Mortgage Rates and the General Election: What’s in Store for Homeowners?

The general election is just around the corner, and homeowners are wondering how it will impact their mortgage rates. With the Bank of England’s base rate still at 5.25%, many are hoping for a reduction in interest rates. However, the election outcome may have a significant influence on the economy and, subsequently, mortgage rates.

Santander UK has recently cut its fixed rates by up to 0.27%, but will this trend continue? Experts believe that the election result will play a crucial role in shaping the future of mortgage rates. A change in government could lead to a shift in fiscal policies, which may, in turn, affect interest rates.

Santander UK cuts fixed rates

The Bank of England’s Monetary Policy Committee (MPC) is set to meet on June 20 to decide on interest rates. While some experts predict a rate cut, others believe that the election uncertainty will prompt lenders to adopt a more cautious approach.

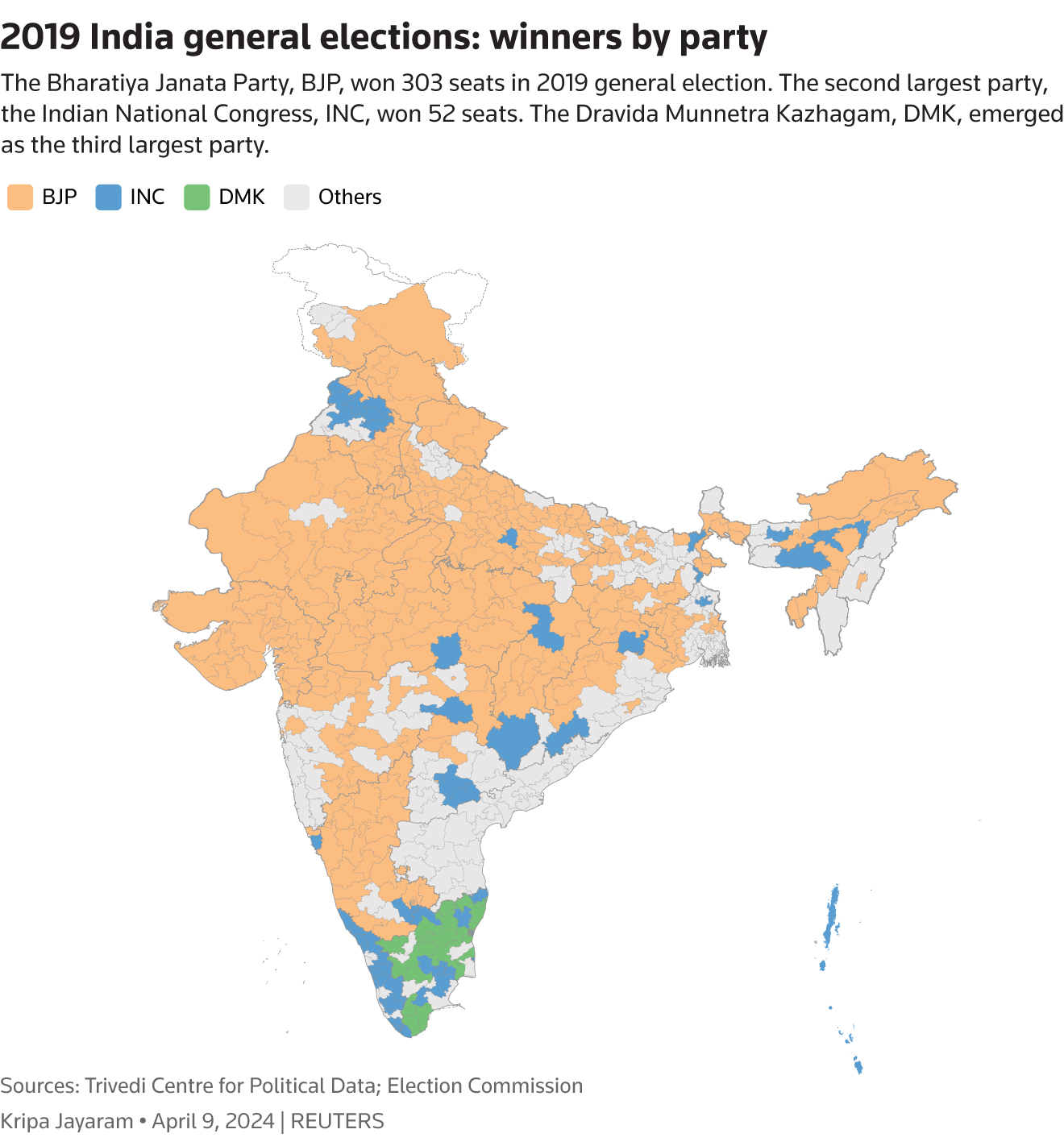

General Election 2024

General Election 2024

A new government may implement policies aimed at stimulating the housing market, which could influence lenders’ products. For instance, tax incentives for homebuyers or reforms to mortgage regulations could drive the first-time buyer market.

Housing Market

Housing Market

The state of the housing market is a significant concern for many Brits. First-time buyers will want to see an extension of support to help them get a foot on the ladder, while existing homeowners will hope for policies that moderate inflation and increase the likelihood of interest rate cuts.

First-Time Buyers

First-Time Buyers

As the election approaches, homeowners are anxious about the potential impact on their mortgage repayments. A change in government could lead to a significant increase in mortgage payments, making it essential for homeowners to stay informed about the election’s outcome and its implications for the housing market.

Mortgage Repayments

Mortgage Repayments

In conclusion, the general election will undoubtedly have a significant impact on mortgage rates and the housing market. Homeowners should stay vigilant and keep a close eye on the election outcome to ensure they are prepared for any changes that may come their way.

Election Outcome

Election Outcome