Mortgage Crisis: The Unsettling Trend of Longer-Term Mortgages

The latest figures from UK Finance reveal a worrying trend in the mortgage market. One in five new first-time buyers are taking out mortgage terms that stretch beyond 35 years, a stark reminder of the ongoing affordability crunch in the UK. This trend is not limited to first-time buyers, as more customers are needing to take out longer-term mortgages in subsequent transactions, further into their home ownership journeys and working lives.

Mortgage Crisis

Mortgage Crisis

The implications of this trend are far-reaching. With mortgage payments stretching into retirement, homeowners may have less free income for other important considerations, such as pension contributions. This could have significant societal implications, which may not become apparent until years down the line.

Sir Steve Webb, a former pensions minister, has raised concerns that some home-buyers could be gambling with their retirement prospects by taking on ultra-long mortgages. According to data from the Bank of England, 42% of new mortgages in the fourth quarter of 2023 had terms going beyond the state pension age.

Retirement Prospects

Retirement Prospects

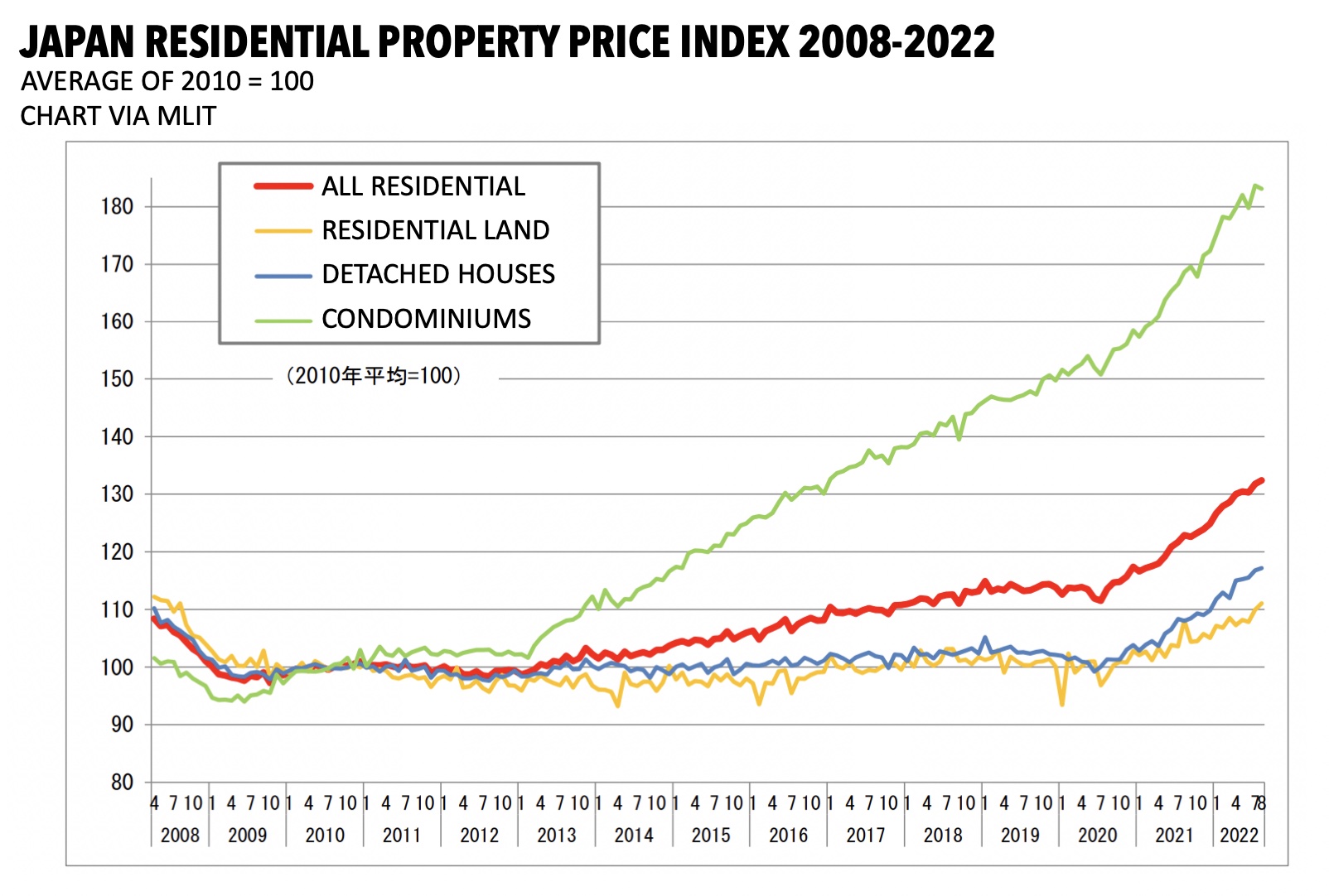

The trend of longer-term mortgages is a clear indication of the ongoing affordability crisis in the UK. With house prices remaining high relative to incomes, many buyers are being forced to take out longer mortgages just to get on the property ladder.

House Prices

House Prices

The situation is not expected to improve anytime soon. UK Finance’s Household Finance Review for the first quarter of 2024 predicts that the mortgage market will continue to be constrained by affordability issues.

Mortgage Market

Mortgage Market

In conclusion, the trend of longer-term mortgages is a worrying sign of the ongoing affordability crisis in the UK. With homeowners taking on mortgages that stretch into retirement, the implications for their financial futures are significant. It is essential that buyers carefully consider their financial situation before taking on a mortgage, and that lenders continue to carry out thorough affordability assessments.

Financial Futures

Financial Futures