Mortgage Borrowing Power Gets a Boost

Danske Bank UK has made significant changes to its affordability calculation, paving the way for mortgage customers to borrow more. The lender has introduced a reduced energy bill assumption for properties with an Energy Performance Certificate (EPC) rating of between A and C. This means that borrowers purchasing homes with high EPC ratings can now borrow larger loans.

Image: Energy efficient homes

Image: Energy efficient homes

The changes are expected to have a significant impact on the mortgage market, particularly for borrowers looking to purchase energy-efficient homes. According to Danske Bank UK, a single applicant earning £60,000 with no dependents can now borrow up to £290,000, compared to £266,164 previously.

Affordability for Single Applicants

The lender has also amended its affordability calculation for single applicants. This move is expected to benefit individuals looking to get on the property ladder or upgrade to a more energy-efficient home.

Image: Single applicant mortgage

The changes to the affordability calculation are a welcome move in the mortgage market, particularly for borrowers looking to purchase energy-efficient homes. With the increasing focus on sustainability and reducing carbon footprint, these changes are expected to have a positive impact on the environment.

Conclusion

Danske Bank UK’s changes to its affordability calculation are a significant step forward for mortgage customers. The lender’s move to reduce energy bill assumptions for properties with high EPC ratings is expected to increase borrowing power for many borrowers. As the mortgage market continues to evolve, it will be interesting to see how other lenders respond to these changes.

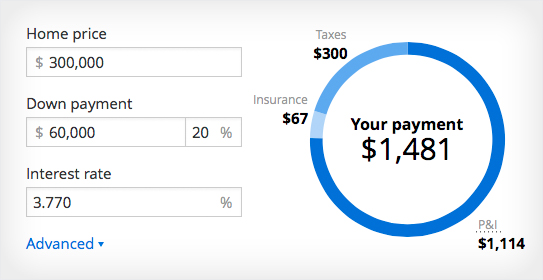

Image: Mortgage calculator

Image: Mortgage calculator