Mortgage Rate Hikes: A Sign of Things to Come?

The UK’s mortgage market has seen a significant shift in recent days, with two of the country’s biggest lenders, NatWest and Santander, announcing rate hikes on their mortgage products. This move has sparked concerns about the direction of interest rates in the UK, with many experts predicting that the Bank of England may not cut rates until August.

The rate hikes, which come into effect on April 30, will see NatWest increase rates by up to 0.21 percentage points on selected new mortgage products and up to 0.22 percentage points on selected remortgage products. Santander, on the other hand, will increase rates by up to 0.2 percentage points for new purchases and remortgages.

Mortgage rates on the rise

Aaron Strutt, product and communications manager at Trinity Financial, described the move as “not a great start to the week.” The rate hikes follow similar increases by lenders such as Barclays and HSBC last week.

The shift in the mortgage market is seen as a sign of the changing landscape of interest rates in the UK. City traders are betting against a June rate cut, with August looking more likely as the date of the first cut. Matthew Ryan, Head of Market Strategy at Ebury, believes that the first cut could be even later, citing the recent positive surprise in the April PMI report.

PMI report shows signs of growth

PMI report shows signs of growth

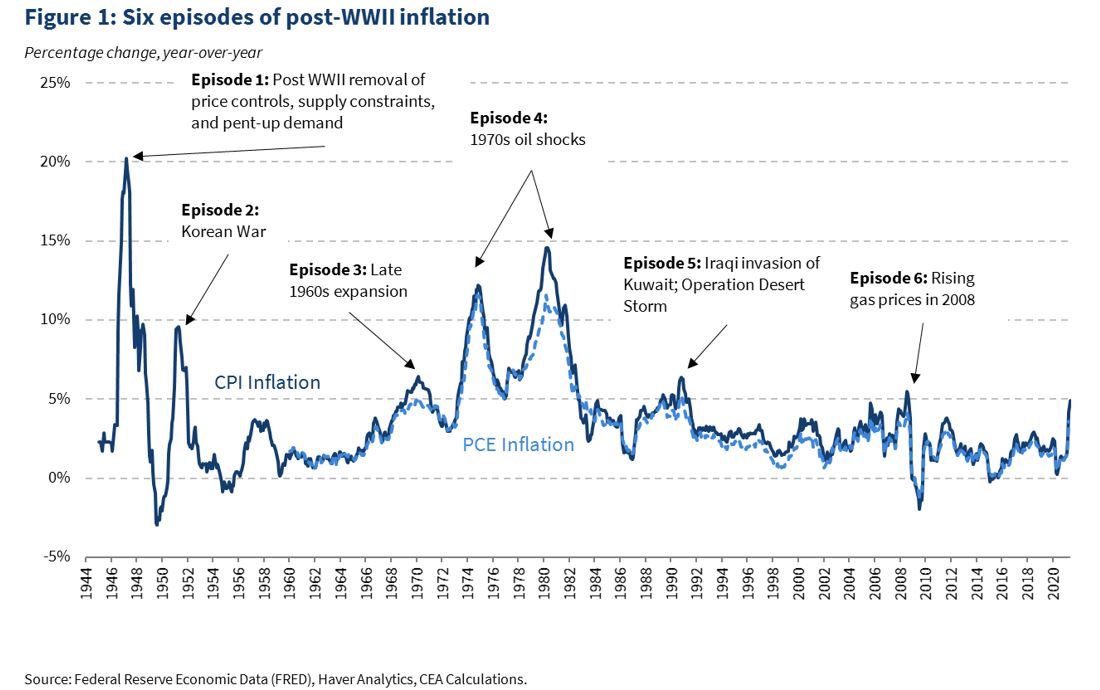

The Bank of England’s Monetary Policy Committee is cautious about cutting rates, despite inflation being expected to fall below the 2% target when April figures are published next month. The committee believes that the impact of volatile items such as energy prices and food prices means the headline inflation rate does not always fully represent underlying price pressures.

Inflation rate expected to fall

Inflation rate expected to fall

According to personal finance information site Moneyfacts, the average two-year fixed residential mortgage rate is currently 5.87%, while the average five-year fix is 5.44%. Both rates remain unchanged from Friday.

Mortgage rates remain steady

As the mortgage market continues to evolve, it’s clear that borrowers will need to be prepared for further rate hikes in the coming months. With the Bank of England’s next move uncertain, one thing is clear: the landscape of interest rates in the UK is changing, and borrowers need to be ready.

Interest rates on the rise

Interest rates on the rise