Navigating the Complexities of Inheritance and Housing in the UK

As the UK housing market grapples with a plethora of challenges, many individuals find themselves navigating the complexities of inheritance while constantly adjusting to shifting economic landscapes. With ongoing reforms and debates surrounding financial management and housing availability, the impact of inheritance tax regulations and mortgage financing options could hardly be overstated. This analysis aims to unpack these intricate issues and provide a comprehensive overview of navigating both inheritance challenges and the path to homeownership.

The intersection of inheritance and housing market dynamics

The intersection of inheritance and housing market dynamics

The Intricacies of Inheritance Tax

Receiving an inheritance can be both a blessing and a burden. As one navigates the emotional terrain of loss, the practical aspects of managing the financial legacy left behind can often feel overwhelming. Recently, one individual seeking to share their inheritance with family faced a pressing question: How might this affect tax liabilities, and what strategies can be employed to mitigate them?

In the UK, gifts received as part of an inheritance are generally not subject to immediate taxation. However, the situation becomes much more intricate if the benefactor were to pass away within seven years of the gift’s issuance. In such cases, the recipient may be liable for inheritance tax, raising the potential burden on future generations.

To ease potential tax burdens, a legal mechanism known as a deed of variation may be utilized, allowing for more direct transfers of inheritance from the estate. It’s an efficient route that could potentially circumvent some inheritance taxes, provided these actions are taken within two years of the benefactor’s passing.

Understanding Mortgage Market Limitations

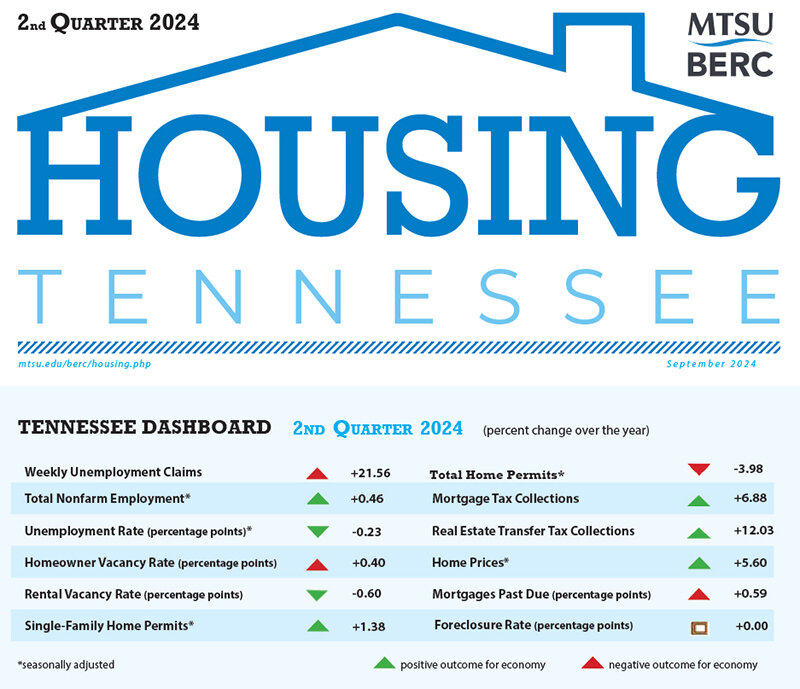

Simultaneously, individuals eager to enter the housing market must contend with the current lending landscape, which continues to evolve. Despite governmental ambitions of achieving a staggering 300,000 new homes annually, the reality is fraught with obstacles rooted firmly in mortgage financing limitations. How can developers and new homeowners align their aspirations amidst these hurdles? Mortgage providers typically cap lending at 4.5 times a borrower’s income, an approach that has shown to be increasingly inadequate as buyer demand skyrockets. Given that the average UK salary hovers around £34,933 while average property prices rise above £299,000, prospective homeowners face a daunting shortfall.

The financial hurdles of the housing market

The financial hurdles of the housing market

Given these statistics, it becomes apparent that for first-time buyers, a staggering £85 billion in additional mortgage financing could be necessary to unlock new building projects targeting this demographic. Unfortunately, the Bank of England’s measures aimed at curbing systemic risk have restricted lenders—allowing them to issue only a limited number of loans exceeding the set thresholds. This mismatch between housing supply, financing capacity, and buyer need creates a perpetual cycle of frustration within the real estate market.

Long-Term Solutions: Amending Lending Criteria

To propel homeownership from aspiration to reality, a crucial shift in mortgage lending criteria is essential. Exempting long-term fixed-rate mortgages from loan-to-income (LTI) caps represents a significant opportunity to boost market accessibility. Providing borrowers with stability, these products would not only facilitate home acquisition but also substantially mitigate systemic risks identified by regulatory bodies. Importantly, as the market for rentals continues to grow—predicted to swell with over 65s renting doubling by 2040—sustainable solutions are necessary to prevent creating a lifetime of tenancy for future generations.

The Economic Landscape: Budget Implications

Meanwhile, the political landscape looms large in shaping these financial dynamics. Labour’s recent budget announcements, including controversial tax initiatives, reflect ongoing struggles within governmental policies to strike the right balance. As Chancellor Rachel Reeves emphasizes the need to address years of problematic economic strategies, the ramifications for working families remain profound.

Reeves indicates forthcoming challenges with a stark warning that the expected tax rises won’t merely be a one-off situation—a notion that could leave both the housing market and inheritance strategies precariously positioned for fluctuation in the coming years. Time will reveal whether the proposed short-term measures succeed where others have failed.

The political landscape influencing the financial environment

The political landscape influencing the financial environment

Seeking Professional Advice

As individuals navigate these overwhelming financial responsibilities, one critical step remains paramount: seeking expert financial guidance. An informed professional can guide beneficiaries through the labyrinth of inheritance tax laws and ensure efficient management of newfound wealth. Similarly, it is advisable for potential homebuyers to consult financial advisors who specialize in housing finances to devise tailored strategies for entering the market.

Ultimately, the interplay between inheritance and housing reflects broader economic realities within the UK—that we must confront with strategic foresight and vigilant planning. To ensure a future where homeownership remains a tangible goal, both policymakers and individuals alike must strive to adapt and innovate in response to evolving market conditions.

This article serves as a lens into the pressing need for clarity in the financial landscape, addressing critical questions about future readiness in inheritance sharing and housing access in the UK.