetary Policy Committee (MPC) has reduced rates twice this year, after maintaining a prolonged stance at a 16-year high of 5.25% before these adjustments.

Economic Outlook

As the economic landscape shifts, all eyes are now on the US Federal Reserve’s upcoming announcement. The MPC’s next meeting is scheduled for 19 December, where economists and market watchers will eagerly await further commentary and insights into the monetary policy trajectory going forward.

Annuity Rates and Mortgages

The potential implications of reduced interest rates on annuity rates could be significant; experts suggest a downturn may arise following the latest rate cut. In surprising contrast, there’s a cautionary note as mortgage rates may see an upward trend, especially considering the looming Autumn Budget and the political climate in the lead-up to the US elections. This could prompt lenders to increase their fixed mortgage rates, leaving borrowers with mixed messages.

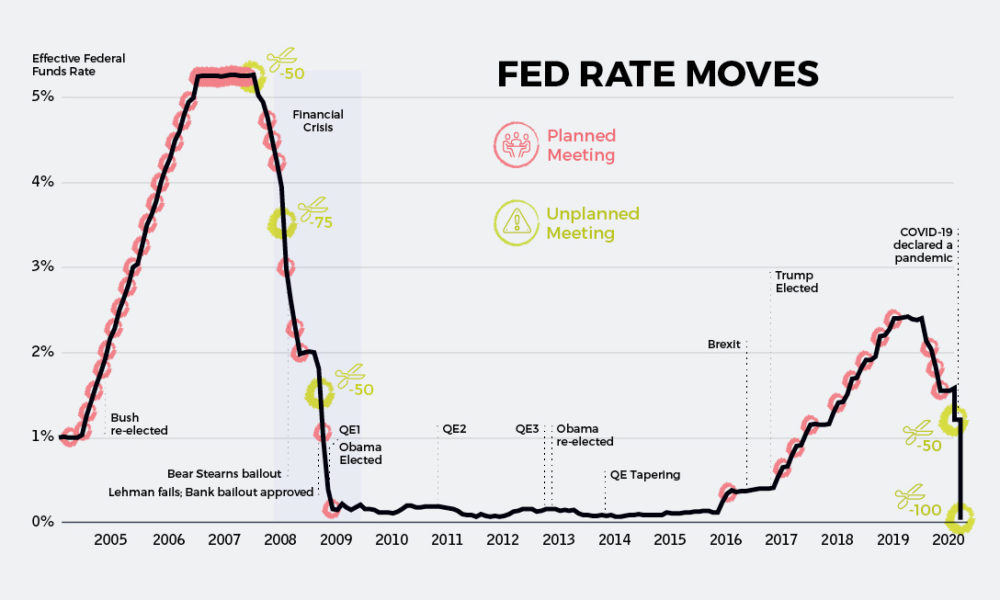

An overview of changing interest rates across the UK.

An overview of changing interest rates across the UK.

Savings Rate Predictions

Savers could face a challenging period ahead, as rates are forecasted to dip. Current averages indicate the following rates:

- Easy-access saver: 3.03%

- Easy-access ISA: 3.23%

- One-year fixed saver: 4.22%

- One-year fixed ISA: 4.07%

The savings landscape is changing, and consumers must stay informed about any shifts that could affect their returns.

Implications for UK Equities

From an investment perspective, a reduction in interest rates is generally expected to favor domestically-focused UK businesses more than the large international corporations listed in the FTSE 100 index. Accordingly, financial analysts will be assessing how this could impact both domestic and international market positions.

“Today’s rate cut was nailed on, but households may have to be more patient for borrowing costs to fall over the next year.” – Ed Monk, Fidelity International

Summary of MPC Meeting

During the MPC meeting, there was a decisive 8-1 vote in favor of the recent rate cut, with discussions highlighting widespread concerns regarding inflation and the trajectory of economic growth. This decision underscores the complex balancing act the Bank of England faces in navigating an uncertain economic future.

Potential Rate Movements

Looking ahead, analysts remain skeptical about the frequency of future rate cuts, with expectations indicating only a couple could materialize in 2025. The specter of inflation remains a concern, especially as the recent Autumn Budget could introduce factors that heighten inflationary pressures.

Chart showing recent economic indicators related to interest rates.

Chart showing recent economic indicators related to interest rates.

For those seeking detailed comparisons on savings accounts, it’s imperative to monitor the rapidly fluctuating rates as banks adjust to the new economic conditions.

Conclusion

In summary, the Bank of England’s recent decision to lower interest rates is set against a backdrop of tenuous economic growth and cautious inflationary expectations. Stakeholders across the financial landscape—ranging from borrowers to investors—will need to adapt as the ramifications of these changes unfold, emphasizing the importance of keeping informed in this volatile environment.