Mortgage Rates on the Rise: HSBC Increases Fixed Rates Amid Market Volatility

HSBC has increased its fixed mortgage rates, sparking concerns that other major lenders may follow suit. The bank has upped its two-year fixed deal for those with a 5% deposit or equity from 5.79% to 6.05%, while its two-year fixed rates for those with a 10% deposit or equity have risen from 5.23% to 5.49%.

HSBC increases mortgage rates

HSBC increases mortgage rates

Experts warn that this move may put pressure on other lenders, such as Barclays, Santander, TSB, and Halifax, to review their pricing and adjust for increased demand. The swap rate market, which has a significant impact on fixed-rate mortgages, has been volatile in recent times, leading to rising fixed rates.

“HSBC have done well to have held their fixed rates for as long as they have, considering their last reprice saw many of their fixed rates decrease.” - Nick Mendes, John Charcol

The increase in mortgage rates may be attributed to rising demand for services, a common practice among lenders. However, experts believe that rates will come back down once interest rates start to fall from their current level of 5.25%.

Mortgage rates on the rise

David Hollingworth of L&C Mortgages notes, “Although HSBC has increased rates by a relatively small amount, this looks set to be one of a number as the market shifts again.” He expects to see more increases this week as other lenders reprice their mortgages.

Smaller providers, including Principality, Saffron, and Vernon building societies, have also withdrawn selected mortgage deals for those with lower deposits or equity.

Mortgage applications on the rise

Mortgage applications on the rise

Despite the current rate hike, experts remain optimistic that rates will come back down once interest rates start to fall. Aaron Strutt of Trinity Financial notes, “Other banks and building societies may well push up their prices, but the consensus is still that they will come down again when the Bank finally lowers the base rate.”

As the mortgage market continues to shift, borrowers are advised to stay vigilant and keep a close eye on rate changes. With the election announcement bringing uncertainty to the market, it’s essential to stay informed about the latest developments in the mortgage industry.

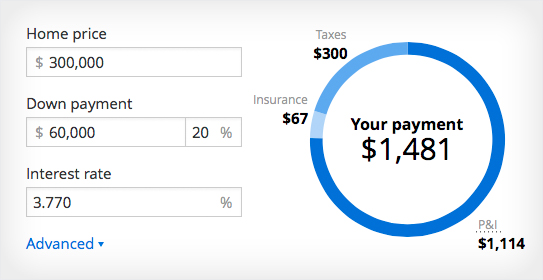

Mortgage calculator

Mortgage calculator

Stay ahead of the curve with MortgageWatch, your go-to source for the latest mortgage news and expert analysis.

Photo by

Photo by