Mortgage Market Insights: Navigating the Scottish Expansion and the Dangers of 35-Year Mortgages

The mortgage market is constantly evolving, with new developments and trends emerging regularly. In this article, we’ll delve into two significant stories that are shaping the industry: Inspired Lending’s expansion into the Scottish market and the warnings surrounding 35-year mortgages.

Inspired Lending enters the Scottish market

Inspired Lending enters the Scottish market

Inspired Lending, a bridging finance provider, has recently expanded its product offerings to the Scottish market. This move marks a significant milestone for the company, which launched in England and Wales in November 2023. Inspired Lending offers a range of unregulated bridging loans, refurbishment finance, and bespoke short-term loans, with loan facilities up to £5 million secured against residential, commercial, semi-commercial, and industrial properties.

As part of this expansion, Inspired Lending has appointed Scotland-based solicitor Wilson McKendrick to its panel. This strategic move is expected to strengthen the lender’s presence in the Scottish market, providing brokers and their clients with access to the company’s innovative funding solutions.

A word from the CEO

A word from the CEO

Gavin Diamond, CEO at Inspired Lending, commented on the expansion, saying: “It has always been our intention to lend in Scotland, and, having seen how well our products and service have gone down in England and Wales, we felt now is the ideal time to launch to the Scottish market.”

“We’re looking forward to working closely with Allan McKendrick and the rest of the team at Wilson McKendrick as brokers in Scotland take advantage of our simple and speedy, bespoke funding solutions.” - Gavin Diamond, CEO at Inspired Lending

The Dangers of 35-Year Mortgages

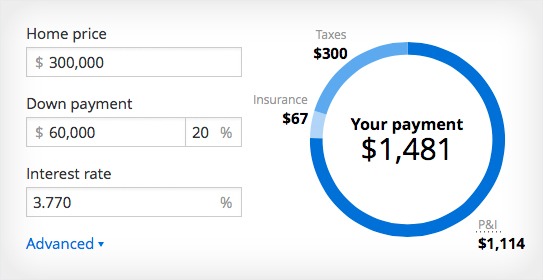

In other news, warnings have been issued to first-time buyers who are opting for 35-year mortgages. With the average mortgage term being 31 years according to UK Finance data, many individuals are choosing to extend their terms to secure lower monthly payments. However, this decision can come at a significant cost, as borrowers may be forced to use their pension to pay off their mortgage.

The cost of longer mortgage terms

The cost of longer mortgage terms

Chris Sykes, associate director at Capital Finance, cautioned: “In the current higher rate environment, many individuals likely hope to extend their terms now and then refinance at a more competitive rate in the future.”

Sykes also emphasized the importance of making small overpayments, highlighting that a monthly overpayment of just £30 could pay off the mortgage one year and five months earlier, saving £12,486 in interest.

John Fraser-Tucker, head of mortgages at Mojo Mortgages, echoed Sykes’ concerns, warning that longer mortgage terms can provide short-term relief in the form of lower mortgage payments but come at the cost of significantly higher overall interest charges over the life of the loan.

The impact on retirement

The impact on retirement

Mark Screeton, chief executive at SunLife, pointed out that many retirees are cash poor and property rich, with a significant portion of their modest income still being spent on housing rather than enjoying life in retirement.

The warnings surrounding 35-year mortgages serve as a reminder of the importance of careful planning and consideration when taking on a mortgage. With the average homeowner retiree having a home worth over £320,000 but a household income of less than £30,000, it’s essential to prioritize mortgage payments to avoid financial strain in retirement.

In conclusion, the mortgage market is constantly evolving, with new developments and trends emerging regularly. Inspired Lending’s expansion into the Scottish market marks a significant milestone for the company, while the warnings surrounding 35-year mortgages serve as a reminder of the importance of careful planning and consideration when taking on a mortgage.