UK Mortgage and Housing Market Trends: A Volatile Landscape

The UK mortgage and housing market is experiencing a period of significant volatility, with interest rates rising and expectations for rate cuts fluctuating. According to a recent research report by KBRA, the cost of financing house purchases has been elevated, while house prices are declining. However, mortgage costs and rental prices are migrating higher, with rents rising at double-digit rates.

The State of the Market

The amount of UK residential mortgage-backed securities (RMBS) held by investors has stopped shrinking, with GBP63.3 billion held by investors. Covered bonds remain the capital market mortgage funding choice for banks, with GBP72.8 billion outstanding. However, loan performance demonstrates signs of ongoing deterioration, with delinquencies increasing, particularly in buy-to-let (BTL) pools.

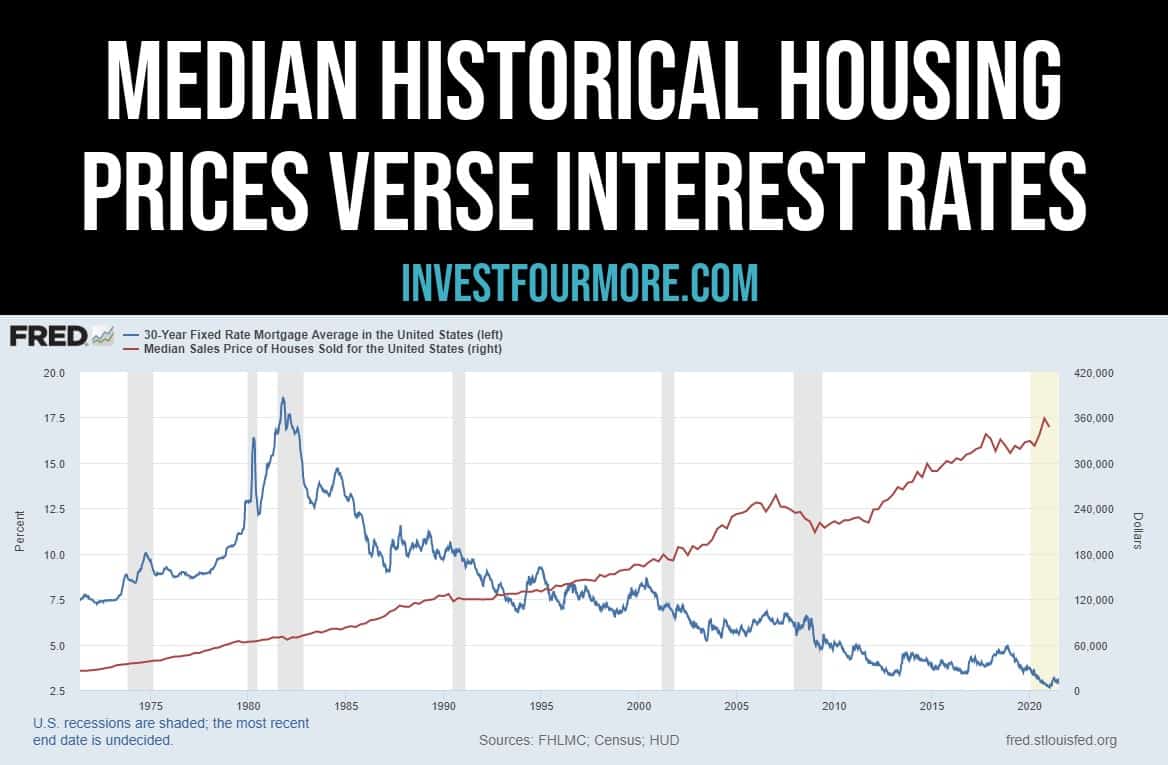

Mortgage rates and house prices are closely linked, but the relationship is becoming increasingly complex.

Mortgage rates and house prices are closely linked, but the relationship is becoming increasingly complex.

Affordability Pressures

Affordability pressures are easing as mortgage rates adjust to rate moves. However, joint incomes now represent 60% of new lending, which is an increasing proportion of mortgage approvals. This suggests that households are stretching further to qualify for mortgages.

First-time buyers are returning to the market, but face significant challenges in securing mortgages.

First-time buyers are returning to the market, but face significant challenges in securing mortgages.

Mortgage Lending and House Prices

Mortgage lending is improving, with house purchase borrowing returning to historical norms. There were 61,325 approvals in Q1 2024, as first-time buyers replace declining BTL volumes. House prices have recently improved, with offer prices up 1.7% in April 2024. Expectations of future declines are waning, with the UK Office for Budget Responsibility (OBR) cutting its forecast for house price declines to only -3% in 2024.

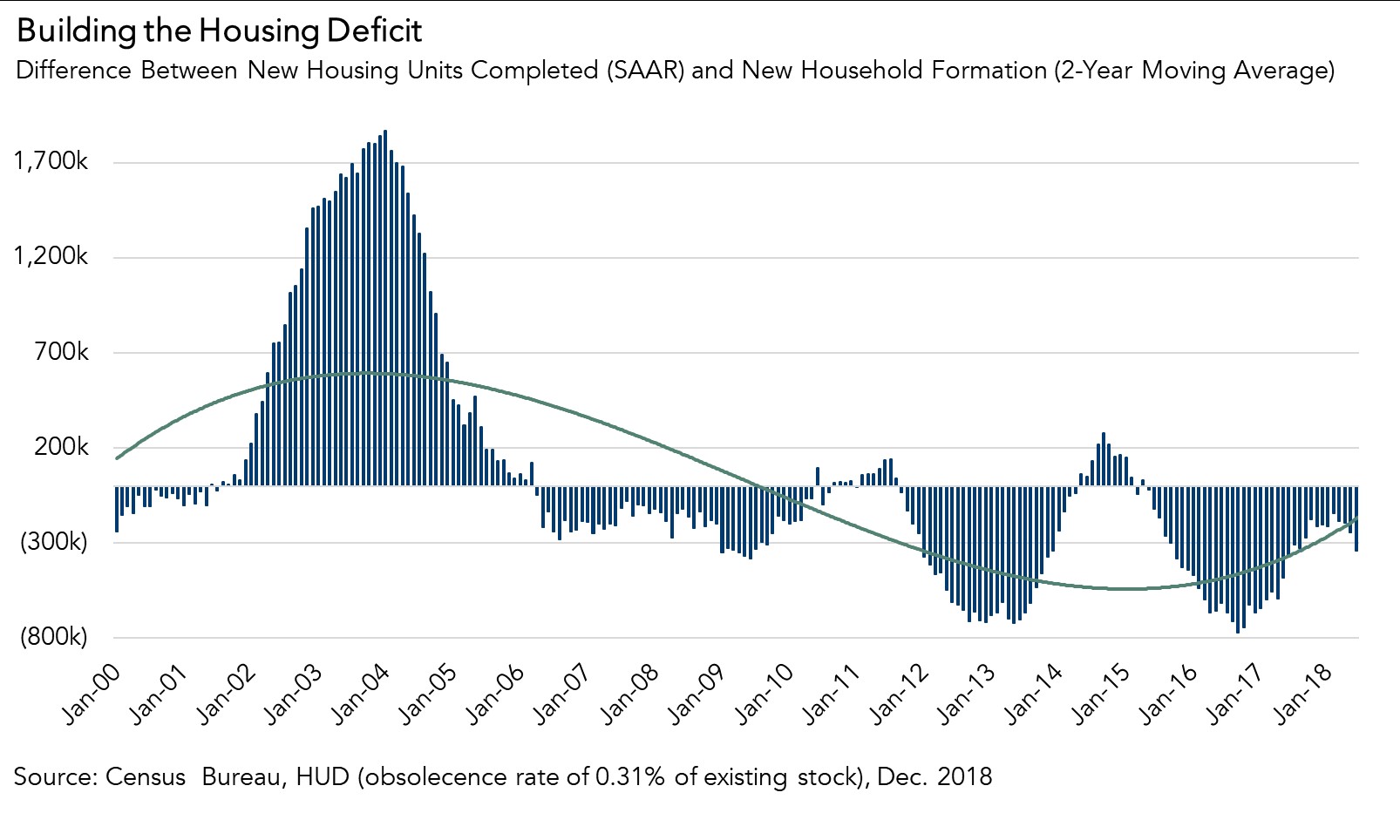

New housing starts are declining, with only 23,360 new starts in Q4 2023, a decline of 40% year-over-year.

New housing starts are declining, with only 23,360 new starts in Q4 2023, a decline of 40% year-over-year.

Conclusion

The UK mortgage and housing market is navigating a complex and challenging landscape. While there are signs of improvement, affordability pressures and supply constraints persist. As the market continues to evolve, it is essential to monitor trends and developments closely.