Barclays Profits Plummet as High UK Interest Rates Take Toll

Barclays has reported a 12% decline in profits during the first quarter, as high UK interest rates have slammed its mortgage and loan business, exacerbated by ongoing economic uncertainties affecting its investment banking operations.

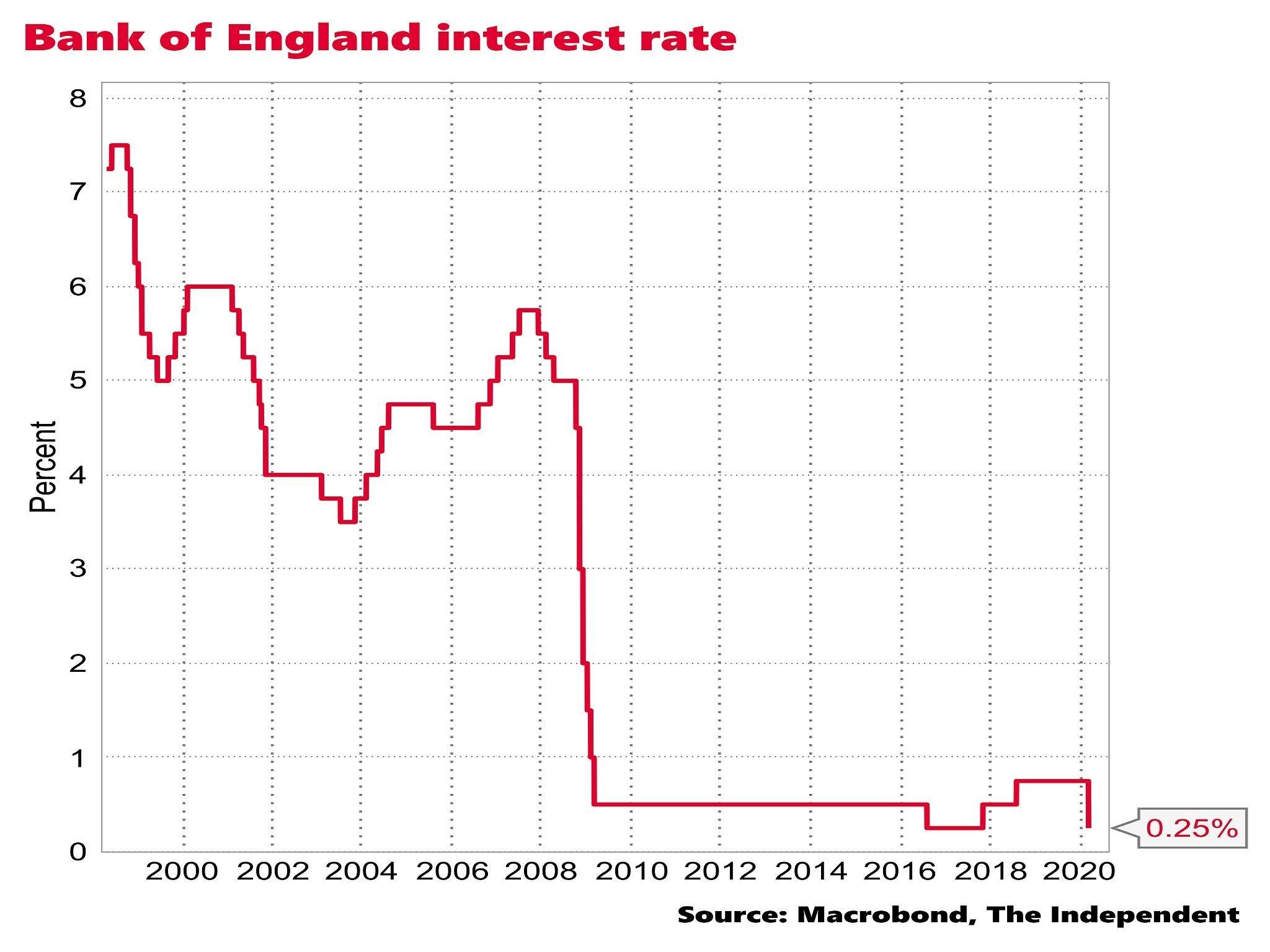

UK interest rates have climbed to 5.25%

UK interest rates have climbed to 5.25%

The bank’s pre-tax profits dropped to £2.3 billion in the first three months of the year, a decrease from £2.6 billion during the same period the previous year, following a series of rate hikes by the Bank of England.

“Consumer behaviour continues to be very robust in the UK. We see customers managing their spending well and wisely. We also see continued conservative behaviour… so they continue to seek higher savings rates, and secure their mortgage financing early.” - Anna Cross, Barclays’ Chief Financial Officer

Despite UK interest rates climbing to 5.25%, enabling the bank to increase charges on loans and mortgages, the higher rates have also strained consumers, leading to a reduced desire for new loans. Barclays reported a 1% decrease in customer loans and advances during the quarter, citing “subdued mortgage lending amid lower market demand.”

Mortgage lending has slowed down

Mortgage lending has slowed down

However, bank executives highlighted an increase in the offering of high loan-to-value mortgages to customers, which might help recover loan volumes.

Barclays has also faced the challenge of having to raise interest rates for savers to stay competitive, further impacting its profits. With fierce competition for customer deposits, Barclays saw a 2% reduction in deposits as clients sought better returns elsewhere.

The bank’s net interest income from its UK operations declined by 4% to £1.5 billion. However, more optimistic economic forecasts for the UK led Barclays to allocate only £58 million for potential loan defaults, down from £113 million the previous year.

Barclays’ investment banking division also faced challenges, with a 12% decline in pre-tax profits to £1.4 billion. Although there was a surge in companies seeking to raise capital in the stock market, there was lesser demand for its fixed-income services dealing with commodities, currencies, and bonds.

Investment banking has been affected by market conditions

Investment banking has been affected by market conditions

CEO CS Venkatakrishnan remarked that the performance in fixed income was “not as strong as we would have liked.”

This downturn underscores the necessity of the bank’s announced £2 billion cost-cutting plan and strategic reorientation initiated in February. This plan involves reducing the size of the investment banking division and focusing more on consumer and corporate businesses with higher returns.

Venkatakrishnan confirmed the bank was “focused on disciplined execution of the plan,” having already achieved £200 million in savings towards the £1 billion target for the year. Meanwhile, after cutting 5,000 jobs from October to December last year, Barclays did not provide an update on additional job cuts.

Barclays is focused on executing its cost-cutting plan

Barclays is focused on executing its cost-cutting plan