Britain’s Economy Roars Back to Life

The UK’s economy has officially emerged from recession, with a stronger-than-expected growth rate in the first quarter. This welcome news has sent the FTSE 100 soaring to new heights, with investors rejoicing at the prospect of an interest rate cut as early as June.

Britain’s economy is back on track

Britain’s economy is back on track

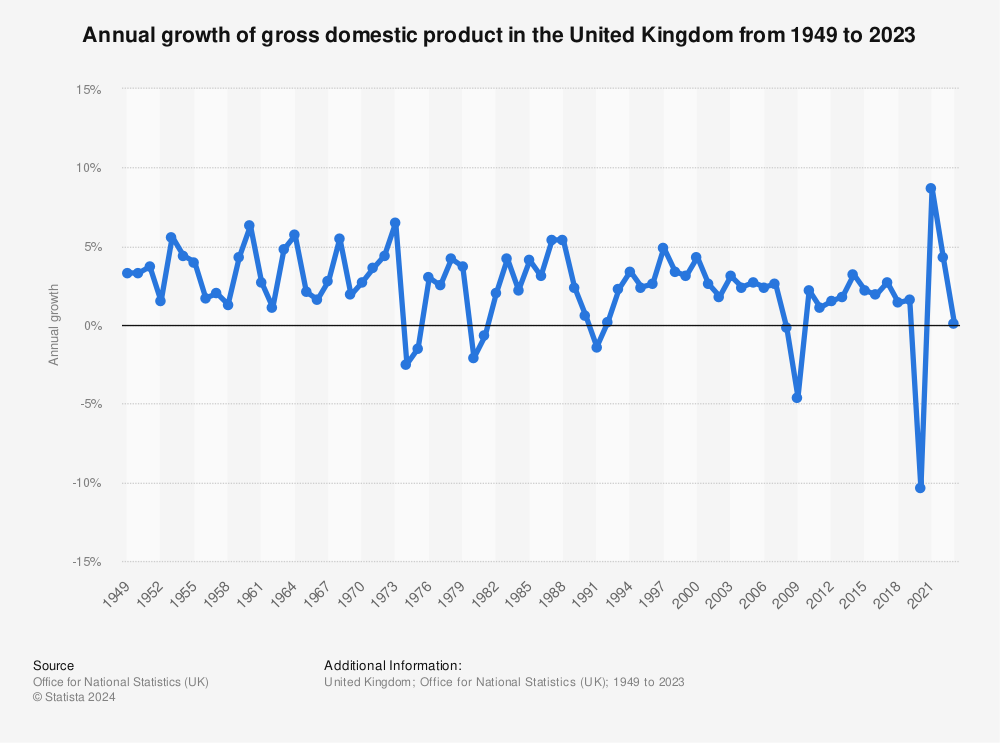

The 0.6% quarterly growth in GDP is the fastest pace since the fourth quarter of 2021, when the country was emerging from the pandemic. This rapid expansion has exceeded City expectations, which had predicted a more modest 0.4% growth.

The strong data has not dampened hopes of an interest rate cut, with many experts predicting a reduction as early as June or August at the latest. This would be a massive relief for families with mortgages, according to Chancellor Jeremy Hunt.

The FTSE 100 index has reached a new record high

The FTSE 100 index has peaked at 8431, representing the latest milestone in a week of record highs. Housebuilders and miners have led the rally, with Vodafone and JD Sports among the top risers.

UK companies need to wake up from their status quo bias

UK companies need to wake up from their status quo bias

City Voices have been calling for an end to the pity party on London company valuations, urging UK companies to wake up from their status quo bias.

The UK’s recession may be officially over, but the road to recovery is long and uncertain. As the economy continues to grow, it’s essential to stay informed about the latest developments and expert analysis. Stay tuned to MortgageWatch for the latest updates and insights.