Mortgage Rates: The New Normal?

The UK’s biggest lender, Lloyds Banking Group, has offered a bleak outlook for anyone hoping for a return of low interest rates. According to the chief executive, the ’new normal’ for mortgage rates won’t be below 3.5%. This news comes as a shock to many, especially those who have been hoping for a return to the low interest rates of the past.

Mortgage rates are on the rise

The Impact on Homeowners

This news will undoubtedly have a significant impact on homeowners, especially those who are currently on variable rate mortgages. With interest rates on the rise, many will be facing higher monthly payments, which could put a strain on their finances.

Homeowners may face higher monthly payments

Homeowners may face higher monthly payments

The Cause of the Rate Hike

So, what’s behind the rise in mortgage rates? According to experts, it’s due to a combination of factors, including the current state of the economy and the Bank of England’s monetary policy.

The economy is a major factor in the rise of mortgage rates

The economy is a major factor in the rise of mortgage rates

What This Means for You

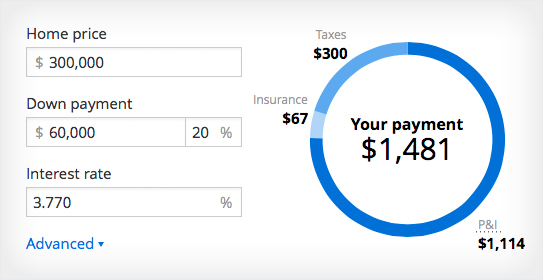

If you’re currently on a variable rate mortgage, it’s essential to review your finances and prepare for the potential increase in monthly payments. You may want to consider switching to a fixed-rate mortgage to avoid any further rate hikes.

Use a mortgage calculator to see how the rate hike will affect you

Use a mortgage calculator to see how the rate hike will affect you

Conclusion

The news that mortgage rates won’t be below 3.5% is a stark reminder of the current state of the economy. Homeowners need to be prepared for the potential increase in monthly payments and consider their options carefully.

Mortgage rates are on the rise