Mortgage Rates on the Rise: Santander Increases Interest Rates for Second Time in Four Days

High street bank Santander has increased its mortgage interest rates for the second time in four days, signaling a shift in the mortgage market. The lender has announced that it will increase certain residential rates and all of its rates for buy-to-let mortgages. This move is expected to impact homeowners and landlords alike, with rates set to increase by as much as 0.22% for homeowners and 0.26% for landlords.

Mortgage rates are on the rise, affecting homeowners and landlords.

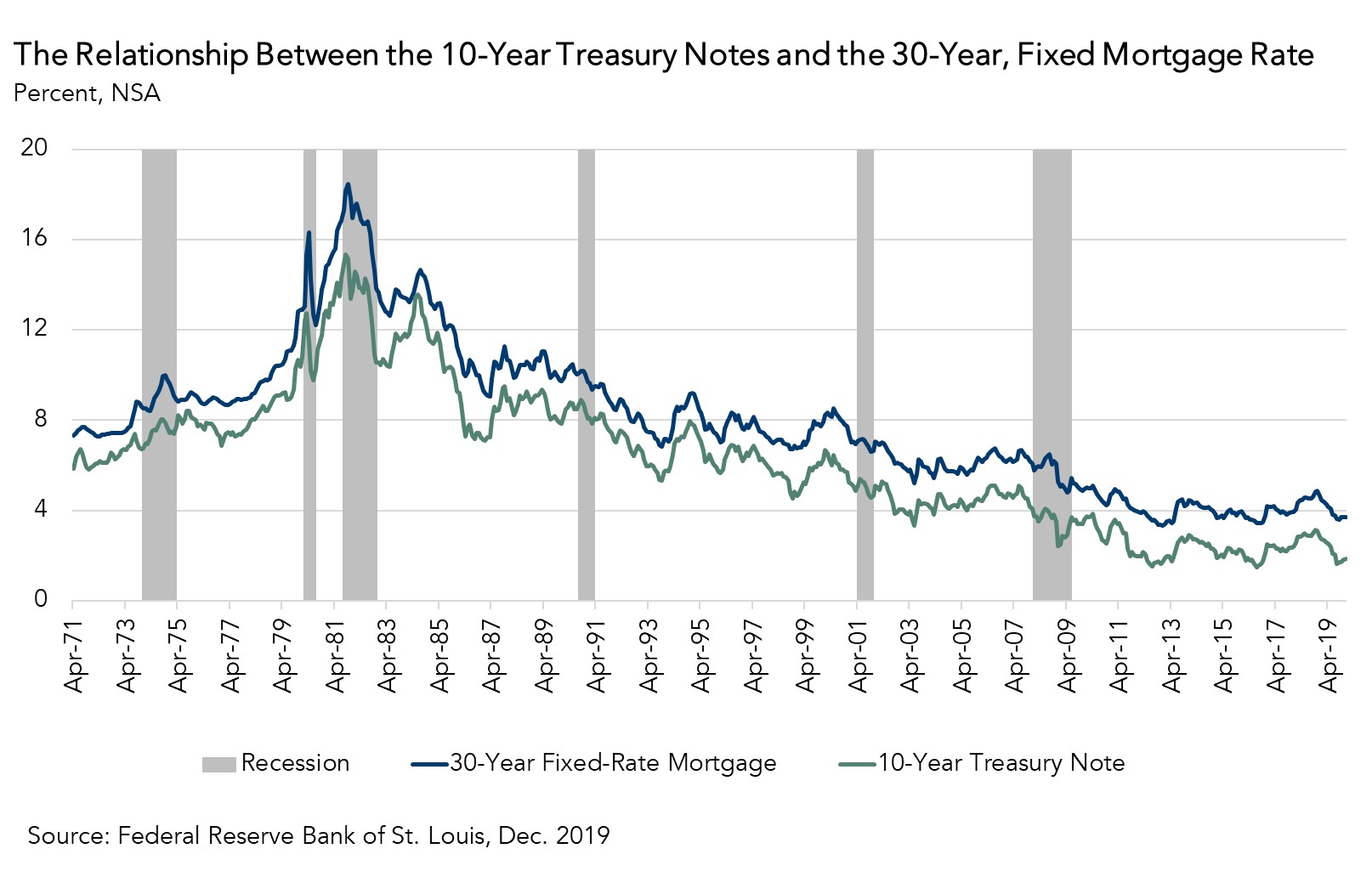

The changes, which come into effect on Friday, May 3, are the latest sign that fixed-rate prices are climbing back up. This development follows a similar move by other lenders, including Nationwide and NatWest, which have also increased mortgage rates this month.

The mortgage market is experiencing a shift, with lenders increasing interest rates.

The mortgage market is experiencing a shift, with lenders increasing interest rates.

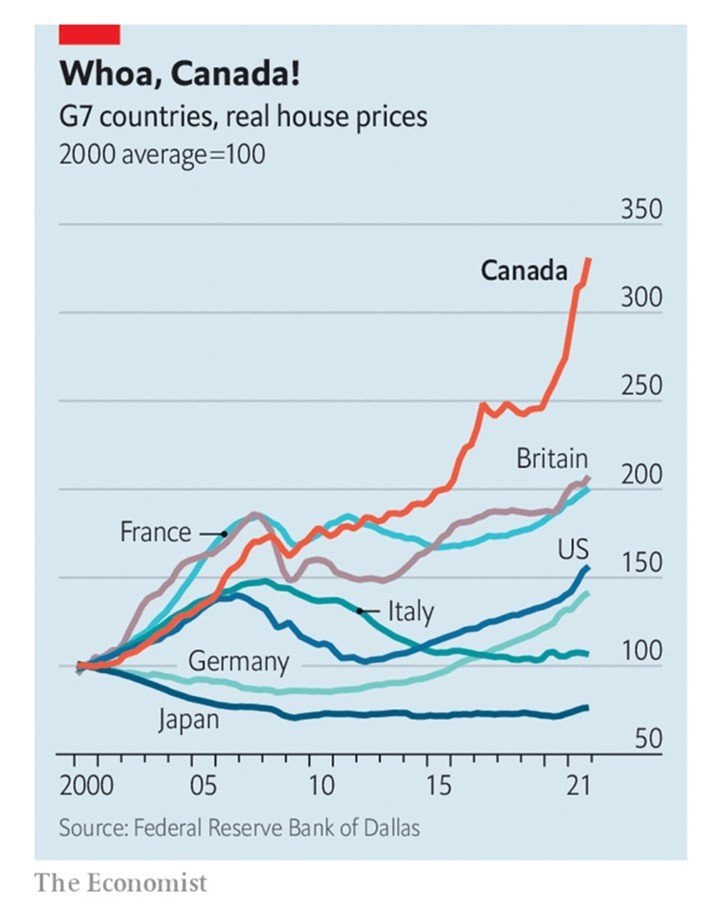

The recent rebound in mortgage rates has put downward pressure on house prices, according to the latest Nationwide House Price Index, which showed prices declining in April.

House prices are feeling the pressure of rising mortgage rates.

House prices are feeling the pressure of rising mortgage rates.

Industry experts are attributing the rate hikes to lenders’ reluctance to offer the cheapest deals on the market. Stephen Perkins, managing director at Yellow Brick Mortgages, described the current market as a “chaotic game of pass the parcel,” where lenders are scrambling to avoid holding the lowest rate when the music stops.

Mortgage brokers are facing a challenging landscape, with rates increasing multiple times within the same week.

Mortgage brokers are facing a challenging landscape, with rates increasing multiple times within the same week.

Katy Eatenton, mortgage and protection specialist at Lifetime Wealth Management, echoed Perkins’ sentiments, highlighting the difficulties of advising clients in an ever-shifting landscape.

Mortgage advisors are facing a challenging task, with rates increasing rapidly.

Mortgage advisors are facing a challenging task, with rates increasing rapidly.

As the Bank of England’s next meeting approaches, markets are predicting that the Monetary Policy Committee will leave rates at a 14-year high of 5.25%. This development is likely to have a ripple effect on the mortgage market, with lenders and borrowers alike bracing for further changes.

The Bank of England’s next move will have a significant impact on the mortgage market.

The Bank of England’s next move will have a significant impact on the mortgage market.

In this uncertain landscape, one thing is clear: mortgage rates are on the rise, and borrowers must be prepared to adapt to the changing market.

The mortgage market is experiencing a period of uncertainty, with rates on the rise.

The mortgage market is experiencing a period of uncertainty, with rates on the rise.