Mortgage Rates: Betting Against the Tide

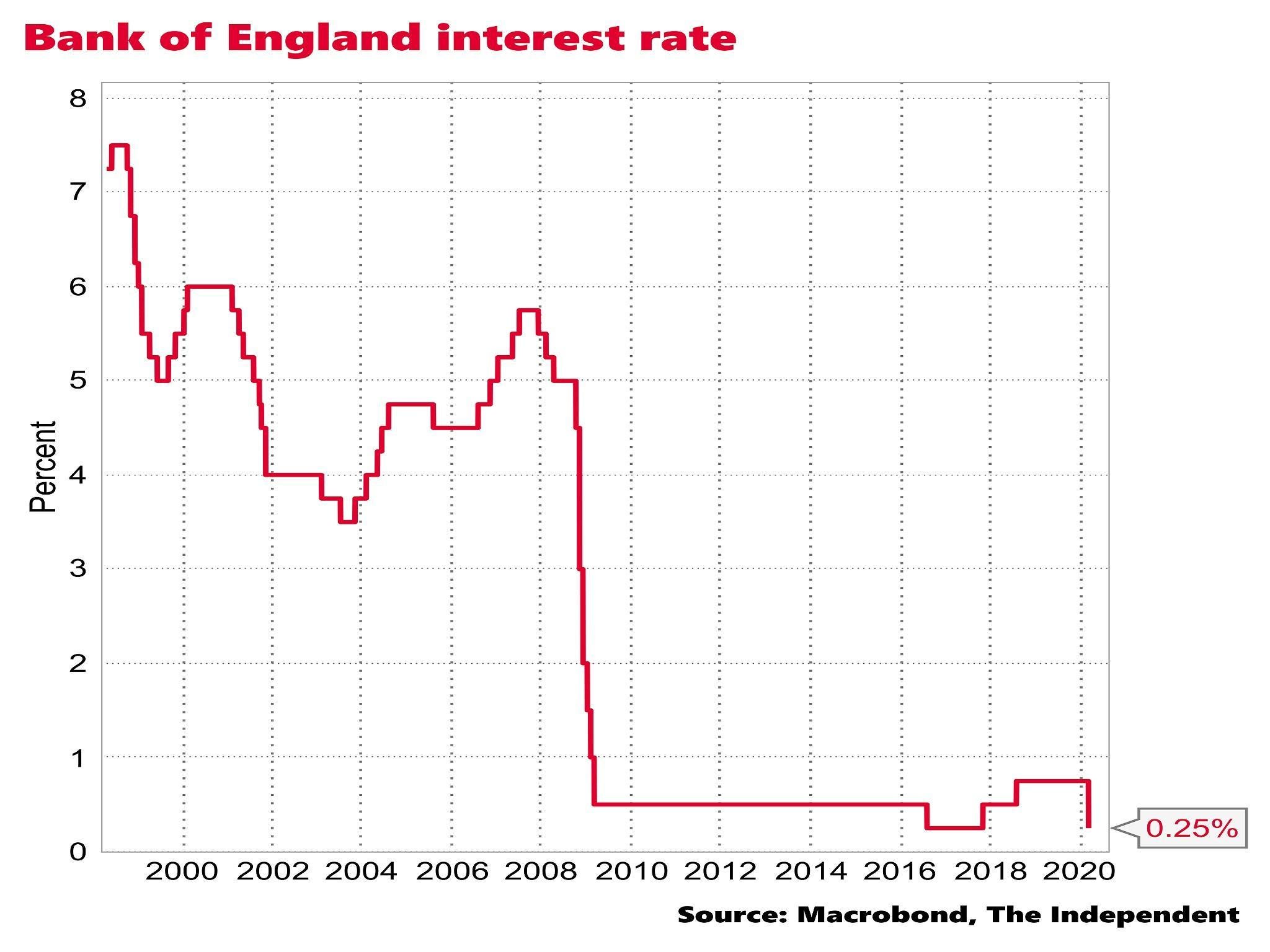

As I sit down to write this article, I’m reminded of the age-old adage: “don’t bet against the market.” But what happens when the market itself is betting against the tide? That’s exactly what’s happening in the UK mortgage market, where traders are betting on interest rate cuts this summer. But according to Monetary Policy Committee member Megan Greene, they’re making a grave mistake.

“Markets are betting in the wrong direction,” Greene warns, citing the differing macroeconomic fundamentals and inflation dynamics between the UK and the US.

The US economy, Greene argues, is stronger and better equipped to fight inflationary pressures. In contrast, the UK economy faces a greater risk of inflation persistence due to its weak potential growth and tight labour market. This means that any easing of interest rates is still some way off.

UK interest rates: will they rise or fall?

UK interest rates: will they rise or fall?

But what does this mean for mortgage borrowers? With the Bank of England governor Andrew Bailey hinting at interest rate cuts, it’s clear that the market is in for a bumpy ride. And with lenders like StrideUp and Clydesdale Bank adjusting their rates, borrowers are left wondering what’s next.

Mortgage rates: will they rise or fall?

One thing is certain: the mortgage market is in a state of flux. As the UK economy navigates the choppy waters of inflation and interest rates, one thing is clear: borrowers need to be prepared for anything.

Mortgage borrowers: stay vigilant

Mortgage borrowers: stay vigilant

In conclusion, the mortgage market is betting against the tide, and it’s a risky game. As Greene so aptly puts it, “markets are betting in the wrong direction.” It’s time for borrowers to take a step back, assess the landscape, and prepare for the unexpected.

Mortgage market: uncertainty reigns

Mortgage market: uncertainty reigns