Mortgage Rates on the Move: What’s Next for First-Time Buyers?

The UK mortgage market is experiencing a significant shift, with major lenders like First Direct and MPowered Mortgages cutting their mortgage rates for first-time buyers. This move is expected to attract more business and make homeownership more accessible to those struggling to get on the property ladder.

The UK mortgage market is experiencing a significant shift

The UK mortgage market is experiencing a significant shift

The cuts in mortgage rates come as a welcome relief to first-time buyers, who are often struggling to save for a deposit and navigate the complex mortgage process. According to data from Moneyfacts, people looking for low deposit deals are often first-time buyers, and the recent rate cuts are expected to make a significant impact on their ability to secure a mortgage.

However, despite the positive news, economists are warning of a potential rise in mortgage defaults in the next three months. According to a Bank of England survey of lenders, defaults on household loans are expected to continue to climb in the next three months, with predictions pointing towards a further increase in the third quarter.

Mortgage defaults are expected to rise in the next three months

Mortgage defaults are expected to rise in the next three months

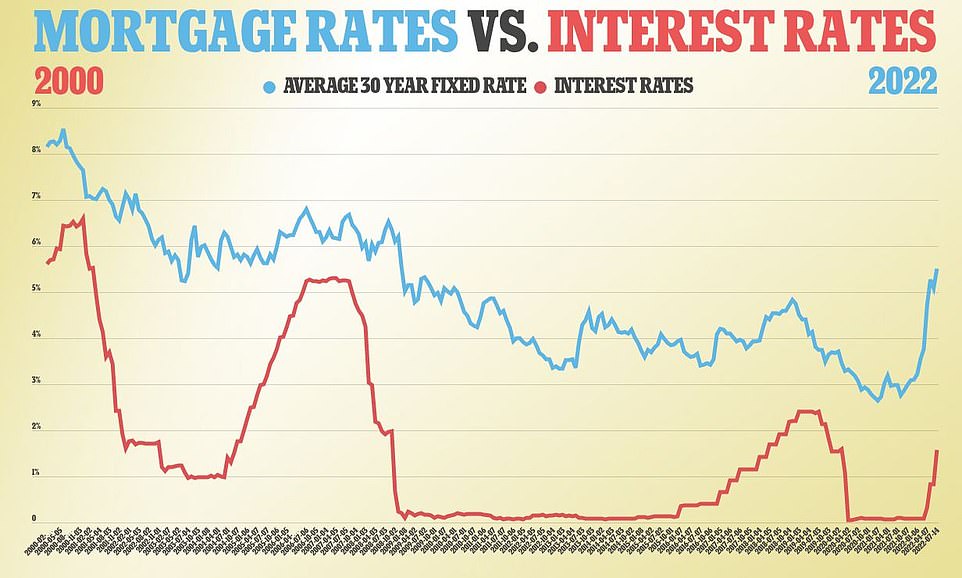

Karim Haji, the global and UK head of financial services at KPMG, commented on the situation, saying: “The falls in inflation, combined with positive wage growth in the past year, are starting to alleviate cost-of-living pressures on households and unlock more spending power. Yet interest rates remain high, and despite expected cuts, are unlikely to return to the levels seen when the hiking cycle began.”

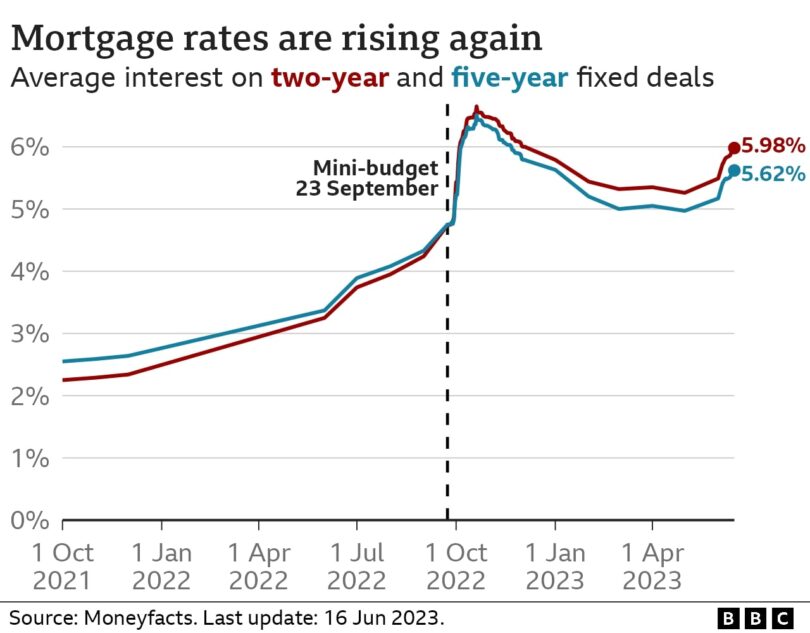

The cost of borrowing remains a major burden on those who have made use of lending facilities since the 2022 mini-budget or will be thinking of doing so in the coming months. As more and more households’ mortgages come up for renewal, it follows that with significant jumps in monthly repayments, the number of defaults could rise.

First-time buyers are often struggling to get on the property ladder

First-time buyers are often struggling to get on the property ladder

Stuart Cheetham, CEO of MPowered Mortgages, said: “We’re pleased to be reducing our two-year fixed rates further, having already reduced them at the end of June, further supporting people making their first steps on the ladder and those moving into their next home.”

The demand for two-year fixed rates has doubled since summer 2022, according to data released by MPowered Mortgages. This growth in demand is in part due to people becoming more optimistic about the prospect of rates coming down in the future.

Demand for two-year fixed rates has doubled since summer 2022

Demand for two-year fixed rates has doubled since summer 2022

However, Cheetham warned borrowers to remain cautious about the future direction of mortgage rates, saying: “History has taught us this. Speaking to a qualified financial adviser or a broker is crucial before making any decisions.”

As the mortgage market continues to evolve, it’s essential to stay informed and adapt to the changing landscape. With the right guidance and support, first-time buyers can navigate the complex world of mortgages and secure a better deal for their dream home.

What do you think about the recent mortgage rate cuts? Are you considering taking advantage of these lower rates? Share your thoughts in the comments section.