Barclays Profits Plummet 12% as UK Interest Rates Hit Mortgage Demand

Barclays profits take a hit as UK interest rates rise

Barclays profits take a hit as UK interest rates rise

Barclays has reported a 12% drop in profits in the first quarter, as higher UK interest rates have led to a decline in demand for mortgages and loans. The bank’s pre-tax profits fell to £2.3 billion, down from £2.6 billion last year.

The UK bank has been under pressure to raise interest rates for savers, putting a further squeeze on its income. Competition has also been tough, resulting in customers placing their cash with more generous rivals, and a 2% drop in deposits at Barclays.

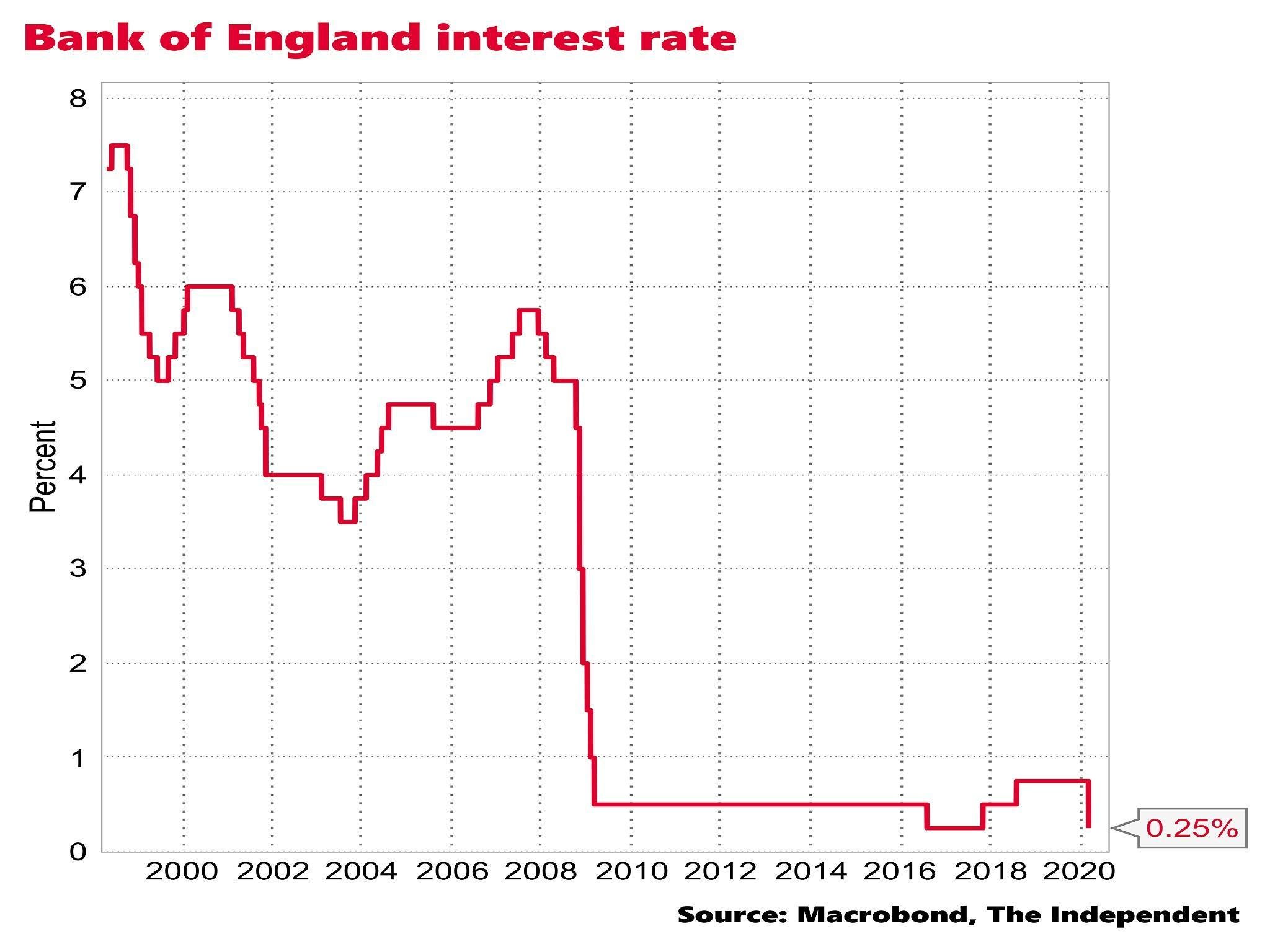

“While UK interest rates have risen to 5.25%, allowing banks to charge more for loans and mortgages, the resulting pressure on households has dampened appetite for borrowing.” - Barclays spokesperson

The bank’s net interest income, which accounts for the difference between money made from loans and money paid out for savings, at its UK bank fell 4% to £1.5 billion.

However, slightly brighter forecasts for the UK economy meant Barclays only put aside £58m for potential defaults, compared with £113m last year.

UK interest rates on the rise

UK interest rates on the rise

The bank’s investment arm was also hit by a backdrop of economic uncertainty, which has led to a decline in profits.

Barclays investment arm feels the pinch

Barclays investment arm feels the pinch

Despite the challenges, Barclays remains optimistic about the future, citing a strong pipeline of new business and a solid balance sheet.

Barclays looks to the future

Barclays looks to the future

As the bank navigates the current economic landscape, one thing is clear: the impact of rising interest rates on mortgage demand is a trend that’s here to stay.

Mortgage demand takes a hit

Mortgage demand takes a hit

In this uncertain environment, Barclays will need to adapt quickly to stay ahead of the competition.

Barclays must adapt to stay ahead

Barclays must adapt to stay ahead