Mortgage Approvals Reach 18-Month High: A Sign of Recovery?

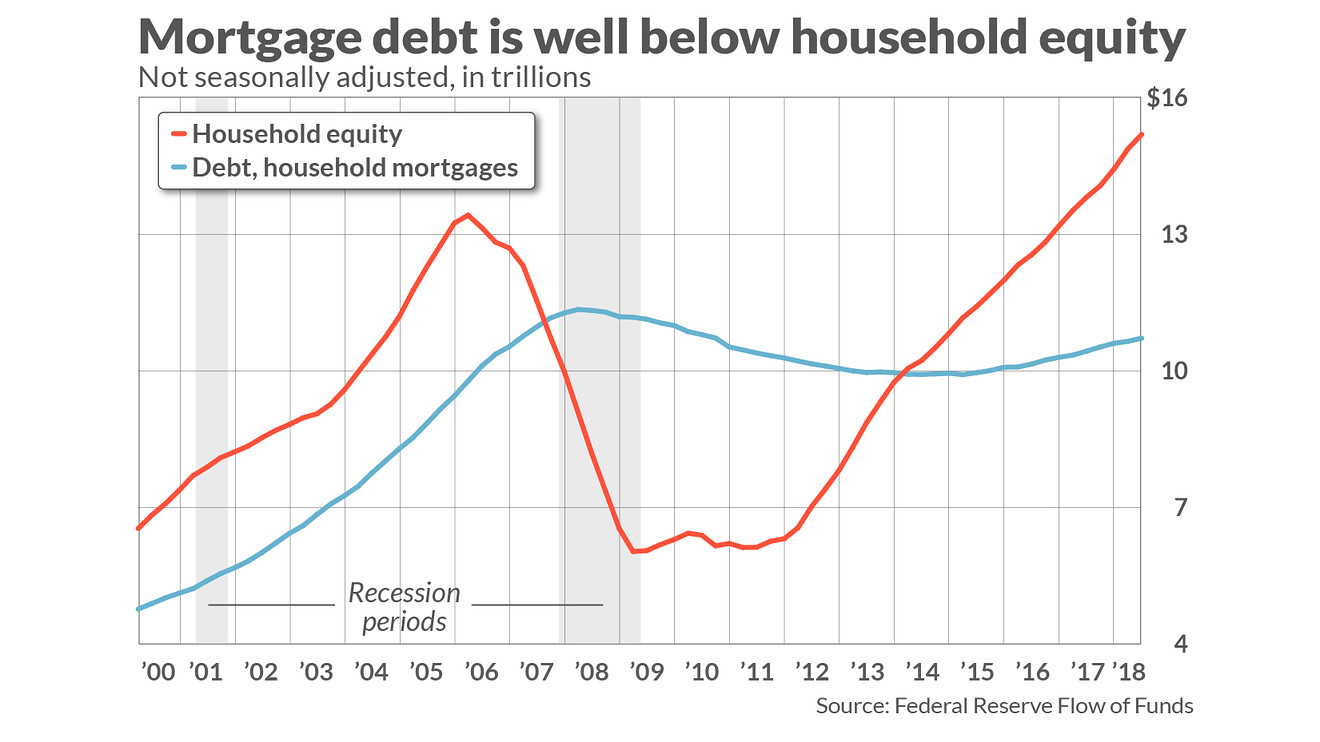

The latest Bank of England Money and Credit report has revealed that mortgage approvals have reached an 18-month high, with net mortgage approvals for house purchases rising from 60,497 in February to 61,325 in March. While this figure is marginally below analyst expectations of 61,500, it is a promising sign of recovery in the mortgage market.

The number of mortgage approvals has been steadily increasing since September 2022.

The effective interest rate on newly-drawn mortgages has also decreased by 17 basis points to 4.73%. This decrease, combined with the increase in mortgage approvals, suggests that the mortgage market is slowly but surely recovering from the recent downturn.

“The recovery in mortgage demand continued in March. However, the interest in mortgage rates over recent months appears to have taken some of the momentum out of the recovery.” - Peter Arnold, UK chief economist at EY

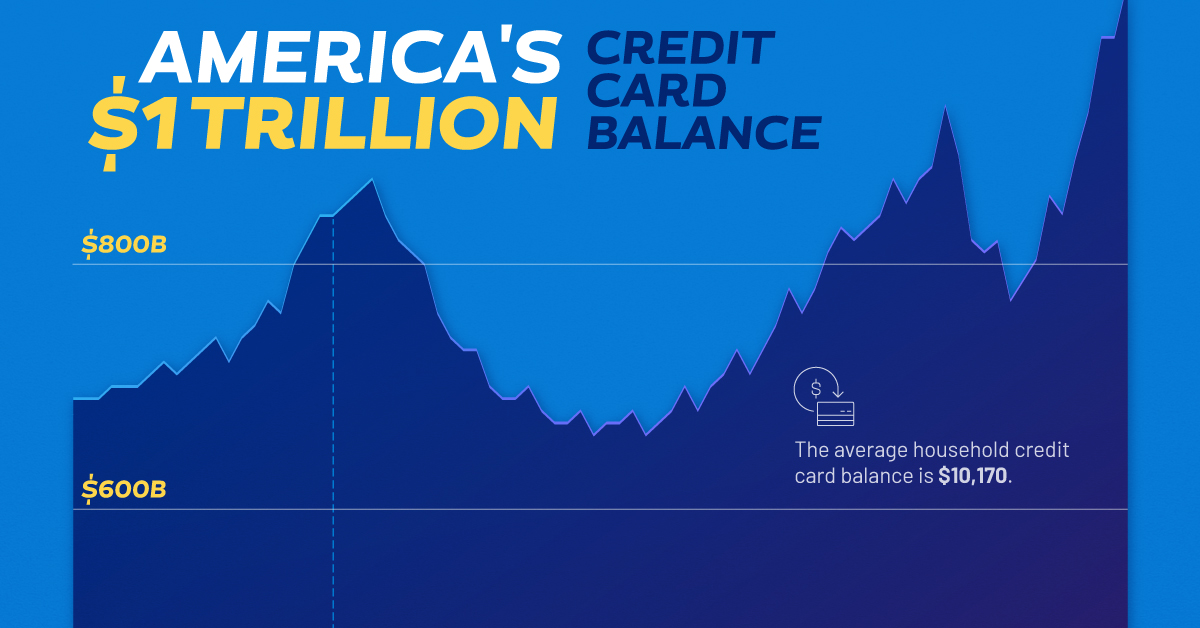

Net consumer credit borrowing has also seen an increase, rising to £1.58bn from £1.43bn in February. This rise was driven by net borrowing on credit cards, which jumped to £0.7bn from £0.5bn. Meanwhile, net borrowing elsewhere, including car dealership finance and personal loans, remained unchanged at £0.9bn.

Credit card debt has seen a significant increase in recent months.

Credit card debt has seen a significant increase in recent months.

Households also deposited an additional £8.5bn with banks and building societies, the highest net inflow since October 2022. This increase in deposits suggests that consumers are becoming more cautious with their finances, opting to save rather than spend.

“Some weeks in March it felt like activity was starting to go through the gears, but the next week it stalled.” - Stephen Perkins, managing director at Yellow Brick Mortgages

The mortgage market is a complex and ever-changing beast, and it’s clear that there are still many factors at play. However, with mortgage approvals reaching an 18-month high, it’s clear that the market is slowly but surely recovering. Whether this trend will continue remains to be seen, but for now, it’s a promising sign for the future of the mortgage market.

The mortgage market is slowly but surely recovering.

The mortgage market is slowly but surely recovering.

Photo by

Photo by