Understanding the Financial Landscape: A Comparative Insight into Living Costs

In a world where household budgets are increasingly strained, insights from real-life experiences can offer a perspective that pure statistics often miss. Recently, an English mother living in Spain brought to light the stark contrasts between living expenses in her new home and those in the UK. Her narrative reveals how the cost of living influences lifestyle choices and paints a broader picture of financial wellbeing in varying environments.

The cost of living varies greatly across Europe, impacting lifestyle and financial decisions.

The cost of living varies greatly across Europe, impacting lifestyle and financial decisions.

The Cost of Living in Spain

Jodie Marlow, who has taken to TikTok to document her family life in Spain, recently shared her experience concerning household energy bills, an issue that resonates with many during this period of economic adjustments. Jodie noted that her family no longer contemplates paying rent or mortgage, as they own their property. This significant financial relief allows them to focus on their day-to-day expenses, which Jodie surprisingly finds to be manageable.

She highlighted the cost of electricity, stating, “Oh my gosh, amazing. Last month, before I really put the aircon on, was €37 (£30.82). This month, with the aircon running nearly every night, it’s around €55 to €60 (£45.82), which I think is nothing.” Such revelations may leave many in the UK pondering how they can contend with their average monthly energy bills, which can often soar beyond these figures, especially during colder seasons.

Basic Utilities and Their Impact

Jodie communicated that water services average around €99 every three months — translating approximately to €33 (£27.49) monthly. Additionally, she described the use of gas bottles for heating, a practice that can seem unusual for those from the UK. These gas bottles last her family about three months at the cost of around €16 (£13.33), working out significantly cheaper than many households in the UK, where gas and electric bills are often bundled in hefty monthly tariffs.

Comparative views on household living can reveal financial pressures faced by individuals in the UK.

Comparative views on household living can reveal financial pressures faced by individuals in the UK.

Lifestyle Adjustments in Energy Usage

Interestingly, Jodie observed a cultural difference, noting that many locals do not utilize hot water frequently. This approach not only reduces costs but reflects a lifestyle tailored to the climate and community norms. Her family’s preference for outdoor barbecues and an air fryer further depicts a lifestyle less reliant on traditional cooking methods, which may explain her lower gas consumption.

The Burden of Financial Strain in the UK

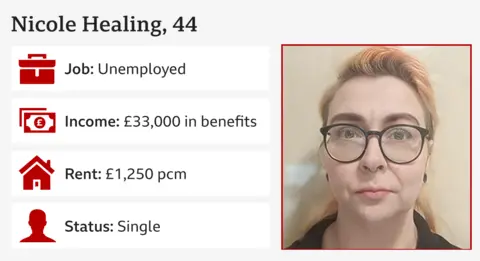

As citizens adjust their living standards to address rising costs, the ongoing discussions surrounding the Budget indicate mounting concerns for households throughout the UK. Recent interviews have revealed a common theme: many feel the pinch of financial strain amidst fluctuating prices and expectations.

Luken Coleman, an apprentice earning approximately £1,500 a month, highlights the struggle young individuals face with local rental costs. He shared how, despite paying £200 monthly to his parents, he’s unable to afford moving out due to exorbitant rental prices. This sentiment echoes a broader concern for millennials and young professionals across major cities in England.

Hannah Clarke, another individual interviewed for insights on the Budget, expressed her fears regarding rising costs impacting her roles as a mother of two. With a household income primarily sourced from student loans, Hannah’s experience starkly contrasts with Jodie’s relatively manageable expenses in Spain, illustrating how government policies and economic conditions significantly shape financial realities.

Financial perspectives from across the UK show contrasting realities when compared to Europe.

Financial perspectives from across the UK show contrasting realities when compared to Europe.

Challenge of Rising Living Costs

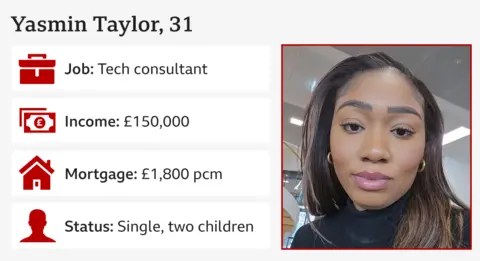

Worry extends to other demographics as well. Yasmin Taylor, a single mother and tech consultant, mentioned the struggles surrounding childcare costing £2,600 monthly. These financial burdens can intensify the feeling of insecurity among families. Even individuals earning higher incomes find themselves grappling with the impacts of rising living costs, as highlighted by Andrew Cunningham, who fears potential changes to tax relief on pensions could impact savings for retirement.

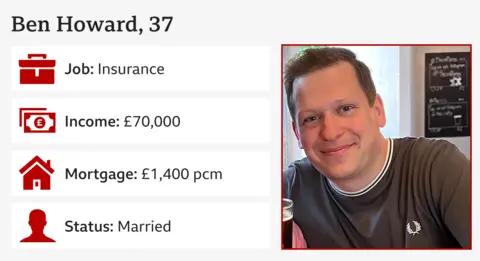

Ben Howard and his wife Sarah anticipate being worse off after upcoming Budget announcements, with rising mortgage repayments further complicating their financial comfort. As costs escalate without corresponding rises in income for many citizens, there looms an increasing urgency for government intervention to stabilize the situation.

The Upcoming Budget: Anticipating Changes

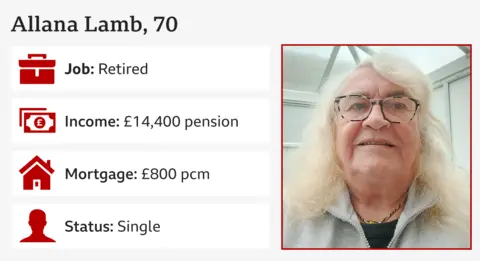

As the Budget approaches, individuals from various income brackets are anxiously awaiting news on potential tax changes and spending on services such as the NHS. Persistent questions over how much tax each citizen will pay and what measures will be implemented to cushion vulnerable social groups underline the gravity of the situation. The government’s decisions will indubitably shape the financial landscape for countless families.

A Global Perspective: Understanding Financial Trends

The juxtaposition of living costs between England and Spain highlights a pertinent issue in today’s global economic climate: the effects of location on household expenses. While Jodie manages to maintain her family’s financial stability in Spain, many in the UK feel cornered by a combination of stagnant wages and escalating costs. This duality opens a conversation about how geographic factors, governmental policies, and social structures influence personal finance.

In looking towards a solution, policymakers must engage in thoughtful discourse and consider varied financial realities across the UK and beyond. Mindful regulation and targeted assistance could introduce the necessary relief to households facing unmanageable costs, ensuring financial safety nets remain robust and effective.

Conclusion: Navigating an Uncertain Future

As we anticipate further developments from the government, it is vital for citizens to remain aware of their financial standing and adapt accordingly. Jodie’s experience in Spain serves as a beacon of hope, showcasing that financial management can bring about relative comfort, even amid a crisis. The coming weeks could prove decisive for many, defining not only current lifestyles but also shaping future financial security in an ever-evolving landscape.

The convergence of economic conditions creates a pivotal moment for household budgeting and financial planning.

The convergence of economic conditions creates a pivotal moment for household budgeting and financial planning.

Related Articles

- Understanding Energy Costs

- UK Household Budgets: A Growing Challenge

- Our Changing Approach to Living Expenses

For ongoing updates and expert insights into taxes, budgets, and help navigating living costs, stay tuned to MortgageWatch.