First-Time Buyers Defy Expectations: A Record Year Ahead?

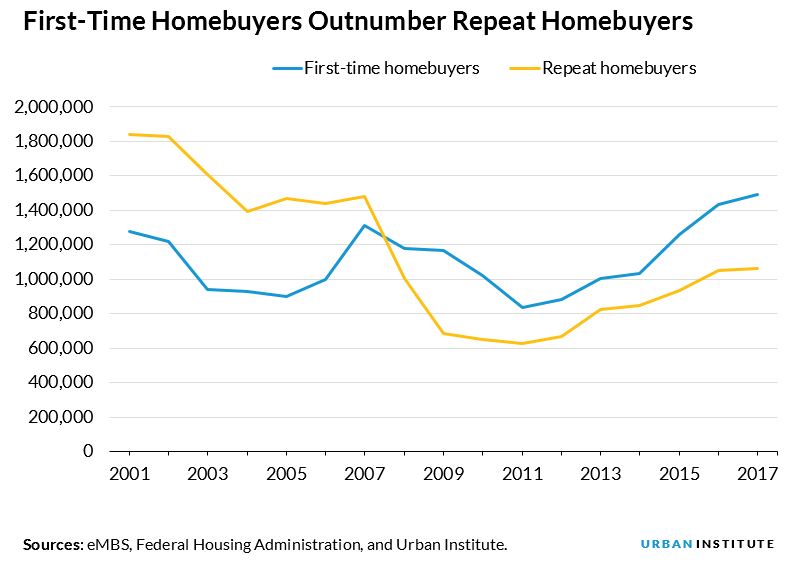

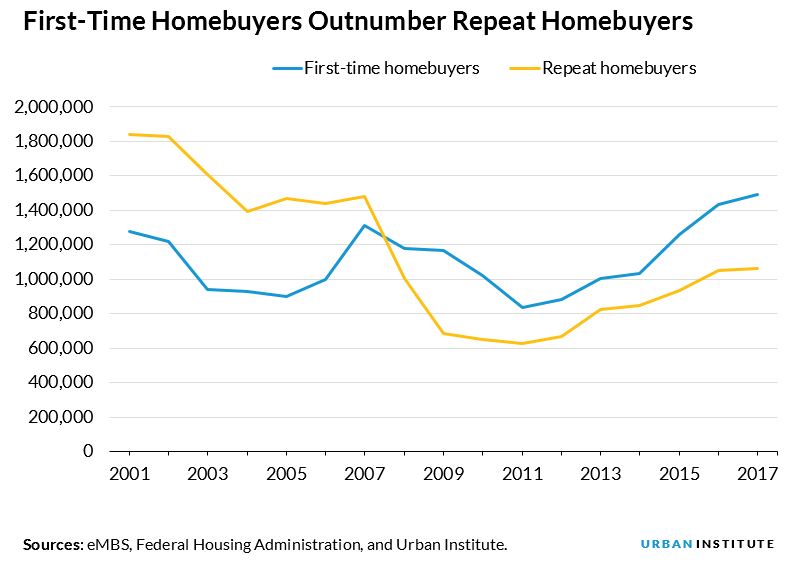

The UK’s first-time buyer mortgage market is on track to reach record highs in 2024, despite initial forecasts predicting a slower year. According to a recent analysis by Yorkshire Building Society, in partnership with CACI, first-time buyers are making up a higher proportion of the home purchase market than at any time since 2016.

First-time buyers are driving the mortgage market forward.

First-time buyers are driving the mortgage market forward.

The data reveals that overall mortgage applications have risen by almost a quarter in 2024, contradicting UK Finance’s forecast of lower gross lending this year. In fact, the value of mortgage applications year-to-date is 15% higher than the equivalent period in 2023, with first-time buyer applications growing by 33% in the same period.

“Things have changed substantially since UK Finance issued its forecasts last November,” says Jeremy Duncombe, director of mortgage distribution at Yorkshire Building Society. “The picture is a fast-changing one, and despite continued inflationary pressures keeping interest rates higher than hoped; coupled with ongoing volatility caused by economic and political uncertainty, consumer confidence seems to be returning.”

The Rise of First-Time Buyers

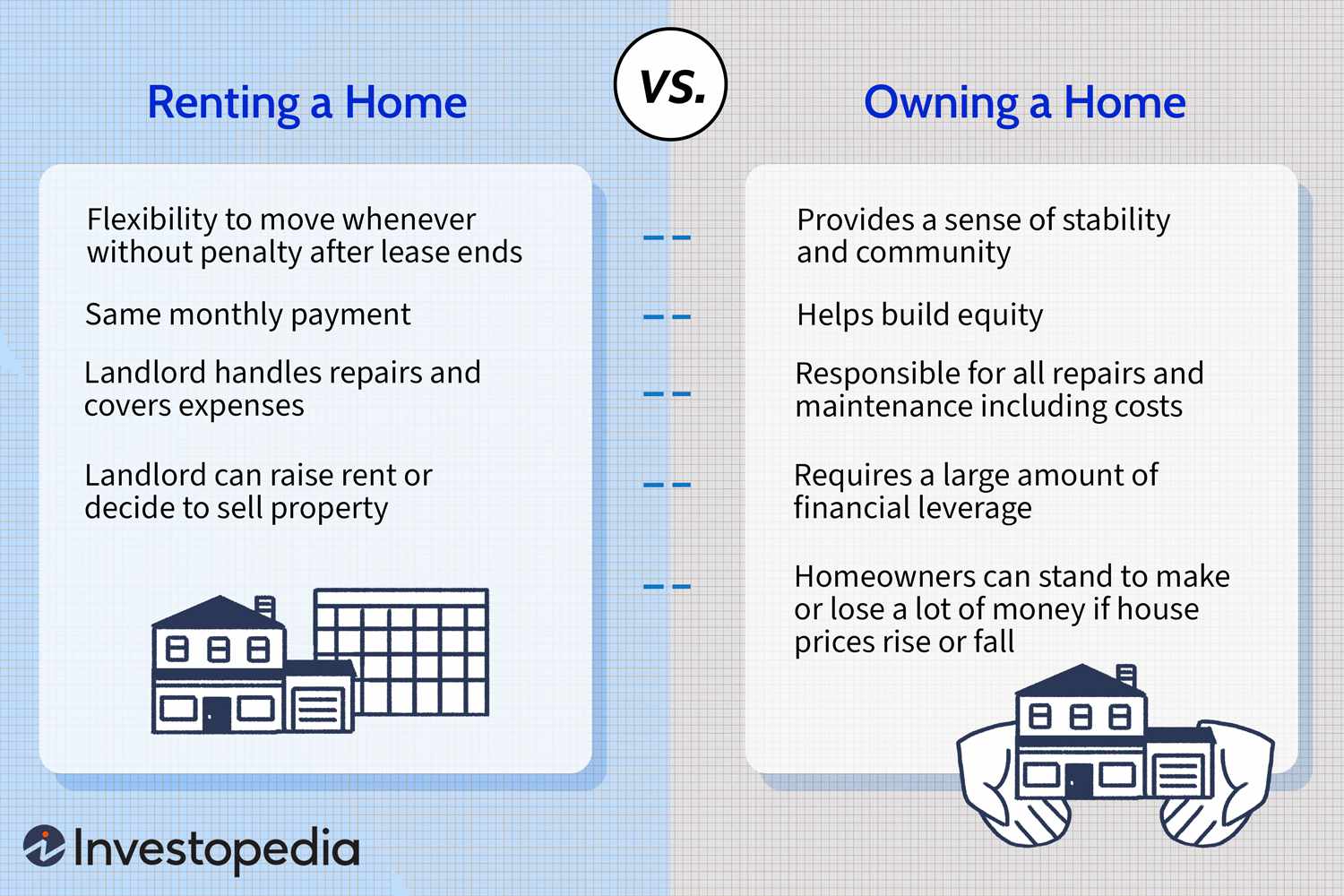

So, what’s driving this surge in first-time buyer activity? For one, high rental costs are making the prospect of owning a property more appealing. According to the latest Office for National Statistics (ONS) data, average rents rose by 9% in the 12 months to February 2024, the highest annual increase since records began in 2015. In contrast, the average monthly mortgage payment for a first-time buyer is £1,139, making homeownership a more attractive option.

Rental costs are driving first-time buyers to seek homeownership.

Rental costs are driving first-time buyers to seek homeownership.

Additionally, many are making life-changing decisions to prioritize homeownership over other milestones, such as starting a family. As Duncombe notes, “We know from our own research that many are making life-changing decisions to prioritise homeownership over other milestones like starting a family.”

A Brighter Outlook for 2024

While there is still uncertainty in the market, the year has gotten off to a better start than predicted, with housing market activity on the rise. House prices are predicted to settle and maybe even increase moderately throughout the rest of the year, with more stable mortgage rates resulting in more buyers deciding to dip their toes back in.

The housing market is expected to remain active in 2024.

The housing market is expected to remain active in 2024.

As the market continues to evolve, one thing is clear: first-time buyers are driving the mortgage market forward, and their confidence in the market is a promising sign for the year ahead.

First-time buyers are leading the charge in the mortgage market.

First-time buyers are leading the charge in the mortgage market.