Mortgage Rates Hold Steady, But for How Long?

The Bank of England’s Monetary Policy Committee (MPC) has voted to maintain the base rate at 5.25%, where it has remained since August 2023. This decision comes despite encouraging news that inflation has reached the bank’s target of 2%.

The Bank of England’s decision to hold rates steady has sparked mixed reactions from experts.

The Bank of England’s decision to hold rates steady has sparked mixed reactions from experts.

The MPC voted by a majority of 7-2 to maintain the base rate at its current level, with some commentators predicting the first drop since before the pandemic. However, the bank’s decision to hold rates steady has sparked mixed reactions from experts.

“The Bank’s decision to hold rates steady today is no surprise, given its aim to maintain a neutral stance amid the ongoing general election,” said Nicholas Mendes, mortgage technical manager at John Charcol.

Mortgage rates have remained high, causing stress for homeowners.

Meanwhile, borrowers are still waiting for a drop in mortgage rates, which have remained high, causing stress for homeowners. The average two-year mortgage deal is now around 6%, and many homeowners are facing mortgage repayments much higher than they have become used to.

“It’s OK saying, ‘Oh, we’ll wait’ but the reality is that 125,000 people a month are coming to the end of their fixed rates, which over a two-month period is the population of Wolverhampton city centre,” said mortgage adviser Ben Perks.

The Bank of England’s interest rate has a knock-on effect on mortgage, credit card, and savings rates for millions of people across the UK.

The Bank of England’s interest rate has a knock-on effect on mortgage, credit card, and savings rates for millions of people across the UK.

The Bank of England’s interest rate has a knock-on effect on mortgage, credit card, and savings rates for millions of people across the UK. While the bank appears to be hinting at a cut in August, many homeowners are still facing mortgage rates much higher than they have become used to.

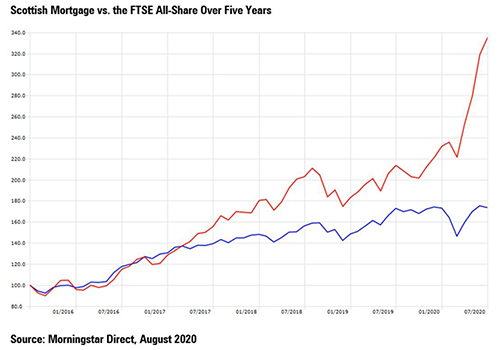

In other news, Scottish Mortgage shares have performed well, with one investor seeing a 13% return in less than six months. The investment trust owns some brilliant companies, including Nvidia, Moderna, ASML, MercadoLibre, Amazon, and Space Exploration Technologies, which have the potential to generate gains for investors in the medium to long term.

Scottish Mortgage shares have performed well, with one investor seeing a 13% return in less than six months.

Scottish Mortgage shares have performed well, with one investor seeing a 13% return in less than six months.

As the Bank of England continues to monitor the economy, one thing is clear: mortgage rates will eventually come down, but for now, homeowners must continue to bear the brunt of high borrowing costs.

Mortgage rates will eventually come down, but for now, homeowners must continue to bear the brunt of high borrowing costs.