Mortgage Market Updates: Acquisitions, Rents, and Later Life Lending

The mortgage market has seen significant developments in recent weeks, with acquisitions, rising rents, and a focus on later life lending. In this article, we’ll delve into the latest news and what it means for the industry.

MAB Completes Purchase of First Mortgage Direct

Mortgage Advice Bureau (MAB) has completed its acquisition of First Mortgage Direct, purchasing the remaining 20% shareholding in the business for £9.35m. This move marks a significant milestone for MAB, which first acquired an 80% stake in First Mortgage Direct in 2019.

MAB completes acquisition of First Mortgage Direct

Ben Thompson, deputy CEO of MAB, commented on the acquisition, stating that it was strategically important for the company to grow its expertise in specific market specialisms such as new build. The acquisition is expected to accelerate MAB’s overall market share.

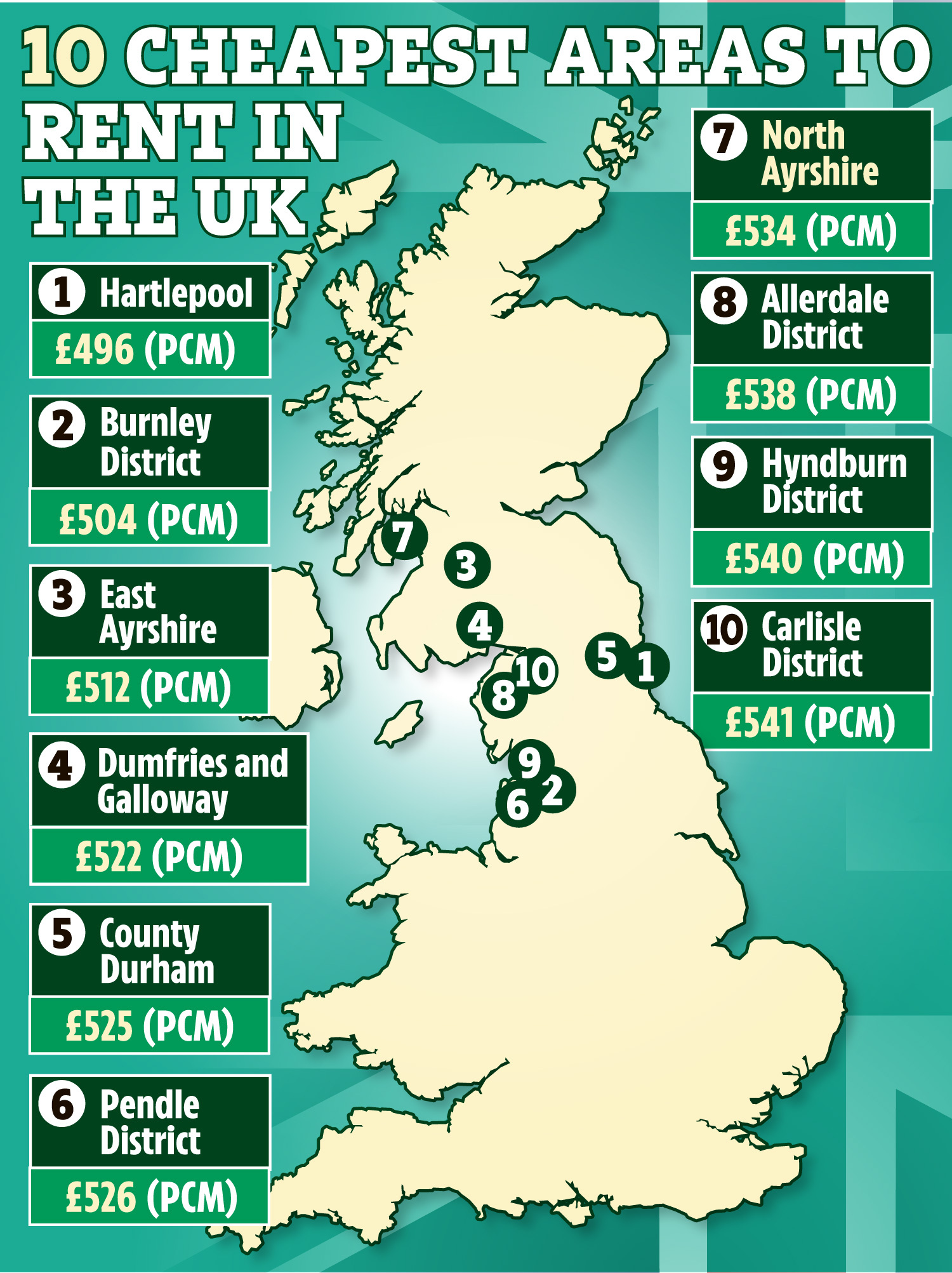

Rents Climb 9.1% Across the UK

Average UK rents have climbed 9.1% over the last year, with London and Scotland seeing the largest increases. According to data from Zero Deposits, rents in London jumped 11.2%, while Scotland saw a 10.5% rise.

Rents across the UK

Rents across the UK

The data also revealed that detached properties have seen a 8.6% increase in rental prices, while semi-detached homes have seen a 8.7% rise. Flats have performed the strongest, with a 9.9% increase in rental prices.

Later Life Lending Collaboration Events

Hodge, Livemore, and the Air Mortgage Club are supporting a series of free adviser events across the UK, focusing on the later life lending sector. The events aim to provide education and expertise in the later life space, with keynote speakers and interactive sessions.

Later Life Lending Collaboration events

Later Life Lending Collaboration events

The events are a collaboration between later life lenders and distributors, including Hodge, Livemore, Air Mortgage Club, Standard Life Home Finance, Legal & General Home Finance, and the Family Building Society.

In conclusion, the mortgage market has seen significant developments in recent weeks, with acquisitions, rising rents, and a focus on later life lending. As the market continues to evolve, it’s essential for advisers and lenders to stay informed and adapt to the changing landscape.