Mortgage Approvals on the Rise: A Sign of Confidence in the Market?

As the latest Bank of England data reveals, mortgage approvals for house purchases in April reached 61,140, a slight decrease from 61,263 in March. While this may seem like a minor setback, experts believe that buyer confidence is building, despite interest rates remaining high.

Image: A person filling out a mortgage application

Image: A person filling out a mortgage application

Alistair Singer, director of My Home Move Conveyancing, notes that this strong month of mortgage approvals demonstrates that buyer confidence is building, even with interest rates yet to come down. He predicts that a cut in interest rates, expected in the coming months, will further boost buyer confidence.

“Another strong month of mortgage approvals demonstrates that buyer confidence is building despite the fact that interest rates are yet to come down.”

However, Singer also warns that as the market heats up, the time it takes to transact is likely to increase, putting strain on operational efficiency and market capacity, including the conveyancing process.

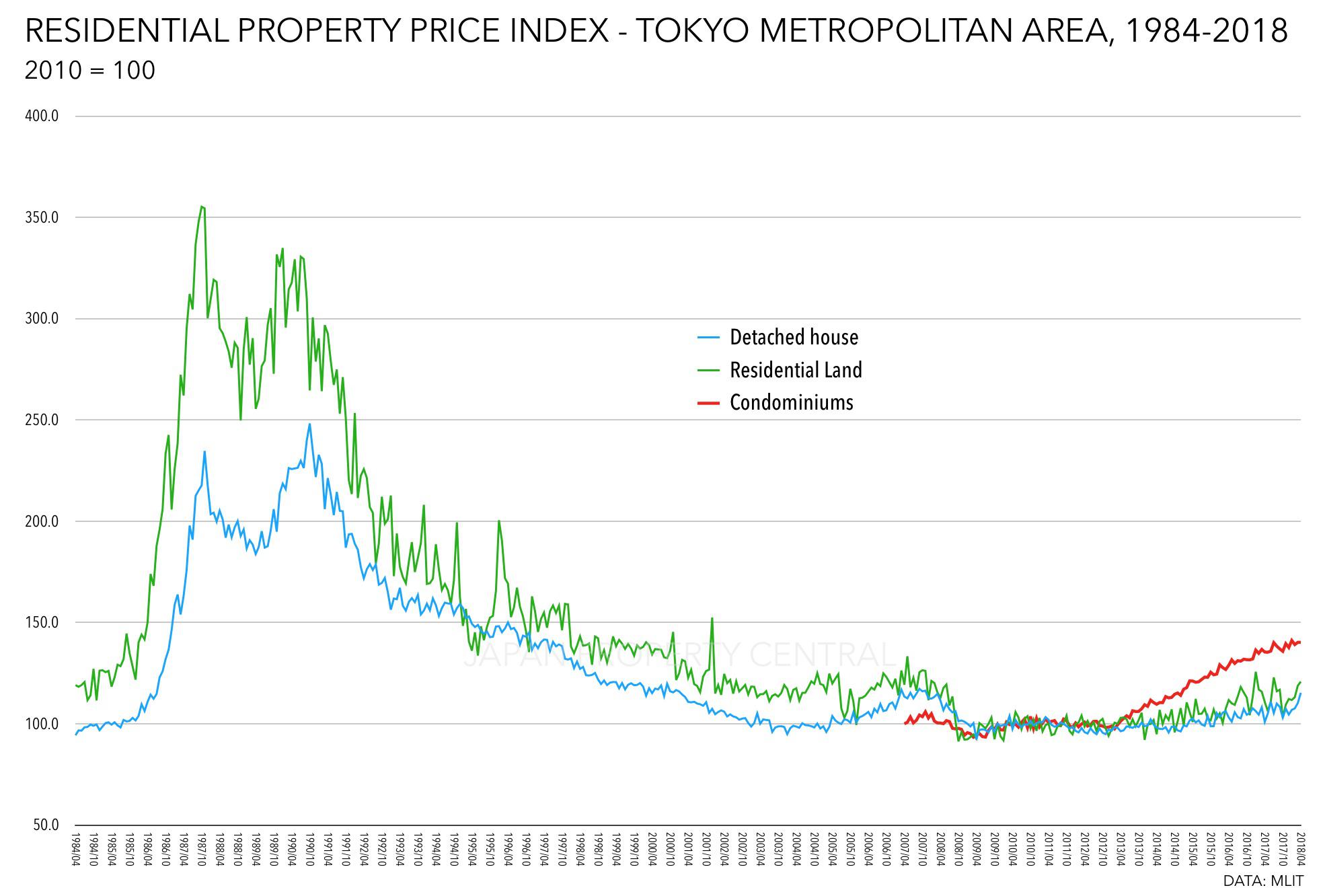

Image: A graph showing house prices

Image: A graph showing house prices

Karen Noye, mortgage expert at Quilter, points out that property transaction statistics produced by HMRC paint a rosier picture. The provisional seasonally adjusted estimate of the number of UK residential transactions in April 2024 is 90,430, 10% higher than in April 2023 and 5% higher than in March 2024. However, she notes that this is still 10% higher than a low base, given the relatively few transactions last year.

Experts believe that the Bank of England is likely to cut interest rates in August or September, while headline inflation eased to 2.3% in the 12 months to April 2024, down from 3.2% in the 12 months to March.

As the market continues to heat up, it’s essential for buyers to stay informed and prepared for the changes ahead. With interest rates expected to drop and buyer confidence on the rise, now may be the perfect time to consider taking the leap into the property market.

Image: A graph showing mortgage rates

Stay ahead of the game and keep up-to-date with the latest mortgage news and trends. Whether you’re a seasoned homeowner or a first-time buyer, MortgageWatch is your go-to source for expert analysis and timely updates.

Photo by

Photo by