Challenges and Changes: Navigating the Housing Market Amidst Economic Pressures

In a significant shift affecting first-time buyers across the UK, Nationwide Building Society has announced plans to raise the income threshold required to qualify for its higher-risk Helping Hand mortgages. Starting next month, the minimum annual income for applicants will increase from £35,000 to £40,000. This decision is framed as a necessary response to government and regulatory guidelines focused on responsible lending practices, albeit it raises eyebrows among potential homeowners eagerly looking to enter the property market.

Aerial view of housing developments in the UK amidst a challenging market landscape.

Aerial view of housing developments in the UK amidst a challenging market landscape.

The Implications for First-Time Buyers

These changes come into effect against a backdrop of soaring home prices in desirable regions, particularly in London and the Southeastern coast. The repercussions of this heightened threshold could significantly restrict access for many individuals seeking to own their first home. Consequently, critics argue that such measures further complicate an already daunting process for young buyers struggling to accumulate required deposits in inflationary economic conditions.

Several voices from the finance community are calling on Chancellor Rachel Reeves to amend existing lending rules, suggesting that lenient measures could invigorate the property market and help revive a sluggish economy. Yet, the cautionary perspective cannot simply be overlooked; some industry experts warn that loosening lending criteria could rekindle the conditions reminiscent of the prelude to the 2008 financial crisis.

Graham Cox, the Director at Bridging Hub, supports Nationwide’s cautious stance, stating, “To borrow up to six times one’s income with a salary of £35,000 means there is incredibly little room for financial maneuverability in today’s economy. It’s prudent to reassess these lending criteria.”

In stark contrast, Jack Tutton from SJ Mortgages expressed his disillusionment, remarking, “This increase is another kick in the teeth for those trying to buy on their own. It only further alienates solo applicants who deserve a chance to invest in property.”

The Counterpoint: Need for Caution

Others, like Michelle Lawson from Lawson Financial, voiced their concerns about the current regulatory environment stifling otherwise deserving applicants. She noted, “This increase represents an arbitrary barrier that suppresses viable borrowers who could responsibly manage mortgage debt but are blocked by regulations.”

Elliott Culley from Switch Mortgage Finance acknowledged the blow to aspiring homeowners but stressed that maintaining product availability is crucial for those still hoping to navigate these new waters. As the market adapts, one can only speculate on how far-reaching the reformation of lending norms will be.

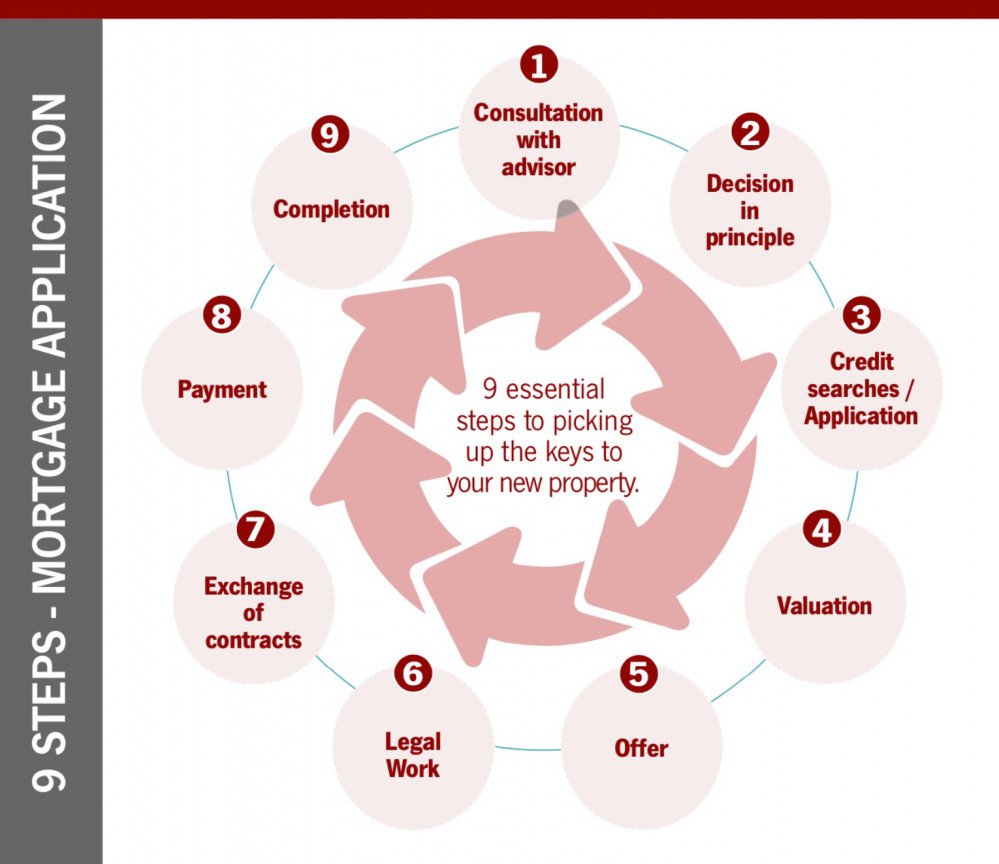

An illustration capturing the complexity of mortgage applications faced by first-time buyers.

An illustration capturing the complexity of mortgage applications faced by first-time buyers.

Asbestos Awareness in Property Ownership

In a separate, but equally pivotal issue for homeowners, another recent surge in public interest has been seen in asbestos removal services. Reports indicate a 21% increase in demand for these services in 2024, highlighting deepening awareness among homeowners of the dangers posed by asbestos—a hazardous material commonly used in buildings until the late 20th century.

The significance of this trend cannot be understated. Asbestos does not pose an immediate risk if undisturbed but can become highly dangerous if damaged, releasing fibers wreaking havoc on lung health. Despite the ban on asbestos materials in the UK since 1999, there remain countless homes built before the turn of the millennium potentially harboring this deadly dust.

Average costs for removal hover between £950 and £3,750, depending on the extent and complexity of the work. Homebuyers are increasingly advised to conduct extensive asbestos checks before any renovation work. Recognizing the potential hazards beforehand not only safeguards health but also preserves property value.

Understanding Asbestos Risks and Remediation

For homeowners, understanding the common locations of asbestos is crucial. It can typically be found in materials such as textured coatings, pipe lagging, and insulation. Homes constructed or renovated between the 1950s and 1990s are of particular concern.

Engaging professional services to carry out thorough asbestos surveys before undertaking any renovations is highly recommended. The cost for these surveys usually ranges from approximately £200 to £1,000, depending on property size. While some may deem these costs steep, the potential health risks and subsequent expenses from neglecting this issue make it a necessary precaution.

Experts conducting an asbestos removal procedure in a domestic setting.

Navigating Car Insurance: Discrepancies in Policymaking

Amidst these pressing housing concerns, another topic of importance emerges within the realm of car insurance, as consumers face confusion regarding varying policy names. Recent studies reveal surprising findings about how insurers label their offerings, in which premium titles such as “platinum” or “gold” don’t necessarily deliver enhanced coverage.

An analysis of over 70 policies by Which? highlights discrepancies among the marketing names used and the actual levels of coverage provided. For instance, Darwin’s ‘Platinum’ policy received a lower overall score than Admiral’s ‘Essentials’ policy. As consumers navigate these options, it becomes crucial not to rely solely on creative naming conventions.

The challenge then for the consumer is not only to compare price but also to assess the actual quality of what is being offered, which might diverge starkly from expectations set by fancy titles or branding.

Tips for Selecting the Right Car Insurance Policy

- Identify Your Needs: Start by outlining the essential cover you require. Make a checklist of must-have coverage options and evaluate policies accordingly.

- Consult Comparison Websites: Many online platforms help you benchmark current offers, ensuring you stay competitive.

- Review Customer Feedback: Pay attention to ratings and reviews based on the experiences of other policyholders—this insight can illuminate the quality of service you can expect.

- Shop Around and Negotiate: When renewing policies, leverage the knowledge gathered from different sources to negotiate better rates with your current insurer.

Conclusion

Navigating the challenges posed by rising mortgage requirements, asbestos concerns, and the ambiguous nature of car insurance offerings requires vigilance and awareness. Each domain presents unique hurdles for homeowners and prospective buyers alike, a reality that demands informed decision-making.

As the financial landscape evolves, understanding these developments and their implications on daily life remains paramount for all navigating through a complex web of economic pressures.