Mortgage Rates Set to Fall as Base Rate Cut Nears

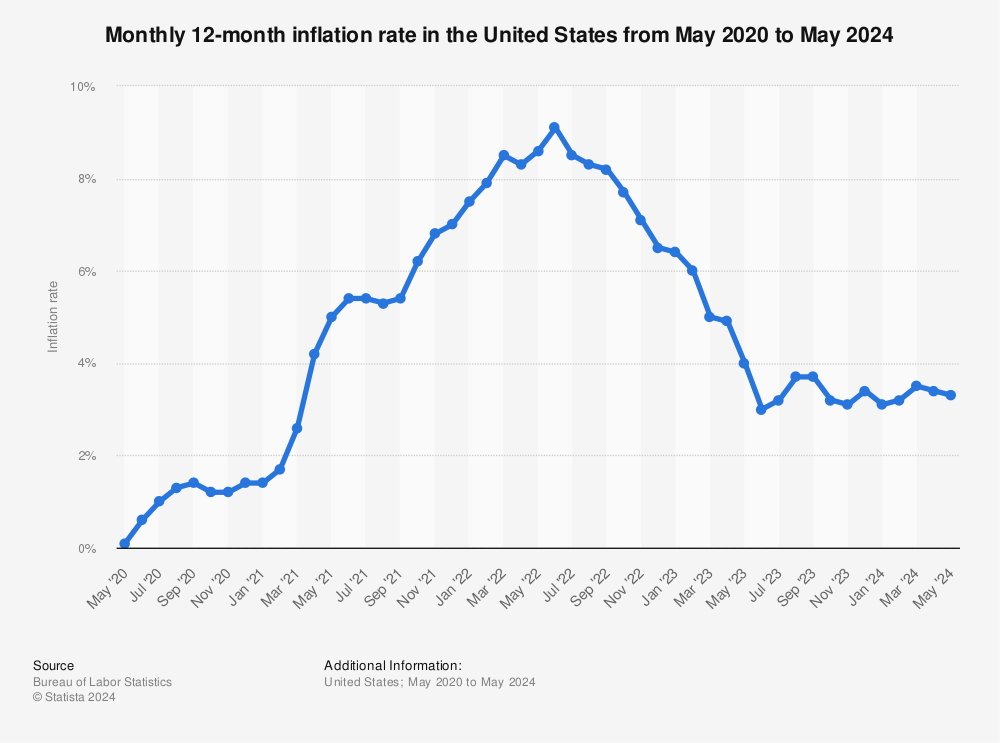

With inflation returning to its target rate of 2%, the chances of a base rate cut and subsequent decrease in mortgage rates have increased. This development could bring relief to mortgage borrowers who have been waiting for a drop in fixed-rate mortgages.

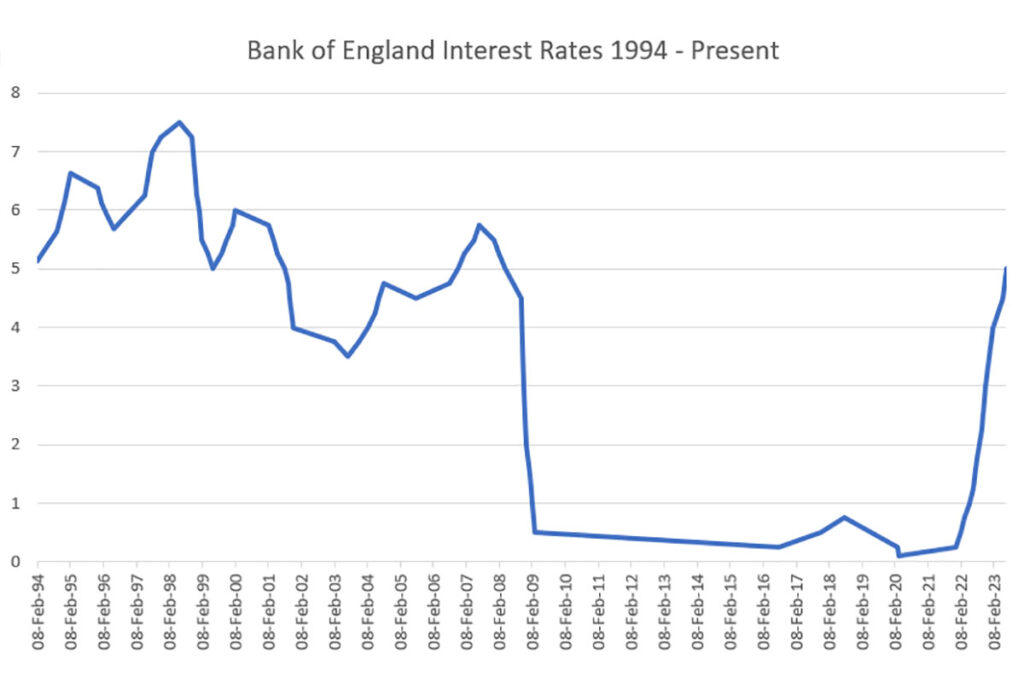

Bank of England’s decisions on interest rates impact mortgage rates

Bank of England’s decisions on interest rates impact mortgage rates

UK Mortgage Rate Forecast for July 2024

Following the news that inflation had dropped to the Bank of England’s stated aim of 2% in May, the odds on the base rate being lowered at the next policymaking meeting in August shortened. This development means that cheaper mortgages could be on the horizon, bringing respite to mortgage borrowers who have been waiting for a drop in fixed-rate mortgages.

Fixed-Rate Mortgages Holding Steady

Many mortgage borrowers will breathe a sigh of relief when meaningful reductions to mortgage rates resume. The significant cuts made to fixed-rate mortgages in January are a distant memory. Bar the occasional period of stability, fixed rates have mainly been rising in the months since.

Mortgage rates have been rising in recent months

Mortgage rates have been rising in recent months

The air of uncertainty that ran through last month’s forecast meant there was little change in the average cost of fixed-rate mortgages in June. There were several instances where a mortgage lender announced it was lowering the rates on certain fixed-rate deals, but raised the cost of others at the same time.

Bank Wants Certainty for Base Rate to Fall

Whether cheaper mortgages are on the horizon relies heavily on the next round of relevant economic data and what the policymakers at the Bank of England take from those figures.

The voting pattern at the June rate-setting meeting was unchanged from the previous meeting in May – the same two MPC members voted for a 0.25% reduction in the base rate to 5.00%, and the same seven voted to keep the rate on hold.

Confirmation the day before the announcement that consumer prices index (CPI) inflation in May had fallen back to the Bank’s target level of 2% was big news. Interest rates were increased to bring inflation down, so the scene may now be set for rates to start falling.

Inflation and Election Hold the Key

The next inflation figures are revealed on 17 July, two weeks ahead of the next base rate announcement on 1 August. As happened this time, it will be important that the inflation readings come in as economists expect or better.

Inflation rates are crucial in determining interest rates

Inflation rates are crucial in determining interest rates

One potential sticking point could be services inflation, which has remained higher than some would like. Though encouragingly, the Bank believes this could be due to short-term volatility and factors which only change annually, such as yearly price rises, rather than anything more persistent.

Lower Mortgage Rates on the Horizon

With inflation returning to its target rate and the base rate potentially decreasing, mortgage borrowers could finally see some relief. The next few weeks will be crucial in determining whether mortgage rates will fall, providing much-needed respite to those struggling with high mortgage payments.