Barclays Profits Plummet 12% as UK Interest Rates Hit Mortgage Demand

Barclays has reported a 12% drop in pre-tax profits, down to £2.3 billion between January and March, compared to £2.6 billion last year. The UK bank’s profits have taken a hit due to the rising interest rates, which have dampened mortgage demand.

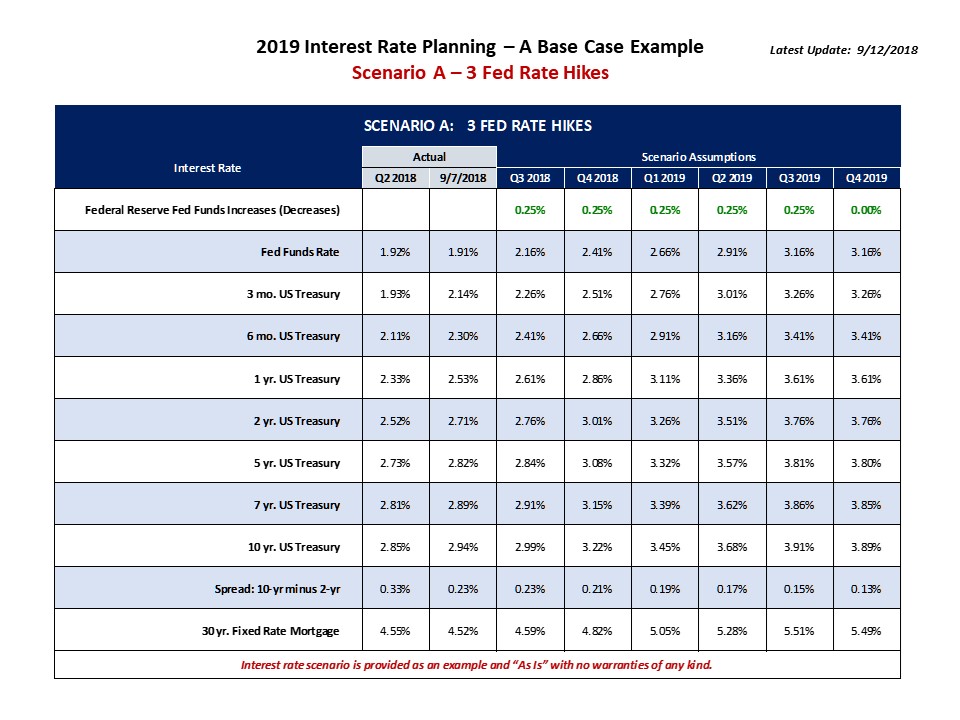

Interest rates have been on the rise, affecting mortgage demand.

Interest rates have been on the rise, affecting mortgage demand.

The Bank of England’s decision to raise interest rates to 5.25% has allowed banks to charge more for loans and mortgages. However, this has also led to a decrease in borrowing appetite among households. As a result, Barclays has seen a 1% drop in loans and advances to customers, reflecting subdued mortgage lending amid lower market demand.

Mortgage applications have slowed down due to rising interest rates.

Mortgage applications have slowed down due to rising interest rates.

Despite the challenges, Barclays is increasing its share of high loan-to-value mortgages offered to customers, which could support a rebound in its loan book. However, the bank is also under pressure to raise interest rates for savers, putting a further squeeze on its income.

Savers are benefiting from higher interest rates, but banks are feeling the pressure.

Savers are benefiting from higher interest rates, but banks are feeling the pressure.

Competition has been tough, resulting in customers placing their cash with more generous rivals, leading to a 2% drop in deposits at Barclays. Net interest income, which accounts for the difference between money made from loans and money paid out for savings, at its UK bank fell 4% to £1.5 billion.

Banks are competing fiercely for customers’ deposits.

Banks are competing fiercely for customers’ deposits.

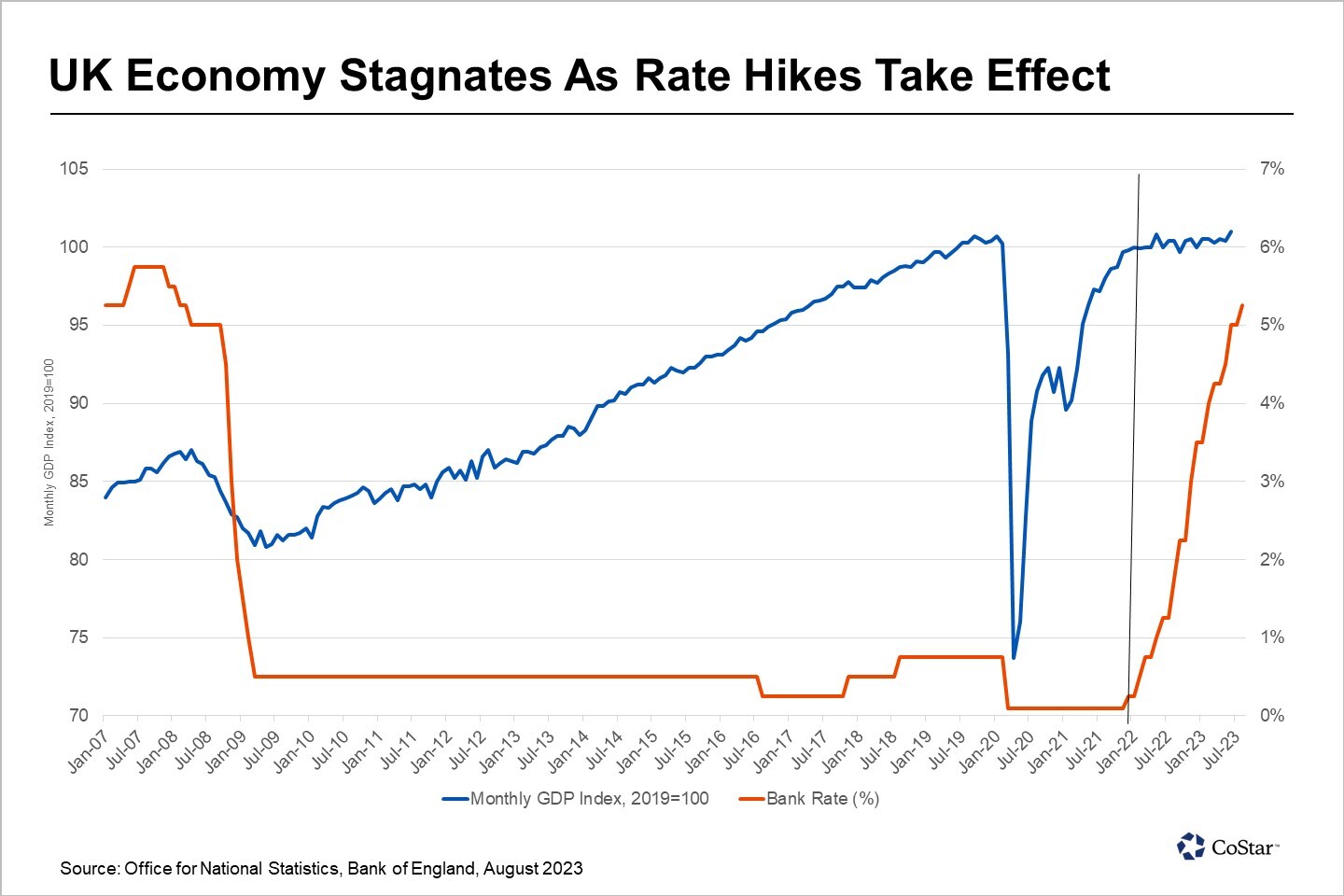

On a more positive note, slightly brighter forecasts for the UK economy meant Barclays only put aside £58m for potential defaults, compared with £113m last year.

The UK economy is showing signs of improvement, leading to reduced default provisions.

The UK economy is showing signs of improvement, leading to reduced default provisions.

In conclusion, Barclays’ profits have taken a hit due to the rising interest rates and decreased mortgage demand. However, the bank is taking steps to increase its share of high loan-to-value mortgages and is benefiting from slightly brighter economic forecasts.

Barclays is adapting to the changing market conditions.

Barclays is adapting to the changing market conditions.