Money Matters: Energy Bills to Fall, but for How Long?

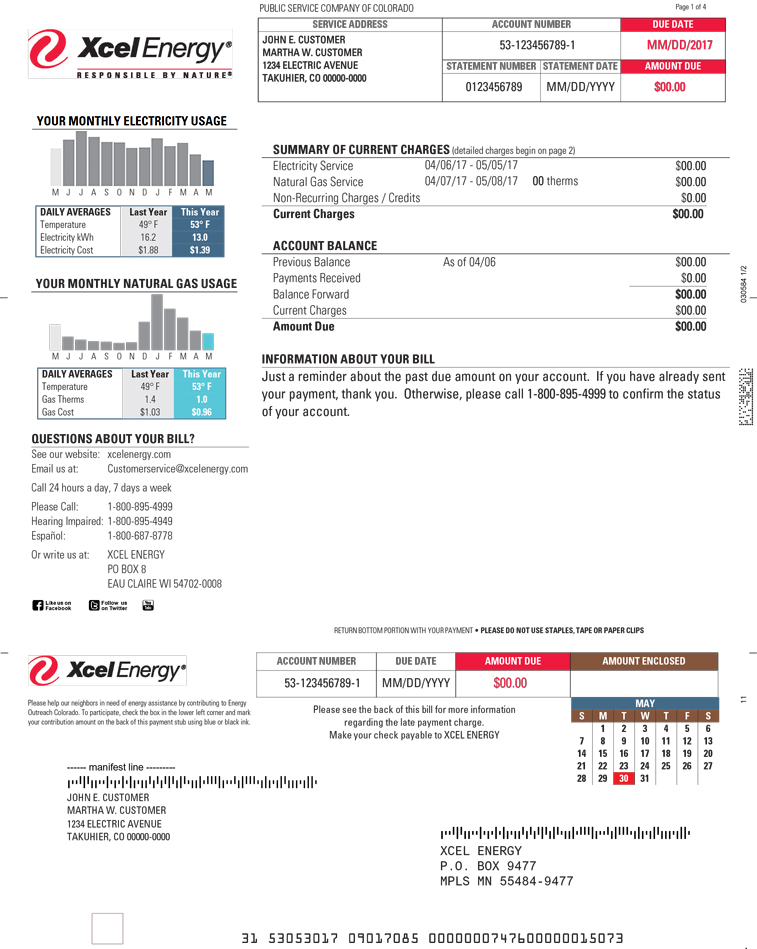

The latest news in the world of personal finance is a mixed bag. On the one hand, the energy price cap is set to fall, bringing some much-needed relief to households across the UK. On the other hand, predictions suggest that this respite may be short-lived, with prices expected to rise again in the not-too-distant future.

Energy bills to fall, but for how long?

Energy bills to fall, but for how long?

The new energy price cap, set to take effect in July, will see average bills fall by over £100. This is welcome news for households struggling to make ends meet, but it’s essential to remember that this decrease is still £300 more than before the Ukraine war energy crisis.

“The UK needs ’longer term solutions’ on energy prices because they are still ‘record high almost’,” said Sir Keir Starmer, Labour leader.

In other news, TSB and Nationwide are paying new customers to join, while Britons are being urged to act quickly to grab above-inflation savings rates while they last.

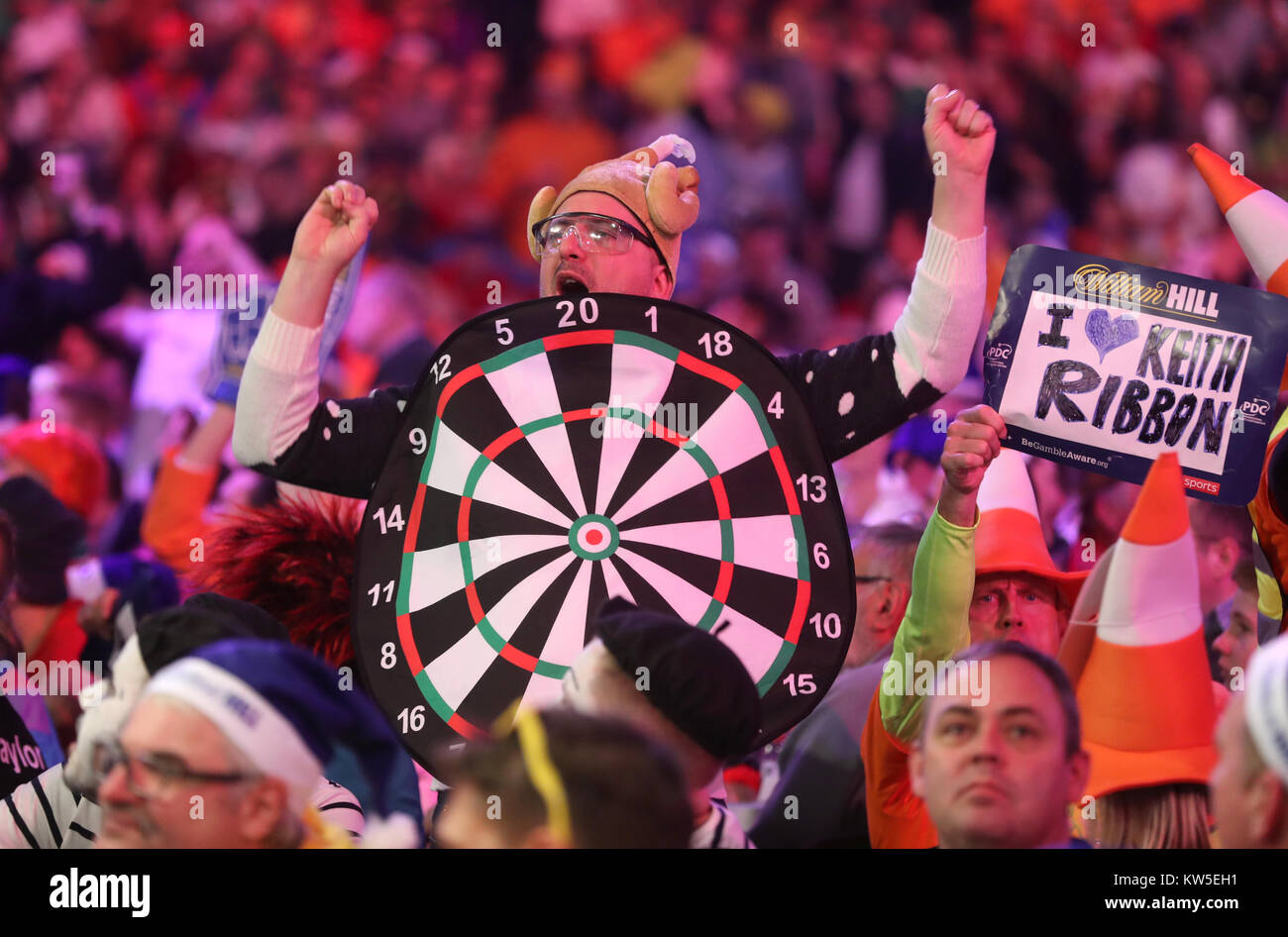

Darts Fans Left Reeling

Thousands of darts fans packed out the O2 last night as Luke Littler was crowned champion in the Premier League Darts final. However, it was the price of a pint that left many fans in shock. With prices reaching astronomical heights, it’s no wonder fans are crying foul.

Darts fans left reeling over pint prices

Darts fans left reeling over pint prices

Biscuit Break

It’s time to talk biscuits. With so many options available, it can be hard to balance the demands of eating well without breaking the bank. Our guide to elevenses will help you make an informed decision about which biscuits to pick.

Biscuit break: making the right choice

Biscuit break: making the right choice

Money Matters: More Than Just Energy Bills

It’s not just energy bills that are causing concern. Putting off ’life admin’ could be costing you thousands of pounds a year, research has suggested. Meanwhile, Cara Delevingne’s childhood home is up for sale, with a hefty price tag of £23.5m.

Stay Informed

Stay up-to-date with the latest news and analysis on the world of personal finance. From mortgages to savings rates, we’ve got you covered.

Stay informed with MortgageWatch

Stay informed with MortgageWatch