The Great Mortgage Dilemma: Should UK Homeowners Sell Now?

In the current economic climate, the reluctance of UK homeowners to sell their properties can be largely attributed to skyrocketing mortgage rates. Many are faced with the stark reality of being forced to re-mortgage at significantly higher rates than their current agreements—often double, going from as low as 3.5% to a drastic 7%. This scenario restricts the flow of homes on the market, as potential sellers weigh the risks of losing favorable mortgage terms against their need for a change.

Challenges in the UK housing market: a crisis of affordability

Challenges in the UK housing market: a crisis of affordability

Unlike the United States, where a staggering 92% of mortgages are fixed for extended periods, UK homeowners have been less fortunate. Typical fixed-rate mortgages only extend for a maximum of five years. As a result, the words of financial analysts resonate more than ever; locking in a mortgage at a low rate is increasingly seen as a no-brainer. During the period from mid-2021 to mid-2022, it was clear that UK homeowners should consider securing their rates for the longest possible term.

Many in the US had the opportunity to lock in fixed mortgage rates under 3%, a privilege not shared by UK residents facing rapid inflation and a more volatile lending environment. The divergence between inflation rates and mortgage rates in the UK is stunning. It is entirely unnatural for mortgage rates to sit roughly 4% below the inflation rate, a phenomenon not witnessed since the early 1980s. As we continue to navigate through these inflationary pressures, foreseeing a consistent return to sub-3% rates seems increasingly unlikely.

What Lies Ahead in the Housing Market?

As we look forward, the outlook for mortgage rates remains intertwined with inflation forecasts. Many economists suggest we may not see a return to lower rates anytime soon, with predictions of several waves of inflation set to churn through the UK economy. Those hoping to see the market correct itself significantly might find themselves disappointed.

In fact, with the current mortgage rates hovering around 7.3%, many homeowners who secured their properties with interest rates under 3% are understandably hesitant to remortgage. Their reluctance will likely tighten the supply of homes available for sale, leading to increased competition and prices that are already reaching precarious levels.

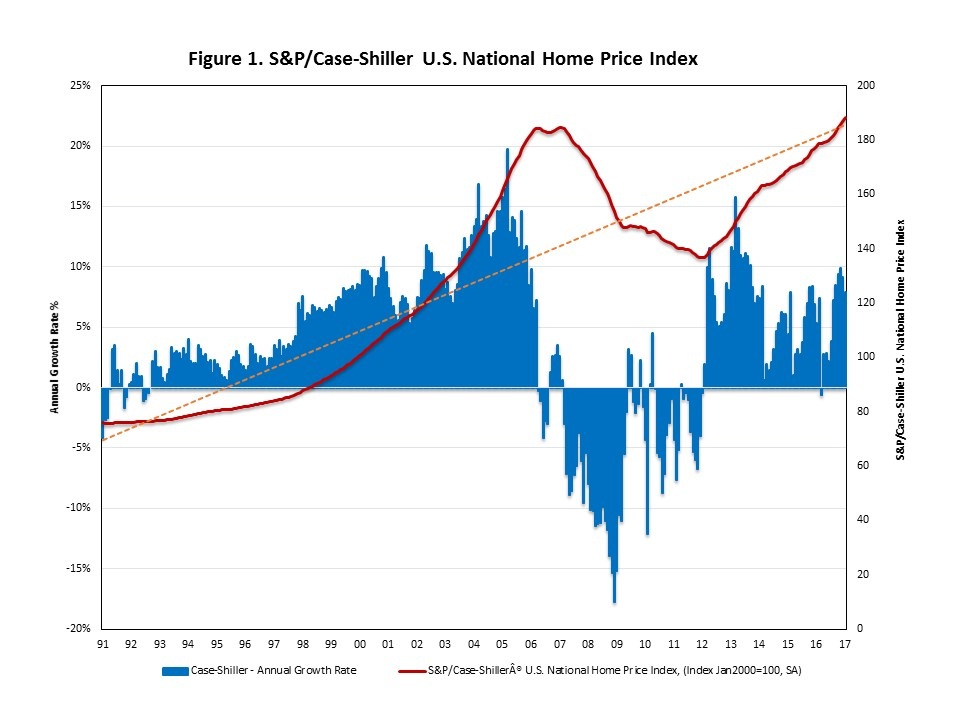

An analysis of home price trends in the UK shows a clear upward trajectory

An analysis of home price trends in the UK shows a clear upward trajectory

As home prices continue to increase, one can expect a rise in new property developments as builders respond to market demands. However, the pressure for existing homeowners to downsize may not be as significant as it once was. Many homeowners may choose instead to ride out this period, opting not to sell unless absolutely necessary.

Final Thoughts

The dynamics of the UK housing market are complex and rife with uncertainty. Homeowners weighing their options must consider not just their current equity but the future landscape of mortgage rates and inflation. As the Federal Reserve navigates this economic labyrinth, their decisions could very well reverberate across the Atlantic.

The undertones of a changing market are palpable, and understanding these nuances will be crucial for anyone wanting to buy or sell in this challenging environment. Ultimately, as the market adapts to higher prices and interest rates, the interplay between supply and demand will shape the future of home ownership in the UK.

For those interested in exploring this further, detailed forecasts and analyses are available. Consider supporting seasoned analysts who provide deep insights into the housing market trends, which could prove invaluable for those planning to make moves in the coming years. Become a Patron and gain first access to detailed analyses here.

Historical trends in mortgage rates lend credence to current predictions

Remember, the decisions faced by homeowners today could have lasting impacts on their financial futures. Being informed is not just advantageous, it is imperative.