US Markets Gain Ground Ahead of Key Economic Indicators

In a day of cautious optimism, major US stock indices today experienced moderate gains, with the S&P 500 climbing 0.37%, and the Dow Jones Industrial Average rising 0.45%. This uptick, which brings the S&P to a one-week high, suggests a cautiously optimistic market sentiment, bolstered by expectations surrounding the upcoming US consumer price index (CPI) report scheduled for Thursday. Investors are hoping to see signs of easing price pressures, which could impact Federal Reserve policy in the near term.

A significant day for U.S. stock markets as optimism prevails.

A significant day for U.S. stock markets as optimism prevails.

What’s Driving the Market Movement?

The recent remarks from Federal Reserve Vice Chair Jefferson have provided a lift to investor confidence, as he indicated that the US economy is growing at a “solid pace.” However, it’s essential to remember that the stock gains today are somewhat tempered by a handful of negative corporate updates. For example, Boeing’s shares slipped over 2% following the collapse of negotiations aimed at resolving a nearly month-long strike by workers, while Alphabet’s stock dipped by more than 1% as news emerged that the US Justice Department is contemplating recommending divestitures to address antitrust concerns. These factors underline the complexity facing investors today.

Global Economic Concerns

Beyond corporate earnings updates, geopolitical tensions continue to loom large, particularly in the Middle East. Israel’s ongoing military operations in Gaza and Lebanon are contributing to an undercurrent of uncertainty in the markets. The Israel Defense Force has recently deployed additional troops, and the potential for further escalation raises questions about the implications for global economic stability.

Mortgage Market Cycles

Turning our attention to more specific financial indicators, the mortgage market reflects similar trends of cautious sentiment. Recently, US MBA mortgage applications have fallen by 5.1% in the week ending October 4. The overall mortgage market has been impacted by rising interest rates, with the average 30-year fixed mortgage rate increasing to 6.36% from 6.14% the previous week. This uptick in mortgage rates is likely to dampen buying activity, reinforcing a trend of cooling prices in the housing market.

“While inflation is getting closer to the Fed’s 2% target, it’s vital to consider how it might affect consumer spending and housing purchases in the coming months.”

Future Market Predictions

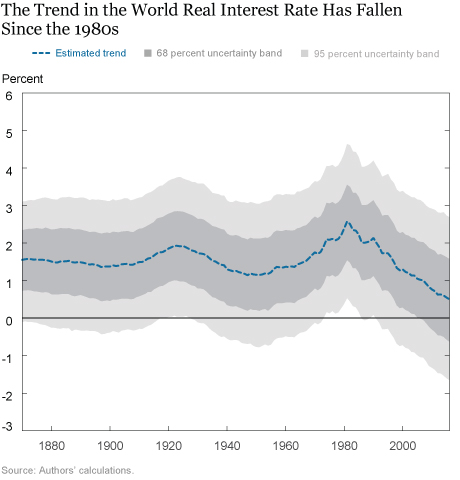

As we gear up for the CPI report, market analysts anticipate a decline in the annual inflation rate from 2.5% to 2.3%. Such a change would align with the Federal Reserve’s goals, possibly providing a green light for further easing of monetary policy. Expectations for the upcoming Federal Open Market Committee meeting are suggesting an 85% likelihood of a quarter-point rate cut. Understanding these nuances is crucial as we navigate the complexities of the current economic landscape.

Key economic indicators are set to influence market behavior in the coming days.

Key economic indicators are set to influence market behavior in the coming days.

Furthermore, with earnings season on the horizon, sector performance is set to come under scrutiny. Major US banks are expected to report results starting Friday, with analysts eagerly awaiting how these financial powerhouses have fared amid the evolving interest rate landscape.

Global Comparisons

Overseas markets are reflecting mixed trends. Europe’s Euro Stoxx 50 is up 0.47%, while China’s Shanghai Composite took a sharp fall of 6.62%. Meanwhile, Japan’s Nikkei 225 recorded a modest gain of 0.87%. These international shifts can often influence US market sentiments, particularly given the globalization of economies and interconnected financial systems.

Interest Rate Trends

On the interest rate front, December 10-year T-notes have dropped 3 ticks with the yield slightly up. The recent rally in US stocks has decreased the demand for safe-haven assets, putting pressure on Treasury yields. The mixed performance of European government bonds also paints a complex picture for investors trying to assess their next steps. As we anticipate the ECB’s next moves, the market is incorporating an overwhelming expectation for a rate cut next week, which, if realized, could further shift investor sentiment.

Yields and interest rates remain pivotal in shaping market sentiment.

Yields and interest rates remain pivotal in shaping market sentiment.

Bottom Line

As we analyze the ongoing situation, it’s clear that both the domestic and international arenas are fraught with challenges and opportunities. Investors must remain vigilant and responsive to rapidly changing market circumstances, adapting their strategies accordingly. For homeowners or potential buyers, the evolving mortgage landscape presents both challenges with rising rates and possible opportunities should inflationary pressures ease further.

In conclusion, with the next few days promising significant economic updates, the potential for shifts in market dynamics cannot be underestimated. Staying informed will be key as we navigate the uncertain waters ahead. Each development, whether from the stock market, mortgage applications, or broader geopolitical events, will weave into the larger narrative of economic recovery and growth.

Stay tuned for further insights and analysis on the evolving financial landscape.

Photo by

Photo by