Morpheus: The Digital-Only Bridging Lender Revolutionizing the Industry

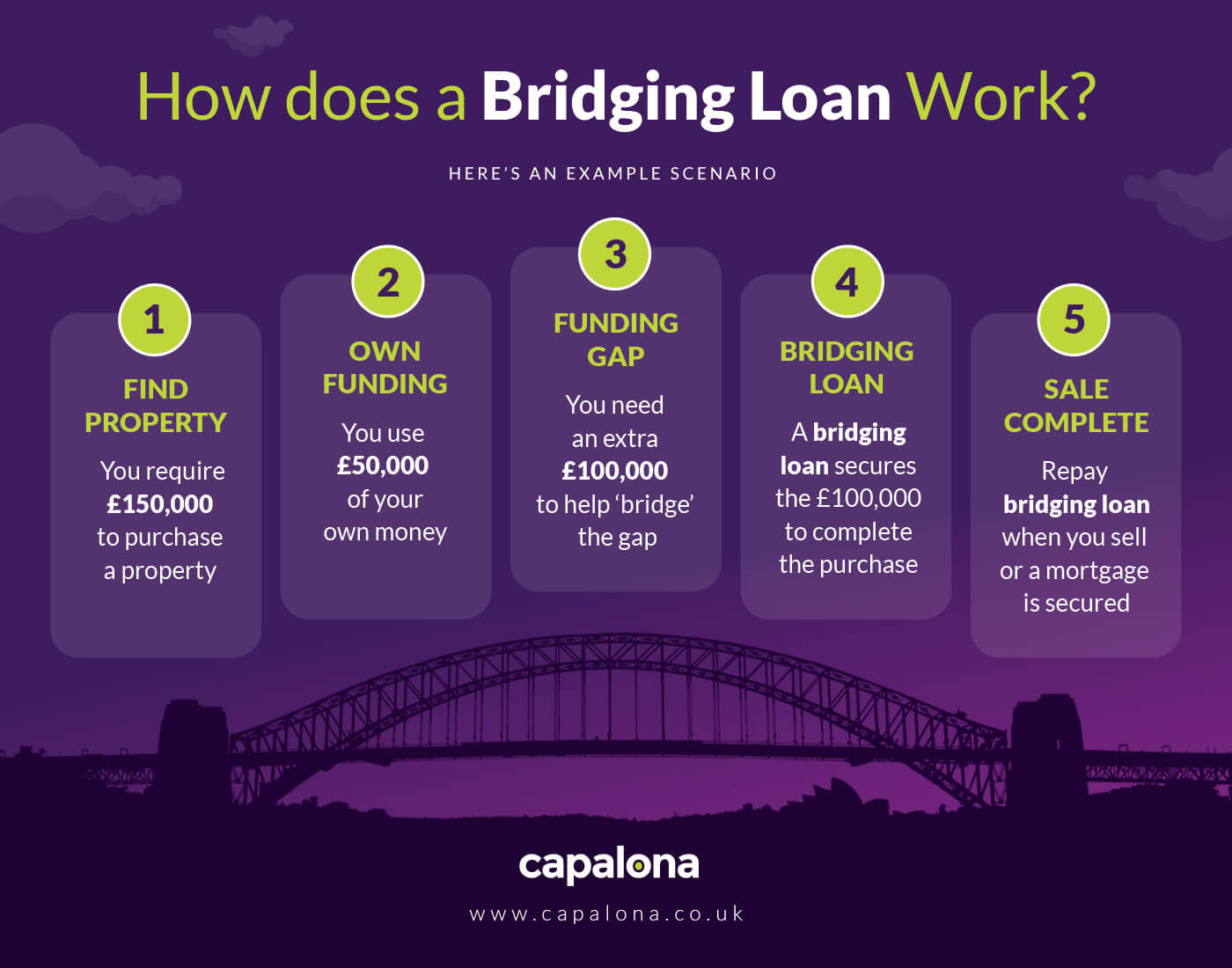

The UK’s commercial, corporate, and property professionals now have a new funding solution with the launch of Morpheus, a digital-only bridging lender. Co-founded by Matt Mawdesley, the lender offers competitive rates and focuses on bridging loans up to £750,000.

Competitive rates for UK professionals

Competitive rates for UK professionals

Mawdesley, who previously served as head of strategy at Together and AO.com, brings his expertise to the table, along with co-founder and chief financial officer Lee Jones and head of sales Ash Richardson. The team is supported by a board of advisers and non-executive directors, including Together’s former chief risk officer Steve Miller, HSBC’s head of growth lending Roland Emmans, and Connells Group’s chief information officer Tom Pirrie.

Biometric authentication and open banking for a seamless experience

Morpheus boasts a digital-only platform, featuring biometric authentication, open banking, and digital Know Your Customer and due diligence checks. This innovative approach aims to simplify the customer journey, making it more efficient and convenient.

A team of experts dedicated to innovative lending

A team of experts dedicated to innovative lending

Commenting on the launch, Mawdesley stated, “I’m incredibly proud to launch Morpheus with the team and introduce an innovative, new way of lending. This digital and more efficient experience is what customers have been crying out for, and with the right people on board, we’re confident in our offering going from strength to strength.”

Morpheus: Revolutionizing the UK’s bridging loan market

Morpheus: Revolutionizing the UK’s bridging loan market

With a strong funding commitment and a clear focus on simplifying the customer journey through technology, Morpheus is poised to make a significant impact in the UK’s bridging loan market.