Investing in Holiday Lets: A Sound Investment Opportunity?

As the world of finance continues to evolve, investors are constantly on the lookout for new and innovative ways to grow their wealth. One such opportunity that has gained significant attention in recent times is investing in holiday lets. With the potential to provide a decent income, capital growth, and a place to escape to, it’s no wonder why many are considering this option.

Holiday homes can be a lucrative investment opportunity

Holiday homes can be a lucrative investment opportunity

The Scottish Mortgage Investment Trust (LSE: SMT) share price has climbed close to 20% so far in 2024, but looking back at the past five years, it’s clear that there’s still room for growth. The trust’s high-profile stars, including some of the biggest winners on the Nasdaq tech stock index, have been driving this growth. From a baseline in mid-2019, the Scottish Mortgage share price climbed 190% by the time of its October 2021 peak, almost twice the Nasdaq’s gain in the same period.

Tech stocks have been driving growth in the Scottish Mortgage Investment Trust

Tech stocks have been driving growth in the Scottish Mortgage Investment Trust

But what’s interesting is that the Nasdaq has pulled ahead in recent times, with the Scottish Mortgage growth lagging behind. This has led many to wonder if the trust is undervalued compared to the Nasdaq. While it’s not a straightforward answer, there are several factors that suggest the trust’s share price could climb higher.

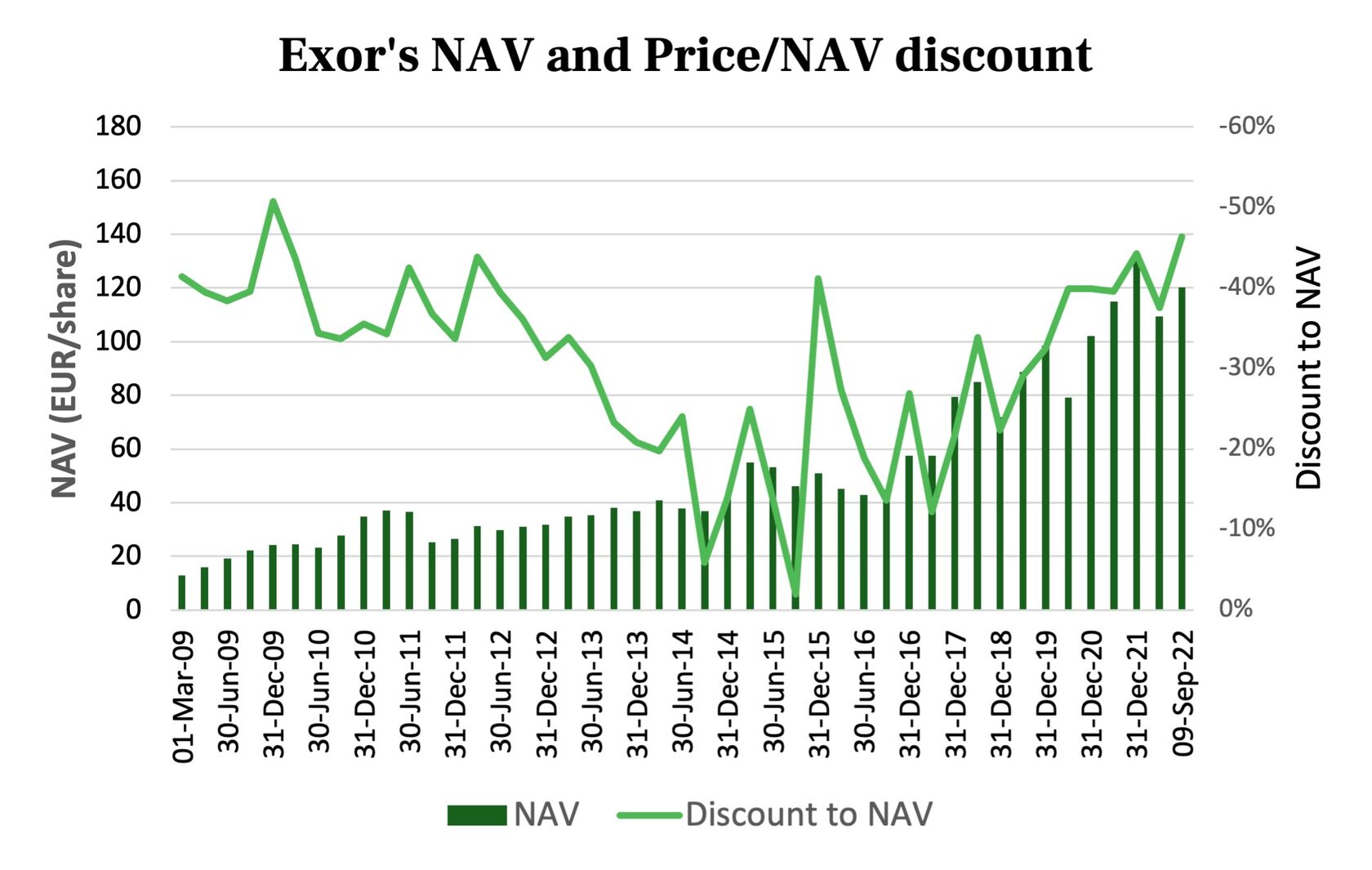

One such factor is the discount to net asset value (NAV). Currently at 9%, this means investors can buy a pound’s worth of underlying assets for 91p. While the discount has been higher in the past, it’s clear that the share price and NAV are converging, and the discount could shrink further.

The discount to NAV could shrink further, driving up the share price

The discount to NAV could shrink further, driving up the share price

Another factor to consider is the trust’s diversification. By spreading risk across a range of global growth stocks, including tech giants like Tesla, Moderna, and Amazon.com, investors can benefit from the growth potential of these companies without taking on too much risk.

Diversification can help spread risk and increase potential returns

Diversification can help spread risk and increase potential returns

So, is the Scottish Mortgage Investment Trust a sound investment opportunity? While there are no guarantees in the world of finance, the trust’s growth potential, diversification, and discount to NAV make it an attractive option for those with a long-term growth plan.

The Scottish Mortgage Investment Trust has growth potential

The Scottish Mortgage Investment Trust has growth potential

In conclusion, investing in holiday lets and the Scottish Mortgage Investment Trust can be a sound investment opportunity for those looking to grow their wealth. With the potential for decent income, capital growth, and diversification, it’s no wonder why many are considering this option.

Investing in holiday lets and the Scottish Mortgage Investment Trust can be a sound investment opportunity

Investing in holiday lets and the Scottish Mortgage Investment Trust can be a sound investment opportunity