Mortgage Repossession Claims Hit Five-Year High

The aftermath of Liz Truss’s disastrous mini-budget has led to a steep rise in mortgage possession claims, with experts warning that millions of households across the UK are struggling with huge mortgage bills.

High mortgage rates are hitting cash-strapped households across the UK

The latest figures show that mortgage possession claims have soared by more than a quarter in just three months, reaching their highest level since 2019. This surge in claims is a stark reminder of the struggles faced by many families who are at risk of losing their homes.

The Consequences of the Mini-Budget

Liz Truss’s mini-budget, which was announced in October 2022, has been widely criticized for its disastrous consequences. The subsequent fallout saw her ousted from office by her own MPs after less than six weeks as prime minister. Despite this, Ms. Truss has refused to take the blame for the higher rates that hit homeowners following her mini-budget.

The Impact on Homeowners

The average two-year fixed rate jumped to more than 6 per cent, although it has since fallen. This sudden increase has left many homeowners struggling to cope with their mortgage payments. The subsequent rise in mortgage possession claims is a clear indication of the struggles faced by many families.

Families are struggling to cope with the rising cost of mortgage payments

Families are struggling to cope with the rising cost of mortgage payments

The Response from the Government

The Treasury has acknowledged that many people are continuing to struggle with their mortgage payments. However, the government has been accused of failing to take adequate measures to address the issue. The Liberal Democrats have criticized the Conservatives for crashing the economy with the mini-budget and then failing to lift a finger to help those impacted.

The Rise of No-Fault Evictions

Housing charity Shelter has reported that no-fault bailiff evictions have soared to a six-year high, with 2,682 households affected between January and March. This is a rise of 19 per cent in a year. Polly Neate, Shelter’s chief executive, has warned that evictions are “rocketing to new heights” five years after ministers pledged to rebalance the scales in private renting.

The Way Forward

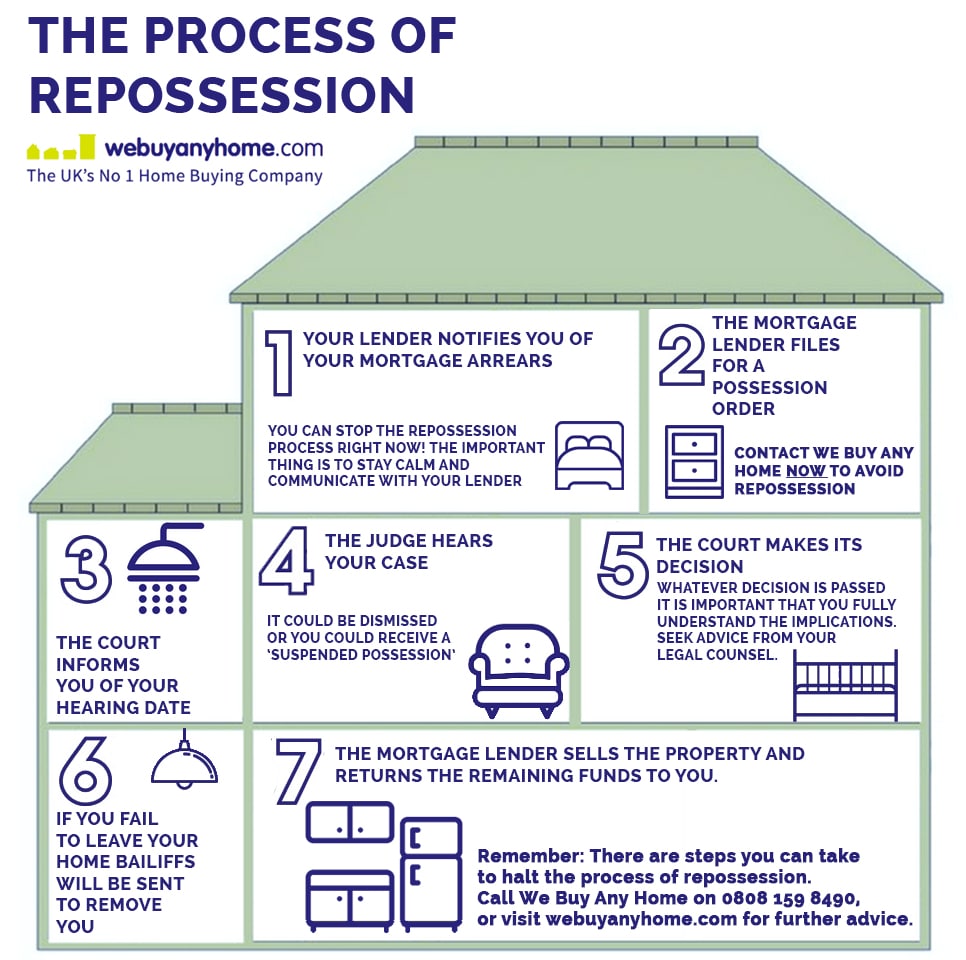

The government has urged homeowners who are struggling with their mortgage payments to contact their lender and consider the flexibilities in the Mortgage Charter. This charter aims to make it easier to manage monthly repayments and provides extra protections against repossessions.

Homeowners are urged to seek help if they are struggling with their mortgage payments

Homeowners are urged to seek help if they are struggling with their mortgage payments

The recent surge in mortgage possession claims is a stark reminder of the struggles faced by many families across the UK. As the government continues to grapple with the aftermath of the mini-budget, it is essential that adequate measures are taken to support those who are struggling to cope with the rising cost of mortgage payments.