Mortgage Market Moves: SBG Acquires Share in New Homes Mortgage Services Amid Interest Rate Cuts

Introduction

The UK’s mortgage landscape is experiencing significant shifts, with major players making strategic moves that could alter the course of the market. Sesame Bankhall Group’s recent acquisition of a stake in New Homes Mortgage Services (NHMS) coincides with the Bank of England’s reduction of interest rates to 4.75%. These developments come at a time when the housing market is facing both challenges and opportunities, thereby demanding a deeper analysis of their implications.

The evolving mortgage landscape in the UK.

The evolving mortgage landscape in the UK.

SBG’s Strategic Acquisition

Sesame Bankhall Group has made headlines by acquiring a stake in New Homes Mortgage Services, one of the UK’s largest mortgage brokers. This acquisition highlights SBG’s ambition to expand its reach and influence within the industry. New Homes Mortgage Services, which has been a part of the Sesame Network for nearly three decades, currently boasts a team of 40 advisers and serves a substantial client base, handling £760 million in mortgage lending annually. Stewart Bartle, Managing Director of NHMS, remarked,

“From day one, it was clear that Sesame Bankhall Group’s own adviser-led growth strategy and vision matched ours.”

This partnership is poised to accelerate NHMS’s growth trajectory, with plans in place to invest further in its operations.

Implications of the Interest Rate Cuts

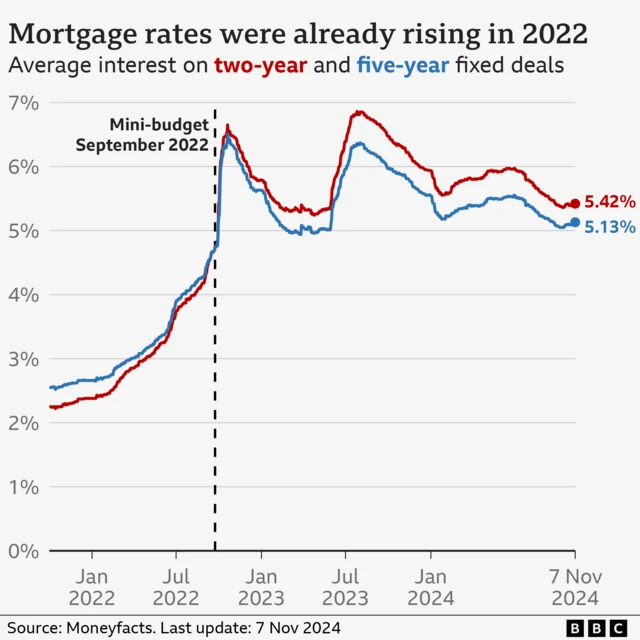

Meanwhile, in a move anticipated by analysts, the Bank of England has cut its base interest rate to 4.75%. This marks the second rate drop this year following a previous decrease in August. The significance of these cuts cannot be overstated; they directly affect borrowing costs, thus influencing both consumer spending and the overall health of the housing market.

Chancellor of the Exchequer, Rachel Reeves, welcomed the rate cut but acknowledged the challenging economic environment.

“I am under no illusion about the scale of the challenge facing households,” she stated, indicating a cautious optimism amid broader financial pressures.

Understanding the impact of interest rate changes.

Understanding the impact of interest rate changes.

The Effect on Homeowners

For homeowners, the impact of these interest cuts will vary depending on individual mortgage arrangements. Tracker mortgage holders can immediately benefit from lower monthly repayments, while those locked into fixed-rate deals will not experience changes until their current terms expire. This discrepancy poses challenges for first-time buyers and existing homeowners, effectively making affordability a pressing issue.

As the Bank of England’s Governor, Andrew Bailey, noted, “It’s likely that interest rates will continue to fall gradually from here.” Yet, with inflation concerns looming, especially after the latest budget announcements, the trajectory of future cuts remains uncertain.

SBG’s Vision for Growth

The investment in NHMS marks a significant milestone for Sesame Bankhall Group, particularly as they embark on their new growth strategy under CEO Richard Harrison. Harrison emphasised the importance of nurturing relationships with advisers and becoming a “proactive partner” in the advisory process.

He stated,

“Through our existing network relationship, it’s clear that we have that partner [in NHMS], and we look forward to helping them thrive and innovate.”

This development illustrates SBG’s commitment to enhancing the support provided to mortgage advisers, thereby fostering a more robust advisory framework.

Building stronger advisory connections in the mortgage market.

Building stronger advisory connections in the mortgage market.

Future Outlook

As the Bank moves forward with its strategy, all eyes will be on the potential for additional interest rate adjustments in the upcoming year. While the current cut is designed to encourage spending, economic indicators suggest that inflation may hinder such immediate benefits. The relationship between interest rates and inflation will continue to be a focal point for both policymakers and consumers alike.

Experts predict that while interest rates may not continue to decrease as swiftly or drastically in 2025, current trends indicate a need for vigilance and adaptability from all market participants. The dynamics of homeownership and mortgage financing are, as ever, shaped by a confluence of governmental actions, economic conditions, and consumer behavior.

Conclusion

The intersection of Sesame Bankhall Group’s strategic investment and the Bank of England’s interest rate cuts reveals a pivotal moment in the UK mortgage market. As businesses like NHMS prepare to capitalize on this investment, potential homebuyers and homeowners must navigate the evolving landscape carefully. The direction taken by these key players will undoubtedly influence the broader economic environment as stakeholders adapt to the shifting tides of the mortgage industry.

Anticipating market changes and their effects on consumers.

Anticipating market changes and their effects on consumers.

Photo by

Photo by