Mortgage Deposits: How Much Do You Need to Save?

Buying your first home can be a daunting task, especially when considering the financial decisions you’ll be making. Among these decisions are mortgage options. Ahead of buying a property, it’s essential to get to grips with how mortgage deposits work, including how much you’ll need to save and the rules around gifted deposits.

According to experts, mortgages are generally available at up to 95% loan-to-value (LTV), which means it’s possible to get on the property ladder with a deposit of 5% of the purchase price and a mortgage covering the remaining 95%. But how much cash will you need to put down?

Here’s how much you’d need to save for a deposit on a £200,000 property, based on different deposit sizes:

- 5% deposit: £10,000

- 10% deposit: £20,000

- 15% deposit: £30,000

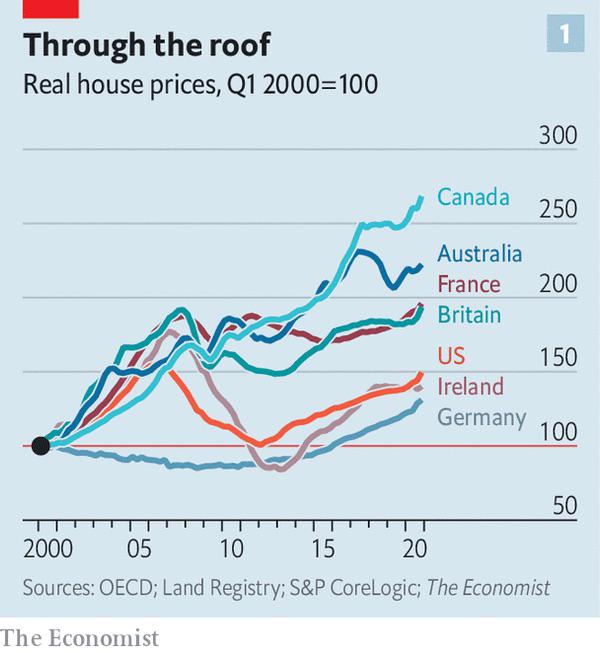

To calculate how much you might need to save for your mortgage deposit, you should consider typical property prices and monthly repayment costs. You should also think about the property prices in your area - you can get a rough idea of local house prices from property portals such as Rightmove and Zoopla, and by speaking to local estate agents.

Local house prices

Local house prices

However, the figures listed on portals and agent websites are asking prices, so they might be a little higher than what the properties are really worth. For more concrete information, you can check how much homes in the area have sold for using the Land Registry’s price paid tool.

Each monthly mortgage payment will include interest as well as some of the loan itself - and the bigger the deposit, the smaller the loan and the less interest you’ll pay. You should also think about factors such as mortgage fees, early repayment charges, and how many years you want to pay back the loan over (the mortgage term). To work out how much a mortgage could cost you each month, you can use the Which? mortgage repayment calculator.

Mortgage repayment calculator

Mortgage repayment calculator

The UK Economy and Mortgage Rates

The UK should cut rates up to three times this year to continue the economy’s “soft landing” from a mild recession, says the International Monetary Fund. It says the Bank of England should reduce rates by “about 50-75 basis points” in 2024, to unshackle the country’s recovering economy after the UK emerged from a technical recession earlier this month.

The IMF says: “Keeping Bank rate constant as inflation, and inflation expectations, fall would raise ex-post real rates, which could stall or even reverse the recovery, and lead to an extended undershooting of the inflation target.”

The base rate has been stalled at a 16-year high of 5.25% since last August. A cut would be the first reduction in over four years, with the last coming in March 2020.

But official data earlier this month showed that the UK expanded by 0.6% in the three months to March, the strongest quarterly growth since the fourth quarter of 2021. This brought the country out of a short recession it stumbled into at the end of last year.

The IMF says: “With growth recovering faster than expected, the UK economy is approaching a soft landing, following a mild technical recession in 2023.”

UK economy

UK economy

Mortgage Crunch for Older Homeowners

One in 10 older homeowners face arrears in the “mortgage crunch”. Almost one in two homeowners aged 55 or over will pay an additional £400 a month on their mortgage after their current fixed-rate deal expires.

These figures were produced by Key Later Life Finance to show the extent of the “mortgage crunch” for older homeowners. A total of 47% of homeowners in this age bracket said they expected repayments to rise by an average of £5,000 a year. This steep rise is creating problems for many with more than one in 10 (13%) in this age group saying they are concerned they will slip into arrears on their mortgage as they head into retirement.

A further third (30%) said they were “unsure” what will happen to their monthly payments at the end of their current fixed-rate term.

Mortgage crunch

Mortgage crunch

Key’s research shows that the average monthly mortgage payment for the over-55 age group is currently £700, with these repayments accounting for around 20% of their monthly outgoings. The later life specialist says this underlines the financial pressure older homeowners are under from the cost-of-living crisis as they try to juggle bills with saving for retirement.

Its research found that around one in seven (15%) said mortgage repayments currently account for 30% or more of their monthly outgoings, with 11% saying monthly repayments total £1,500 or more.

The research shows this age group are taking action to limit increases, with one in five taking advice on reducing their mortgage repayments and one in four having already spoken to their current lender.

Mortgage advice

Mortgage advice