Mortgage rates have been on the rise, leaving many homeowners and prospective buyers searching for answers. In Jersey, a recent report by the Jersey Consumer Council (JCC) has highlighted the disparities in mortgage rates between the island and the UK. The JCC found that rates offered by lenders in Jersey are about 1% higher than those offered by the same banks in the UK. This discrepancy has led to “confusion” among customers and raises “serious questions about the price Islanders are paying for living in an international finance centre.”

Jersey’s mortgage market is under scrutiny

Jersey’s mortgage market is under scrutiny

The JCC’s investigation revealed that many banks in Jersey still align with their UK parents in terms of branding, marketing material, and products that track the Bank of England base rate. However, the banks claim that the difference in rates is due to their operational structure as ring-fenced and separate entities from their UK counterparts.

Banks in Jersey are under pressure to offer competitive rates

Banks in Jersey are under pressure to offer competitive rates

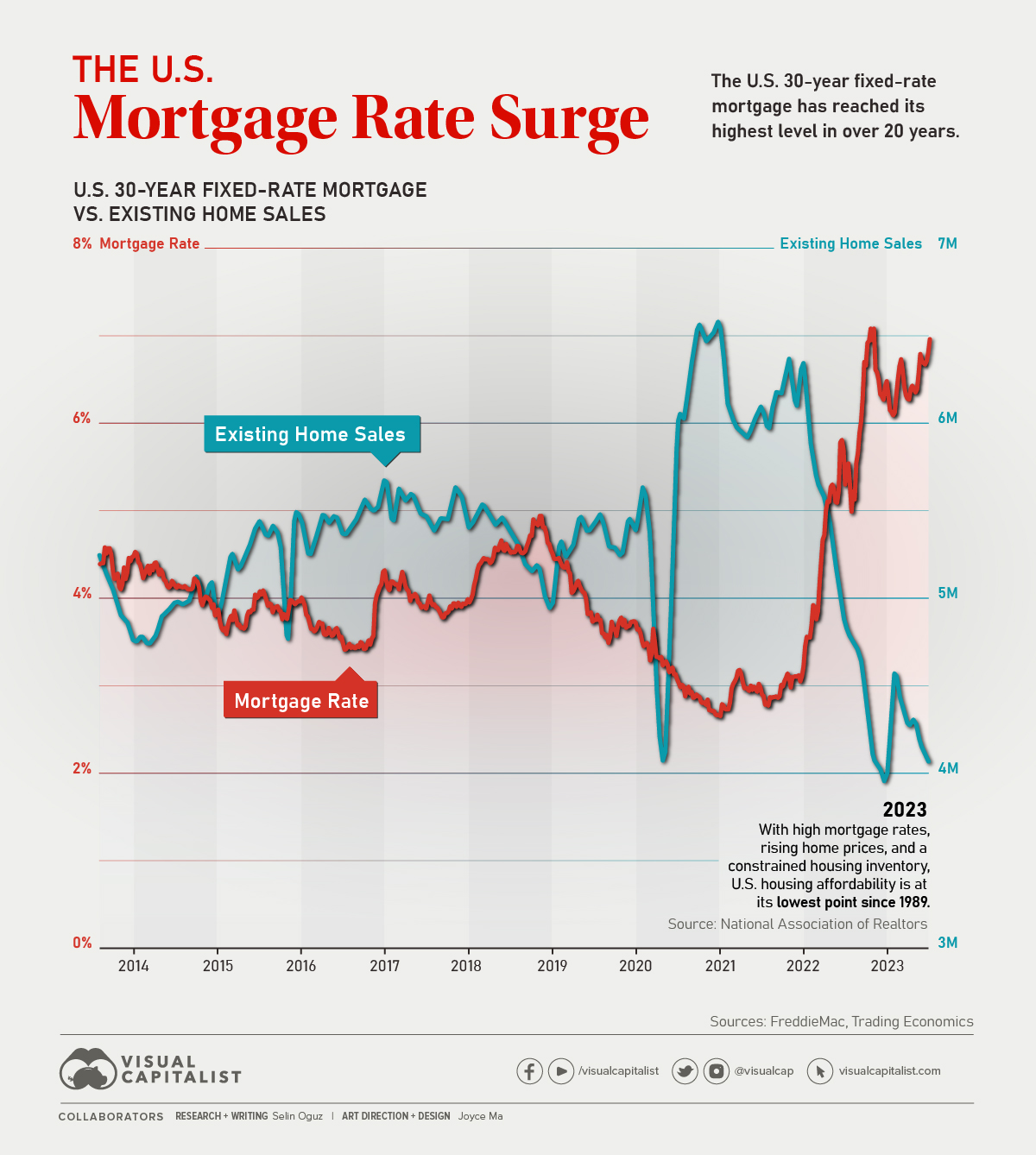

The Jersey government has encouraged lenders to offer competitive mortgage products to Islanders and will continue to monitor this availability closely. Meanwhile, experts in the US predict that mortgage rates will gradually fall by the end of 2025, although it is unclear when exactly they will decline.

Mortgage rates in the US are expected to fall by 2025

Mortgage rates in the US are expected to fall by 2025

In the UK, insurance-backed financial support mechanisms are being proposed as a safety net against rising rates. These mechanisms would provide peace of mind for homeowners, ensuring that they can continue to pay their mortgage repayments even if rates rise.

Insurance-backed support could provide a safety net for homeowners

Insurance-backed support could provide a safety net for homeowners

As the mortgage market continues to evolve, it is essential for homeowners and buyers to stay informed and explore their options. With the right approach, it is possible to navigate the complexities of the mortgage market and find a solution that works for you.

Staying informed is key to finding the right mortgage solution

Staying informed is key to finding the right mortgage solution