Mortgage Rates Cut Ahead of Bank of England Interest Rate Decision

NatWest has cut mortgage rates across its products ahead of the Bank of England’s interest rate decision tomorrow. The reductions follow the latest inflation figures, which saw the Consumer Prices Index (CPI) rise by two per cent in the 12 months to May 2024.

The lender is lowering its fixed-rate deals by up to 0.17 percentage points from Thursday, June 20. This will come as a small relief for those coming off fixed contracts, as they may be able to secure cheaper deals. Remortgagers opting for a five-year fix may be able to secure a rate of 4.41 per cent.

“Hopefully today’s inflation drop is the first step on the journey towards lower mortgage rates in the second half of the year.” - Matt Smith, mortgage expert at Right Move

Co-operative Bank has also reduced loans by up to 0.22 percentage points, and Nottingham Building Society has lowered deals by 0.24 points. Many banks and building societies are anticipating rate cuts from the Bank of England this week at a Monetary Policy Committee meeting.

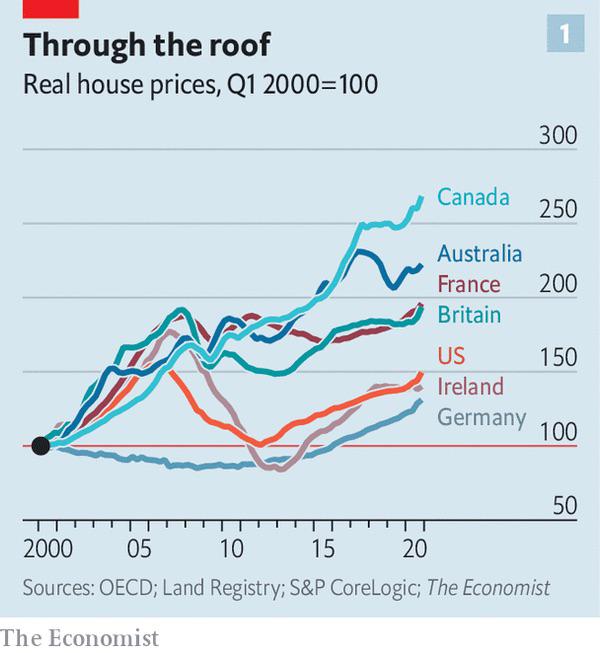

House prices have increased slightly for a second month in a row, according to the latest figures from the Office of National Statistics. In April, the average home sold for £281,000, 1.1 per cent more than 12 months ago.

This means the average price of goods and services is now 2 per cent higher than it was last year. The hope is that the Bank of England will soon consider cutting interest rates, which may result in lower mortgage rates.

“As we expect the economic landscape to continue improving, it’s likely that we will see a spike in activity as the year progresses, especially with an interest rate cut from the Bank of England on the horizon.” - Nicky Stevenson, managing director at national estate agent group Fine & Country

This would positively affect home buyers by making mortgages more affordable, increasing consumers’ spending power, and helping them to get their desired properties more easily.

The current average mortgage rate for a five-year fixed rate mortgage is 5.03 per cent, down from 5.04 per cent last week. The lowest available five-year fixed rate is 4.28 per cent, and the lowest available two-year fixed rate is 4.75 per cent, both unchanged from last week.