Melton BS Increases Maximum Loan Size Across All LTVs

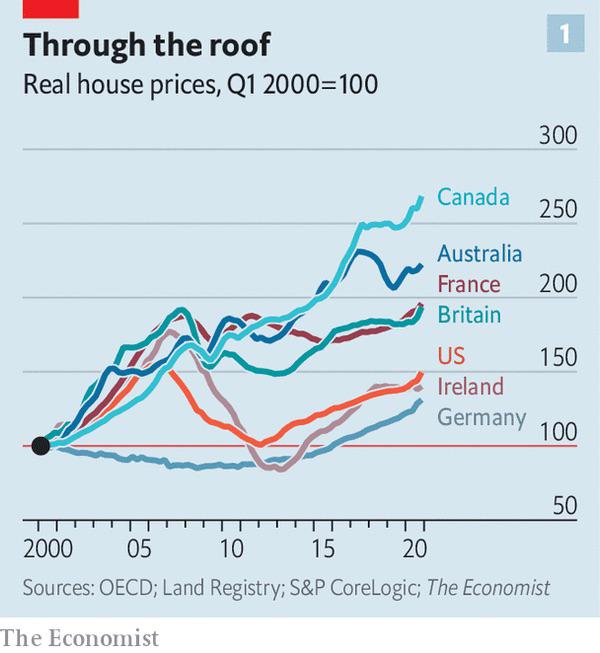

As a homeowner or prospective buyer, you’re likely no stranger to the challenges posed by rising house prices. It’s a well-documented fact that house prices have been on a steady upward trajectory for years, making it increasingly difficult for buyers, especially those in the south, to get their foot on the property ladder.

Rising house prices have made it difficult for buyers to get on the property ladder.

Rising house prices have made it difficult for buyers to get on the property ladder.

In response to this challenge, Melton Building Society has taken a proactive step to support a broader range of borrowers. From 24 May, the maximum loan size across the Melton’s loan-to-value range will increase, providing more options for those looking to secure a mortgage.

Increased Loan Sizes Across All LTVs

For those borrowing between 75-80% LTV, the maximum loan size will now be increased to £1m. For those borrowing at 90% LTV, the maximum loan size will be up to £750,000, and for those borrowing at 95% LTV, the maximum loan size will be up to £500,000.

More borrowers will now have access to larger loan sizes.

More borrowers will now have access to larger loan sizes.

In addition to these changes, Melton BS will also be launching new two- and five-year products available up to £2.5m. These new products will be available on a capital and repayment basis or for those borrowing on an interest-only basis up to 60% LTV.

Supporting Prospective Homeowners

According to Dan Atkinson, head of intermediaries at Melton BS, “Our aim is to offer a broader range of clients the option of a mortgage with Melton Building Society, and we’re committed to helping prospective homeowners and those looking to take their next steps on the property ladder.”

Melton BS is committed to helping prospective homeowners.

Melton BS is committed to helping prospective homeowners.

This move by Melton BS is a welcome development in the mortgage market, providing more options for borrowers and helping to make homeownership more accessible.

The mortgage market is constantly evolving, and Melton BS is leading the way.

The mortgage market is constantly evolving, and Melton BS is leading the way.

As the mortgage market continues to evolve, it’s heartening to see lenders like Melton BS taking proactive steps to support borrowers. With rising house prices showing no signs of slowing down, it’s more important than ever to have lenders that are committed to helping people achieve their homeownership dreams.