Struggling Under the Weight of Rising Costs: Voices from the Ground

As the nation braces for the upcoming Budget announcement this Wednesday, financial burdens weigh heavily on many households across the UK. The forecast reveals more than just the tax implications; it underscores the struggles of individuals navigating an increasingly complex financial landscape.

Concerns mount over the effects of rising costs on everyday lives.

Concerns mount over the effects of rising costs on everyday lives.

Among those who feel the pinch is Luken Coleman, an apprentice earning approximately £1,500 a month. Luken currently contributes £200 towards rent in his family’s home, yet finds it nearly impossible to afford living alone in a market where rental prices hover between £700 and £900.

“If I did move out, I’d have to move further away, so I’d need a car,” he said, reflecting the transportation challenges that accompany high rental rates.

The situation resonates across various demographics, with individuals from different income brackets sharing their anxieties about the impending financial landscape.

Families at Breaking Point

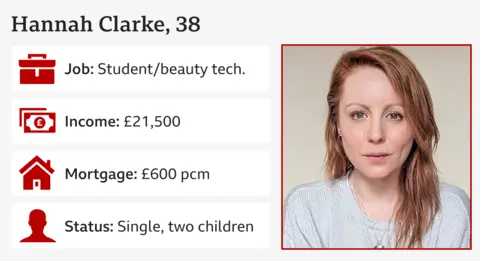

Hannah Clarke, a mother of two from Rutland, manages an income of £1,800 monthly, primarily supplemented by a student loan. Her mortgage payments have surged significantly this year, impacting her ability to make ends meet.

“I just about make ends meet, but it isn’t easy and I do sometimes have to ask for help,” she shared. Hannah’s story is indicative of a broader trend where families struggle against rising home costs.

Businesses, too, feel the repercussions of economic decisions made at the governmental level. The Chancellor’s upcoming Budget is set to reveal tax strategies aimed at alleviating the public finances’ historical deficits yet risks perpetuating a cycle of debt that amplifies household burdens.

Rising Concerns Over Interest Rates

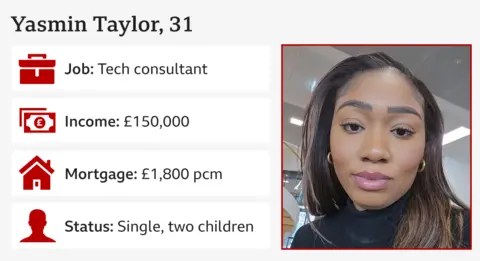

Consultants like Yasmin Taylor, who brings in £7,600 a month from her role in tech, confront significant challenges as well. Her largest outlay comes from childcare expenses amounting to £2,600 each month. Despite her higher income, Yasmin is frustrated by her ineligibility for Child Benefit due to salary thresholds.

With discussions about the Chancellor potentially easing fiscal rules to borrow an additional £20 billion for infrastructure, the prospect raises alarms about increased interest rates affecting mortgage rates. Shadow Treasury Minister Alan Mak highlighted these concerns, questioning whether higher borrowing will result in prolonged elevated interest rates, further pressuring families who rely on borrowing for housing.

Families face tough decisions with rising childcare costs.

Families face tough decisions with rising childcare costs.

A Call for Fair Wages

Kirsty Brett, a part-time cleaner, echoed the sentiments of many, expressing the urgent need for fair compensation in the working world.

“People should be paid at least £15 an hour. That would help a lot of people,” she asserted, pointing to the disconnect between wages and the cost of living.

As individuals grapple with the pressures of increased rents, higher mortgage payments, and stagnant wages, the issue of equitable pay becomes even more pressing.

Individuals on the Edge

The story of Nicole Healing, who rents a one-bedroom flat in Brighton for a staggering £1,250 a month, further demonstrates the dire circumstances many face today. Once financially independent, Nicole now finds her situation altered due to disabilities, relying on benefits to cover her expenses.

In a time of rising inflation and heightened public stress, the government’s Budget announcement serves as more than just fiscal policy—it is a reflection of the well-being of the citizens it aims to serve. The promise of extra funds for the NHS to relieve the waiting list, which supersedes a daunting 7.6 million, introduces a glimmer of hope, albeit amid uncertainty regarding increased taxes affecting individual financial stability.

Housing costs continue to climb, leaving many in precarious financial positions.

Housing costs continue to climb, leaving many in precarious financial positions.

Conclusion

As we await details from the Budget, the voices of Luken, Hannah, Yasmin, Kirsty, and Nicole resonate through the corridors of power, reminding decision-makers of the real-world impact their choices have. The balancing act between stimulating economic growth and providing relief to households will shape the meticulous details of the Budget, which countless families will scrutinise closely.

It is certain that the repercussions of these decisions will last far beyond this week, framing the delicate future of housing, wages, and the very foundation of financial health for individuals across the UK.

Photo by

Photo by