How the US Election Influences Your Mortgage, Pension, and Savings in the UK

As the United States prepares to cast its votes, the ramifications of their decision extend far beyond American shores. With the election occurring this Tuesday, the stakes are high—especially for those of us in the UK who may see significant changes to our personal finances depending on who prevails. Recent polling shows a tight race between Kamala Harris of the Democrats and the incumbent Donald Trump, creating a sense of uncertainty that can rattle our economic landscape.

The potential ripple effects of the US election on UK finances are considerable.

The potential ripple effects of the US election on UK finances are considerable.

Mortgage Rates: A Tug of War

The most immediate impact of the US election could be felt through mortgage rates. As markets evaluate each candidate’s proposed economic policies, changes in the Bank of England’s interest rate decisions may follow. If Harris emerges victorious, we could see a fall in US treasury yields, which might correlate with lower mortgage rates for British homeowners. Conversely, a Trump victory, coupled with his suggested tariffs and immigration policies, could lead to a stagnation or even an increase in inflation, pushing UK mortgages rates upwards. In my conversations with financial analysts, the prevailing sentiment is that the longer the interest rates remain high, the slower any eventual decline in mortgage rates will be.

“While market reactions can be swift, the long-term impacts are often far more muted,” says Paul Dales from Capital Economics.

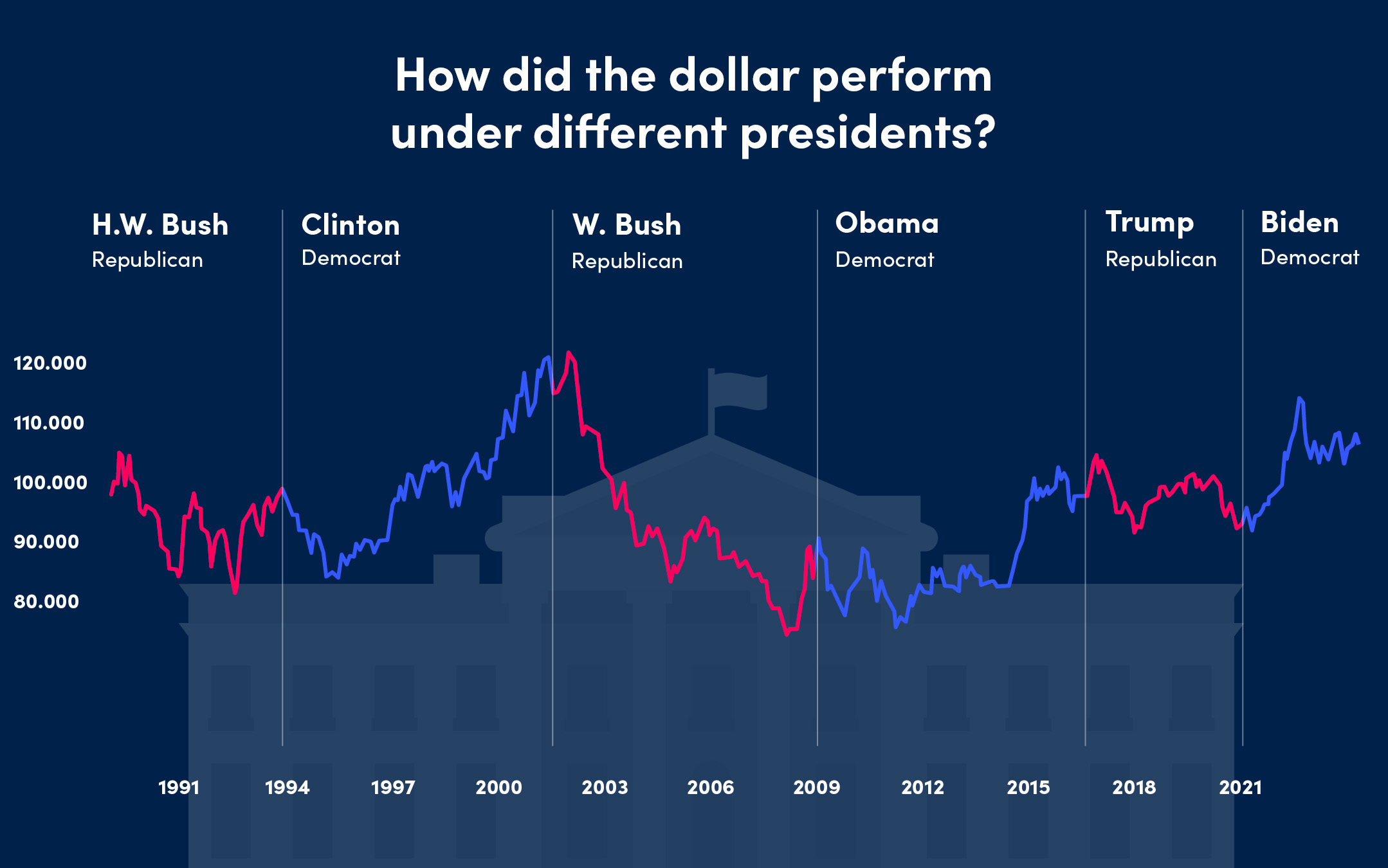

Currency Exchange: The Pound’s Fate

Another key area to watch is the value of the pound against the dollar. Geopolitical shifts caused by the election can lead to fluctuating foreign exchange rates. Experts predict that a win for Trump might have negative consequences for the UK currency, potentially stifling its strength due to market wariness of his policies. On the flip side, a Harris win could bolster confidence in the global financial markets, resulting in a stronger pound and enhancing our purchasing power abroad.

I cannot help but reflect on the implications this has for everyday UK consumers. A stronger pound can make travels to the US more affordable and lower the cost of imported goods, a much-needed reprieve for shoppers feeling the squeeze.

Investment Outlook: The Broader Picture

The outcome of the US election could also drive significant changes in investment landscapes, especially regarding equities and cryptocurrencies. With many investors holding substantial portfolios that include US stocks, the market – swayed by election outcomes – could see volatility that impacts asset values across the board.

Analysts like Dan Coatsworth from AJ Bell have expressed concern that any sharp shifts in policies or investor sentiment could lead to short-term market disruptions. Recent trends indicate a pivot towards growth stocks that cater to the digital economy, but these could be jeopardized based on the election’s fate.

Investors need to stay alert during the volatility surrounding election results.

Investors need to stay alert during the volatility surrounding election results.

Pensions: A Varied Impact

When examining pensions, the influence of the US election becomes more nuanced. Public sector defined benefit pensions may remain insulated from immediate fluctuations in market performance. However, those reliant on defined contribution plans will have to be more vigilant. These pension schemes rely heavily on investment performance, and any market instability following the election could directly affect retirees’ financial security.

In my experience, having a diversified retirement fund is essential, especially when external factors could suddenly alter economic conditions. Staying informed about the stock markets and maintaining an adaptable investment strategy can provide a buffer against uncertainty.

Final Thoughts

Though the US election will undoubtedly stir up thịngs, it’s important to retain perspective. While initial market reactions may lead to significant shifts, historical trends show that the long-term impacts on UK mortgages, savings, and pensions may not be as dramatic as they first appear.

As we await the results, it’s an opportune time for all of us to review our financial positions—whether that means refinancing a mortgage, reassessing investments, or exploring new savings avenues. The upcoming weeks will be pivotal, but our ability to adapt will determine how we navigate this financial landscape going forward.

Adapting to market changes is essential as we face the uncertainty of the US election results.

Adapting to market changes is essential as we face the uncertainty of the US election results.