Mortgage Market Update: Rates and Lending Criteria in Focus

The mortgage market is experiencing a period of change, with lenders adjusting their rates and lending criteria in response to shifting economic conditions. In this article, we’ll explore the latest developments and what they mean for borrowers.

Santander Reduces Residential Mortgage Rates

Santander has announced a reduction in selected residential mortgage rates, effective from July 4th. The lender is cutting fixed rates by between 0.02% and 0.16% for purchases, in a move that will be welcomed by borrowers. This change is reflected in Santander’s latest mortgage rates page, which will be updated from July 4th.

Private Label Launches ‘Rockstar Range’ of Mortgages

Private Label has introduced its new ‘Rockstar Range’ of mortgages, which includes interest-only lending up to 90% loan-to-value (LTV), including into retirement. The range also offers flexibility regarding self-employment and complex income, with criteria that accepts professional individuals with less than 12 months’ trading history. Additionally, the Rockstar Range will consider foreign nationals with less than 12 months in the UK, and will accommodate large loans exceeding £5m.

Mortgage rates continue to fluctuate

Mortgage rates continue to fluctuate

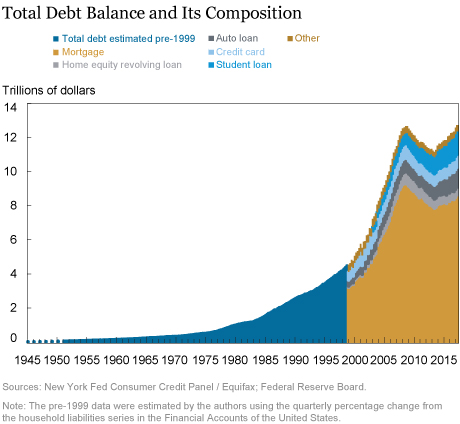

UK Household Borrowing Surges as Mortgage Approvals Dip

The Bank of England has reported a surge in household borrowing, with consumer credit borrowing rebounding to £1.5 billion in May. This increase is driven by borrowing through methods such as credit cards, personal loans, and car finance. However, mortgage approvals for house purchases have dipped slightly to 60,000 in May, down from 60,800 in April.

Household borrowing on the rise

Household borrowing on the rise

What Do These Changes Mean for Borrowers?

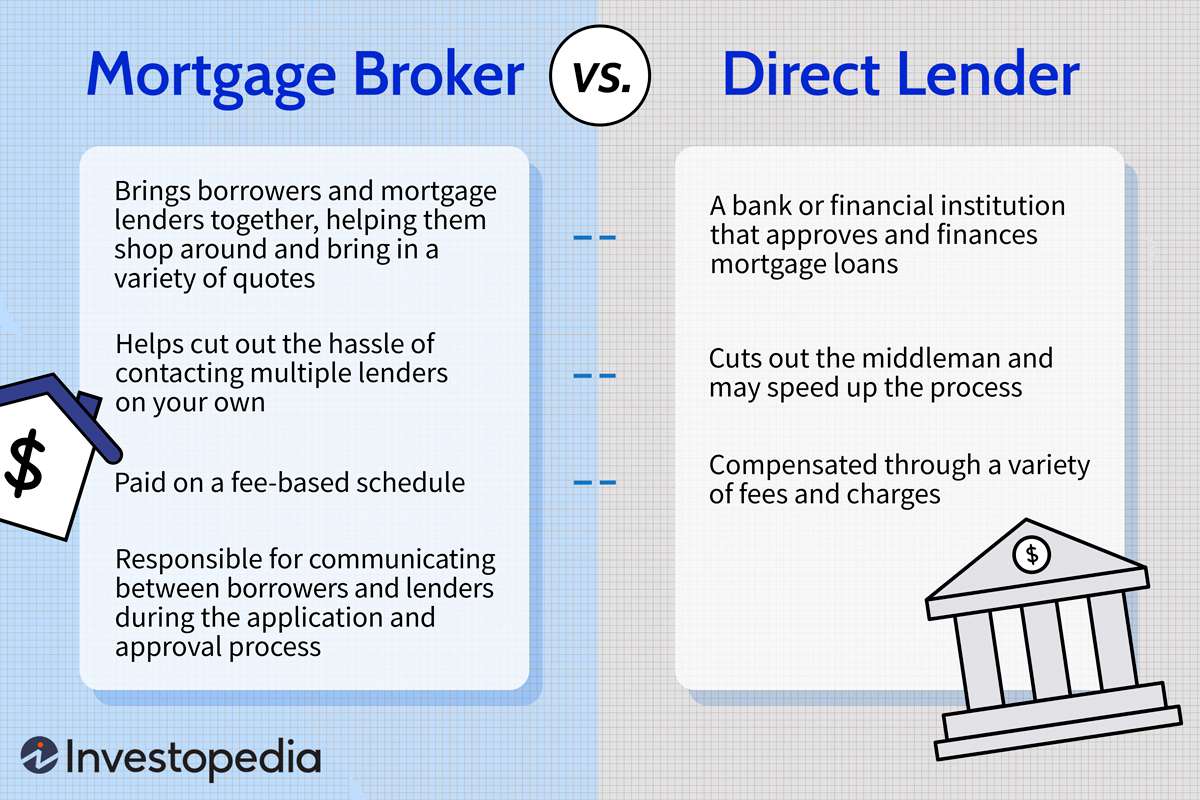

The reduction in mortgage rates by Santander and the launch of Private Label’s Rockstar Range are positive developments for borrowers. However, the dip in mortgage approvals and the surge in household borrowing suggest that borrowers are approaching the market with caution. With interest rates remaining high, it’s essential for borrowers to carefully consider their options and seek professional advice before making a decision.

Seeking professional mortgage advice is crucial

Seeking professional mortgage advice is crucial

Conclusion

The mortgage market is constantly evolving, and borrowers need to stay informed about the latest developments. By understanding the changes in mortgage rates and lending criteria, borrowers can make informed decisions about their financial future.

Stay up-to-date with the latest mortgage market news

Stay up-to-date with the latest mortgage market news