Housing Market on the Brink of a Surge

The UK’s housing market is poised for a surge in demand, experts predict, as the general election approaches and interest rates are expected to fall. According to the latest House Price Index from Halifax, the average house price across the UK has held steady in May, with a slight decrease of £170. However, with average wages growing by 6% year-on-year, properties are becoming more affordable.

Housing market on the brink of a surge

Housing market on the brink of a surge

Labour has promised to deliver 1.5 million new homes, and Sir Keir Starmer has announced plans to make the low-deposit mortgage guarantee deal permanent. This could lead to a surge in demand, similar to the “Boris bounce” seen in 2019 after Boris Johnson’s election victory.

“While both prices and activity have been meandering, it’s clear there is plenty of pent-up demand from buyers primed and ready to go once the election uncertainty is over.” - Jonathan Hopper, CEO of Garrington Property Finders

The future path of house prices will likely depend on the Bank of England’s decision on interest rates. With the European Central Bank cutting interest rates in the Eurozone, pressure is mounting on the Bank of England to follow suit. City traders are expecting a rate cut in August or September.

Meanwhile, the rental market is slowing down, with average UK rents rising 6.6% to £1,226 in April from a year ago. This is the slowest rate of growth in two-and-a-half years, according to Zoopla. The property website attributes the slowdown to weakening demand and affordability constraints.

Rental market slows down

Rental market slows down

The rental market is still on track for a 5% growth slowdown in 2024, driven by changes in demand and affordability rather than any expansion in supply. The report highlights the need for rent reform to improve protections for existing renters.

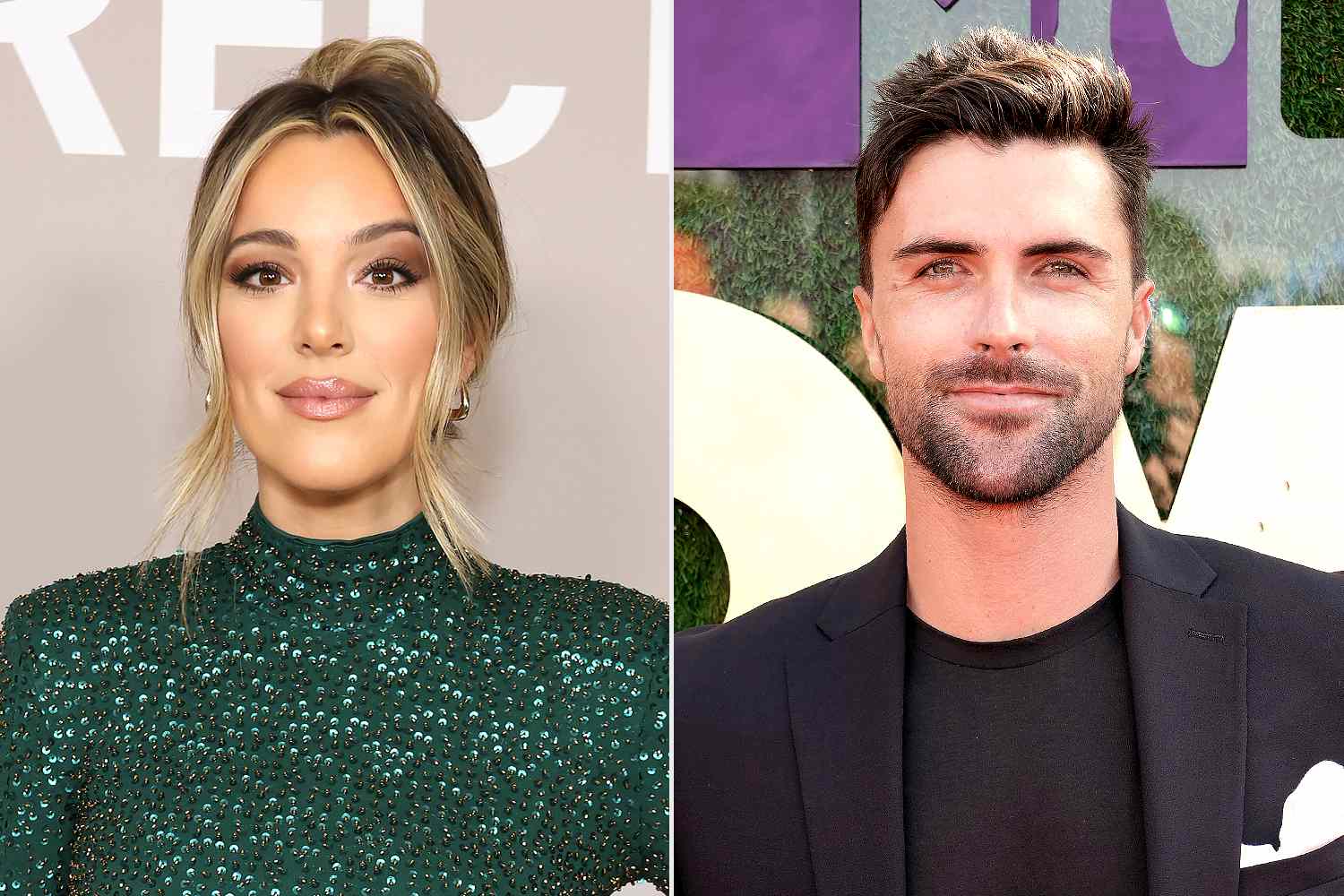

In other news, Pepper Money has promoted Alex Hall to regional development manager for the South West. Hall will support brokers in finding solutions for complex cases that fall outside the mainstream mortgage lender’s criteria.

Alex Hall, regional development manager for the South West

Alex Hall, regional development manager for the South West

The housing market is poised for a surge in demand, driven by the general election and expected interest rate cuts. As the market prepares for a potential “Starmer spurt,” experts predict a surge in demand and a potential increase in house prices.

Housing market surge on the horizon

Housing market surge on the horizon