Mortgage Rates on the Move: Halifax Intermediaries Reduces Residential Mortgage Rates

In a move that reflects the current sentiment amongst lenders, Halifax Intermediaries has announced a reduction in residential mortgage rates across its existing product range. Effective from Friday, 24th May, the lender will make rate reductions of up to 0.19% on 2-year and 5-year fixed rate products for both homemovers and first-time buyers.

Mortgage rates are on the move

Mortgage rates are on the move

The product search tool on the Halifax Intermediaries website, Halifax Intermediaries Online, and sourcing systems will be updated by Friday, 24th May. Brokers wishing to secure existing product codes are urged to submit applications in full by 8pm on Thursday, 23rd May.

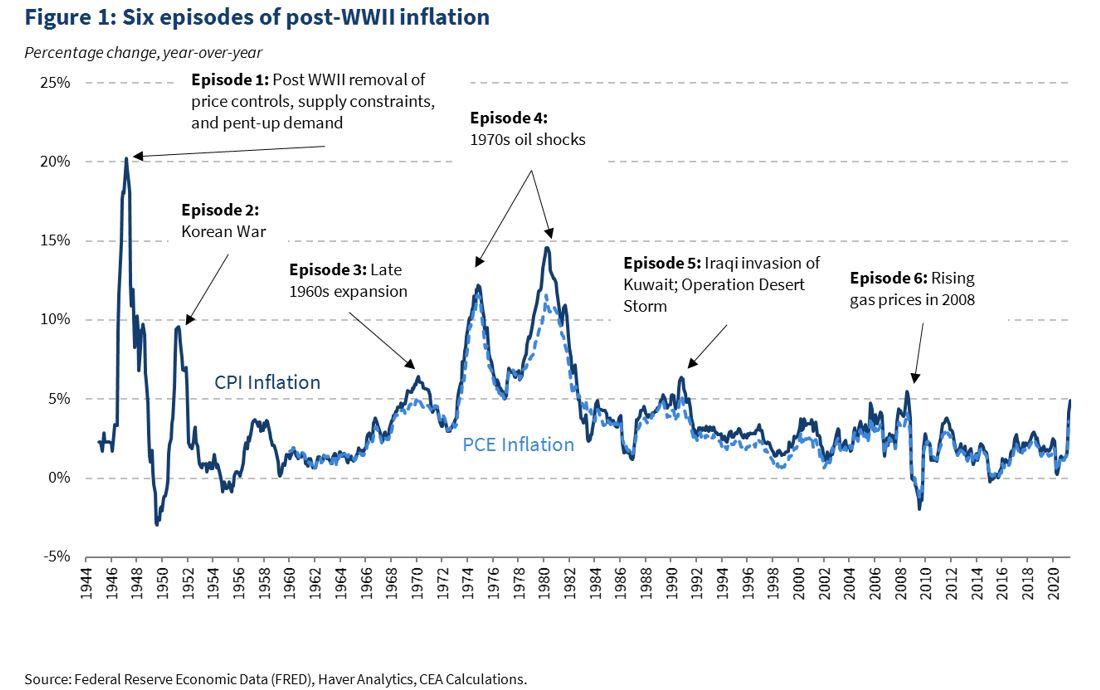

“This latest reprice from Halifax reflects the current sentiment amongst lenders,” said Nicholas Mendes, head of marketing and mortgage technical manager at John Charcol. “Today’s inflation data unfortunately means markets will be pricing in a prolonged hold, meaning mortgage rates will remain around their current levels for a bit longer.”

Inflation data plays a significant role in mortgage rate decisions

Inflation data plays a significant role in mortgage rate decisions

Mendes added, “It’s important to note that until an official bank rate cut happens, lenders will exhibit mixed attitudes. Those with smaller pipelines may be more proactive in implementing reductions.”

Mortgage lenders are taking a mixed approach to rate reductions

Mortgage lenders are taking a mixed approach to rate reductions

The reduction in mortgage rates by Halifax Intermediaries is a welcome move for borrowers, but it’s essential to keep an eye on the bigger picture. With inflation data playing a significant role in mortgage rate decisions, it’s crucial to stay informed about the latest developments in the mortgage market.

Stay informed about the latest developments in the mortgage market

Stay informed about the latest developments in the mortgage market