Bank of England’s Predicted Rate Cut: Implications for Borrowers and Savers

As the financial landscape of the UK prepares for another influential decision from the Bank of England, all eyes are on the upcoming meeting of its Monetary Policy Committee (MPC) scheduled for Thursday. Analysts widely predict that the Bank will reduce the benchmark interest rate from 5% to 4.75%, a significant move that could reshape borrowing costs for consumers and businesses alike. Barclays has indicated that such a change is critical, especially following recent economic indicators showing a drop in inflation.

The shifting tides of interest rates and their impact on the economy

The Inflation Landscape

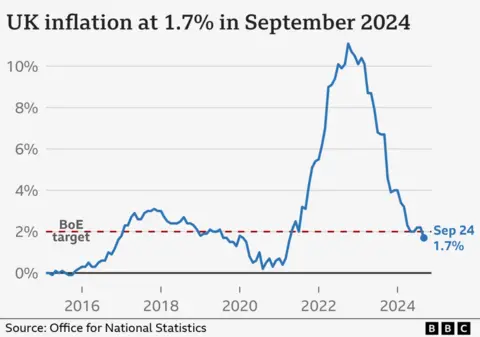

The backdrop to this anticipated rate cut is the recent decrease in the UK inflation rate, which dropped unexpectedly to 1.7% in September—its lowest level in over three years. This decline puts it below the government’s target of 2%, indicating that the Bank of England’s aggressive rate hikes over the past years may have begun to yield the desired effects. As inflation moderates, the Bank can consider cutting rates to further stimulate economic growth.

However, the implications of such a cut reach further than just business sentiment. As stated by Bank Governor Andrew Bailey, the committee is likely to adopt a more aggressive stance on cutting borrowing costs if downward pressures on inflation continue to grow.

Impact on Borrowers

The actual impact of a rate cut will resonate most with borrowers. Rates set by the Bank of England influence the borrowing costs across the entire economy. According to financial services company Moneyfacts, the average two-year fixed mortgage rate currently sits at 5.4%. Many borrowers, particularly those on tracker or variable mortgages, could see an immediate decrease in their monthly repayments as lenders adjust their rates in response to the Bank’s decision.

Rachel Springall, a finance expert, commented:

“Savers are the ones who feel the force of cuts to interest rates. Those savers who use their interest to supplement their income will feel overlooked if rates plummet.”

For over one million borrowers on such deals, there is potential relief ahead, while others locked into less flexible agreements may feel the pinch more acutely.

The Save or Spend Dilemma

As spending on rent and mortgages has risen by 6.4% annually, as reported by Barclays, the current economic environment is putting financial strain on many households. With property prices presenting the largest hurdles to homeownership, 69% of renters view these costs as insurmountable. Amidst these pressures, the Revolut report indicates increased consumer expenditure on home improvement projects, suggesting that individuals are choosing to renovate rather than relocate.

Consumers are opting for renovations over relocations under financial constraints

Mark Arnold from Barclays underscores the challenge ahead, stating that while a decrease in interest rates could bolster confidence, systemic barriers must still be addressed to make home ownership more accessible as we move toward 2025.

Regulatory Landscape: The FCA’s Focus

Concurrently, the UK Financial Conduct Authority (FCA) has published important portfolio letters to various sectors, outlining its priorities moving into 2025. Key areas of focus include the treatment of customers in distress, promoting financial resilience, and ensuring that consumers are not unfairly excluded from banking services. Retail banks and lending entities are required to improve transparency and demonstrate compliance with consumer duty requirements.

This regulatory environment is crucial, especially as UK consumers navigate the complexities of borrowing and saving amidst evolving interest rates.

The Broader Economic Context

The forthcoming US interest rate decision, influenced by political shifts such as Donald Trump’s presidential victory, may also have ramifications for UK markets. If inflation increases due to anticipated tariffs, the Federal Reserve may have less flexibility to alter rates, which in turn could affect the Bank of England’s monetary policy decisions.

Conclusion: A Cautious Optimism

As the lid on interest rates edges toward a possible reduction, borrowers will welcome the potential for lower monthly repayments, while savers prepare for possible decreases in their interest income. Navigating this landscape will require a nuanced understanding of both local and global economic indicators, as well as the regulatory conditions set forth by bodies like the FCA.

For individuals seeking to make the most of their financial situations, it is advisable to explore different savings options as the market continues to fluctuate. Websites like MoneyHelper provide valuable insights into finding the best savings accounts tailored to unique financial needs, enabling consumers to make informed decisions.

The future remains uncertain, but by understanding the unfolding economic dynamics, borrowers and savers alike can position themselves for a more stable financial footing going forward.

Photo by

Photo by