Inflation Falls to 2% Target: What Does it Mean for Interest Rates?

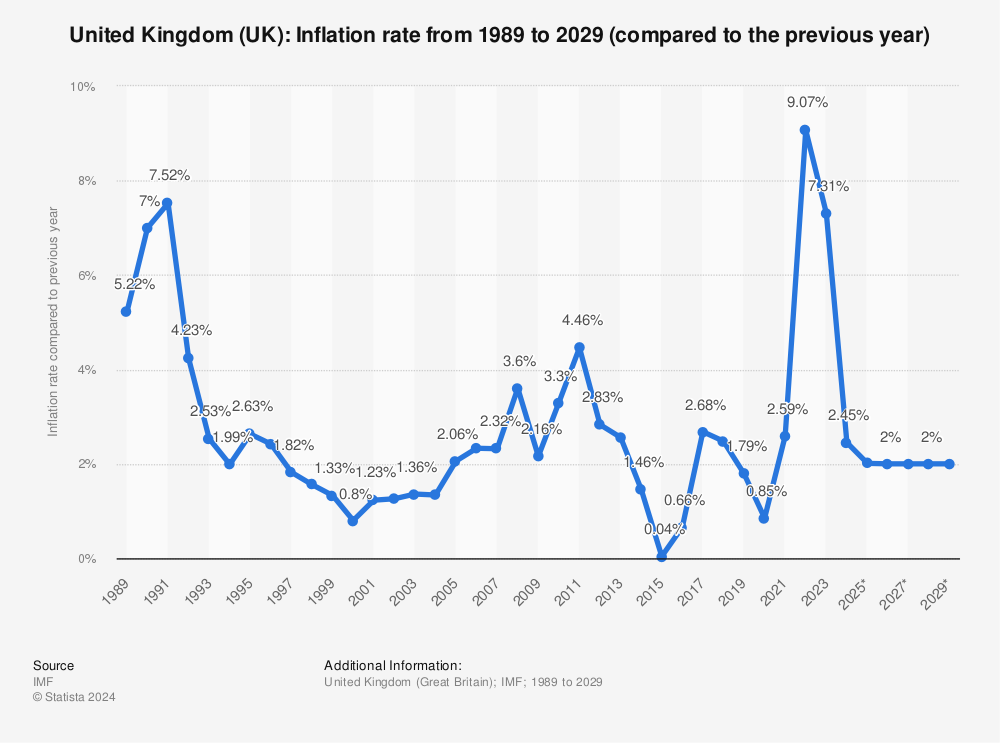

The UK economy has reached a major milestone as the rate of inflation has dropped to 2% in May, down from 2.3% in April. This marks the end of a three-year battle to return price rises to target levels, with the last time it was this low being in July 2021.

Inflation rate falls to 2% target

Inflation rate falls to 2% target

The fall in inflation is a welcome relief for many, but what does it mean for interest rates? The possibility of a summer interest rate cut is now on the table, and this could have significant implications for borrowers and savers alike.

Prices Still Rising, but at a Slower Rate

While prices are still rising in almost every sector, the rate of increase has slowed down in May compared to April. This is a positive sign, but it’s essential to keep in mind that inflation is still present in the economy.

Political Reaction to Inflation Fall

The fall in inflation has sparked a reaction from opposition parties, with Labour warning that the news shouldn’t be a reason to choose the Conservatives in the upcoming election. The Conservatives, on the other hand, see this as proof that their economic plan is working.

Pound Rises on Inflation News

The pound has risen slightly against the euro and dollar following the announcement, a sign that the markets are responding positively to the news.

Core Inflation at 3.5%

Core inflation, which strips out volatile elements such as food and energy, stands at 3.5%. This is a better measure of inflation, and it’s still above the target rate.

What Does it Mean for Interest Rates?

The fall in inflation increases the chances of a summer interest rate cut. This could be good news for borrowers, but savers might not be so thrilled.

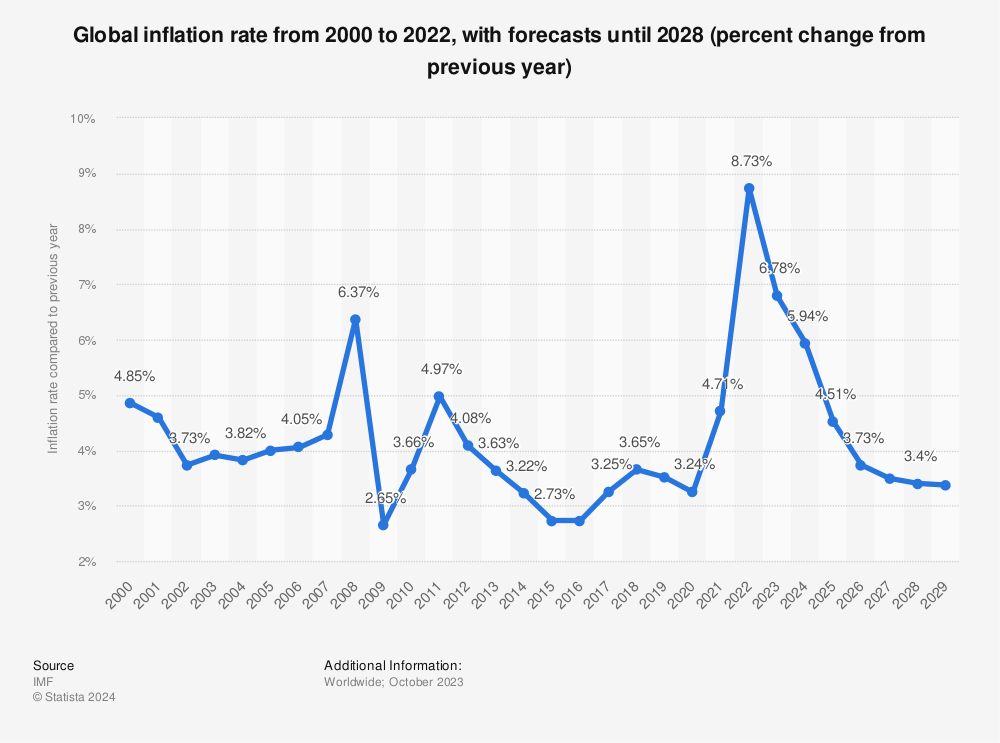

How Does the UK Compare with Other Countries?

The UK’s inflation rate is now in line with other major economies. This is a positive sign, but it’s essential to keep in mind that inflation is still a global issue.

Global inflation rates

Global inflation rates

What is Inflation?

Inflation is the rate at which prices are rising. It’s a crucial indicator of the health of an economy, and it has a significant impact on our daily lives.

Inflation explained

Inflation explained