The Ultimate Guide to Investing in Stocks and Shares

As a financial journalist, I often get asked about the best ways to invest in the stock market. Today, I want to share with you a comprehensive guide on how to buy stocks and shares, covering everything from the basics to key considerations.

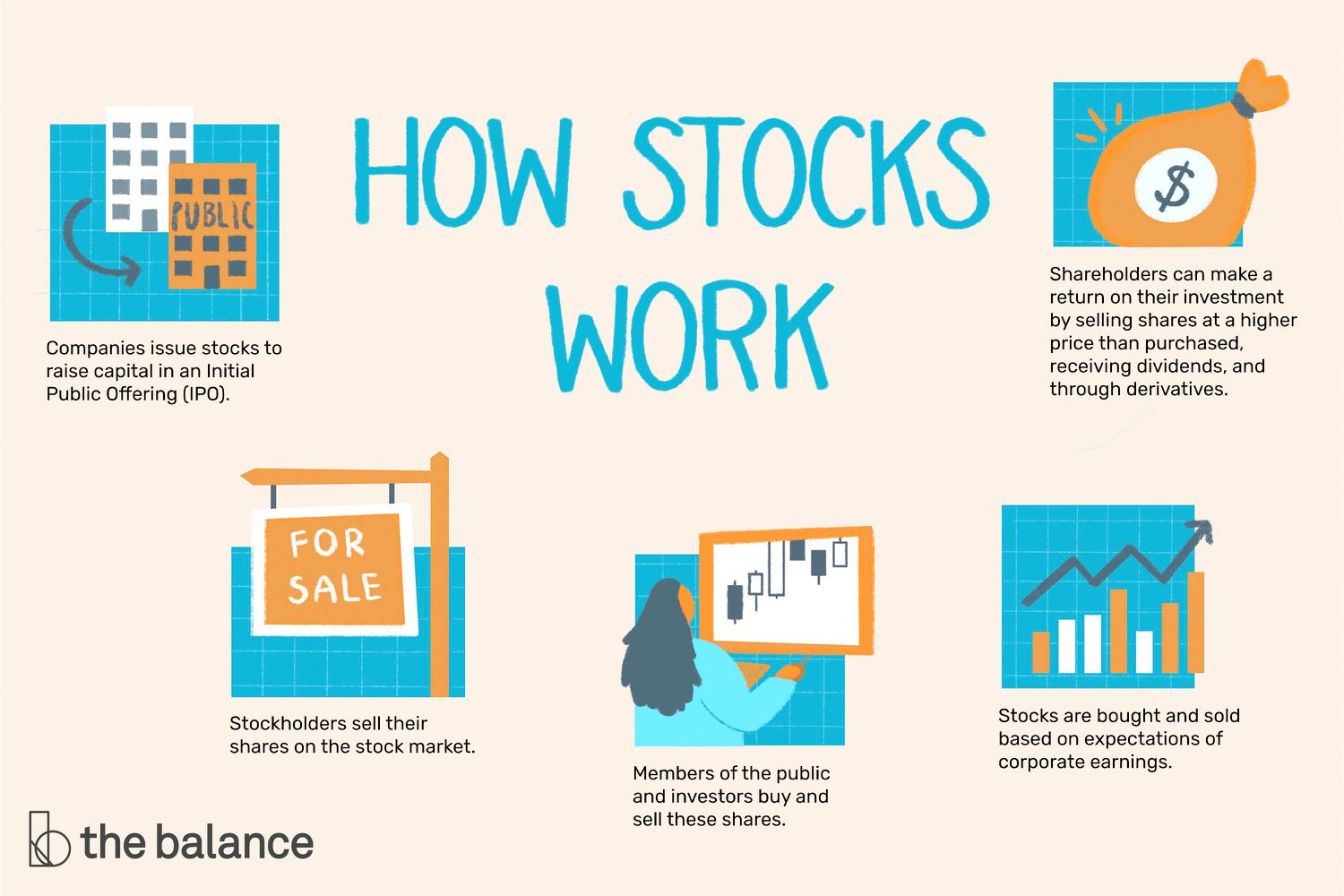

Understanding Stocks and Shares

Stocks and shares represent ownership in a company. When you purchase shares, you essentially become a part-owner of that company. This ownership entitles you to a share of the company’s profits, often distributed as dividends. However, it’s important to note that the value of your shares can fluctuate based on the company’s performance.

stocks shares

stocks shares

Distinguishing Between Stocks and Bonds

While stocks represent ownership, bonds are a form of debt investment. When you buy bonds, you are lending money to a company or government in exchange for regular interest payments and the return of your initial investment when the bond reaches maturity. Unlike stocks, bonds offer more predictable returns but with lower potential for growth.

Ways to Purchase Stocks and Shares

There are various methods to buy stocks and shares, each with its own advantages and considerations:

-

Online Brokers: Platforms like Online Brokers allow you to directly trade stocks and shares. You have control over your investments and can execute trades at your convenience.

-

Investment Platforms: Services such as Investment Platforms offer managed investment portfolios tailored to your risk tolerance and financial goals. They provide a hands-off approach to investing.

-

Financial Advisors: Seeking guidance from Financial Advisors can help you make informed investment decisions aligned with your financial situation and objectives. While they come at a cost, their expertise can be invaluable.

Key Considerations for Investors

When delving into the world of stocks and shares, it’s crucial to consider the following factors:

-

Risk Management: Stock markets can be volatile, so understanding your risk tolerance is essential. Diversifying your portfolio across different assets and sectors can help mitigate risk.

-

Tax Planning: The tax implications of your investments can significantly impact your returns. It’s advisable to comprehend the tax treatment of stocks and shares and consult with a tax professional if needed.

-

Cost Analysis: Buying and selling stocks involve various costs such as broker fees and taxes. Being aware of these costs and factoring them into your investment strategy is vital for long-term success.

In conclusion, investing in stocks and shares can be a rewarding endeavor if approached with caution and diligence. By grasping the fundamentals, understanding the differences from bonds, and considering key factors, you can navigate the stock market confidently and potentially achieve your financial goals.