Mortgage Lending on the Rise: A Sign of a Booming Housing Market?

As the UK housing market continues to soar, mortgage lending has reached new heights. According to recent data from the Bank of England, mortgage lending rose to £7 billion in March, with 70,961 mortgage approvals. This marks a significant increase from the previous month, and a substantial jump from the pre-pandemic average.

The UK housing market continues to boom, with mortgage lending on the rise.

The UK housing market continues to boom, with mortgage lending on the rise.

The data also reveals that net borrowing of mortgage debt increased to £7 billion in March, up from £4.6 billion in February. This surge in mortgage lending is a clear indication of the housing market’s resilience, despite concerns over rising interest rates and inflation.

A Volatile Market

The recent monthly mortgage lending data has been extremely volatile, according to Adrian Lowery, financial analyst at Bestinvest. This volatility is likely due to the ongoing pandemic, which has caused uncertainty in the market. However, the latest figures suggest that the housing market is still going strong.

Mortgage approvals remain high, despite volatility in the market.

Mortgage approvals remain high, despite volatility in the market.

What Does This Mean for Homebuyers?

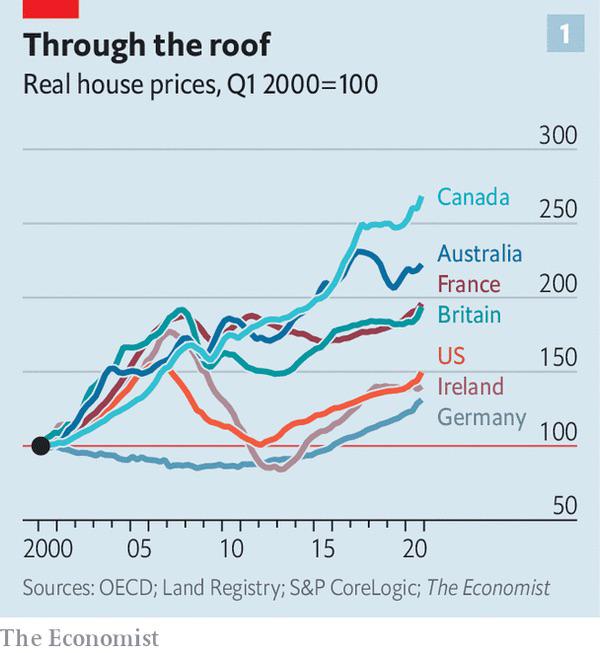

The rise in mortgage lending is a clear indication that the housing market is still booming. This is good news for homeowners and investors, but may be concerning for first-time buyers who are struggling to get on the property ladder. With house prices continuing to hit record highs, it’s becoming increasingly difficult for new buyers to enter the market.

House prices continue to soar, making it difficult for first-time buyers to enter the market.

House prices continue to soar, making it difficult for first-time buyers to enter the market.

As the Bank of England considers hiking interest rates to rein in inflation, it’s likely that the housing market will continue to fluctuate. However, for now, it seems that the UK housing market is still going strong.

About the Author

I’m a financial journalist with a passion for exploring the latest trends and developments in the UK housing market. With years of experience in the industry, I’ve developed a keen eye for detail and a deep understanding of the complex factors that drive the market.