Navigating the Shifting Landscape of UK Mortgages and Political Dynamics

The UK is facing a significant transformation in its mortgage market, coinciding with politically charged discussions that could influence economic growth. Rates are falling, and as major banking institutions prepare to announce their financial results, the question on everyone’s mind is whether consumers are truly benefiting from these shifts.

Cheaper Mortgages: A Silver Lining for Borrowers?

With the economic landscape fraught with uncertainty, borrowers might finally be seeing some relief. Major banks such as Lloyds, Barclays, and NatWest are set to unveil their third-quarter financial results, illuminating the extent to which recent interest rate cuts are translating to lower borrowing costs.

Major banks are set to reveal their latest financial results, shedding light on the mortgage market.

Major banks are set to reveal their latest financial results, shedding light on the mortgage market.

As per analysts, the banking sector has shown resilience in recent months, with borrowing costs appearing to normalize after a peak. Matt Britzman, senior equity analyst at Hargreaves Lansdown, notes that following the Bank of England’s first rate cut in July, there is growing anticipation regarding how much of this decrease will be passed on to consumers. In July, Lloyds reported a decline in net interest income, which hints at a competitive mortgage market where borrowers could find better deals.

The Impact of Political Decisions on Mortgage Rates

However, the positive momentum in the mortgage market is shadowed by political uncertainties, particularly ahead of Chancellor Rachel Reeves’ first Budget announcement set for October 30. Analysts observe that this looming Budget may lead some borrowers to hesitate in moving forward with decisions, as they await clarity on tax thresholds and potential cuts to welfare programs.

In terms of earnings, Barclays expects to report marginal improvement from the previous year, while NatWest is also predicted to perform better than last year. Investors remain cautious but optimistic about the future direction of the market as lending activity starts showing tentative signs of improvement.

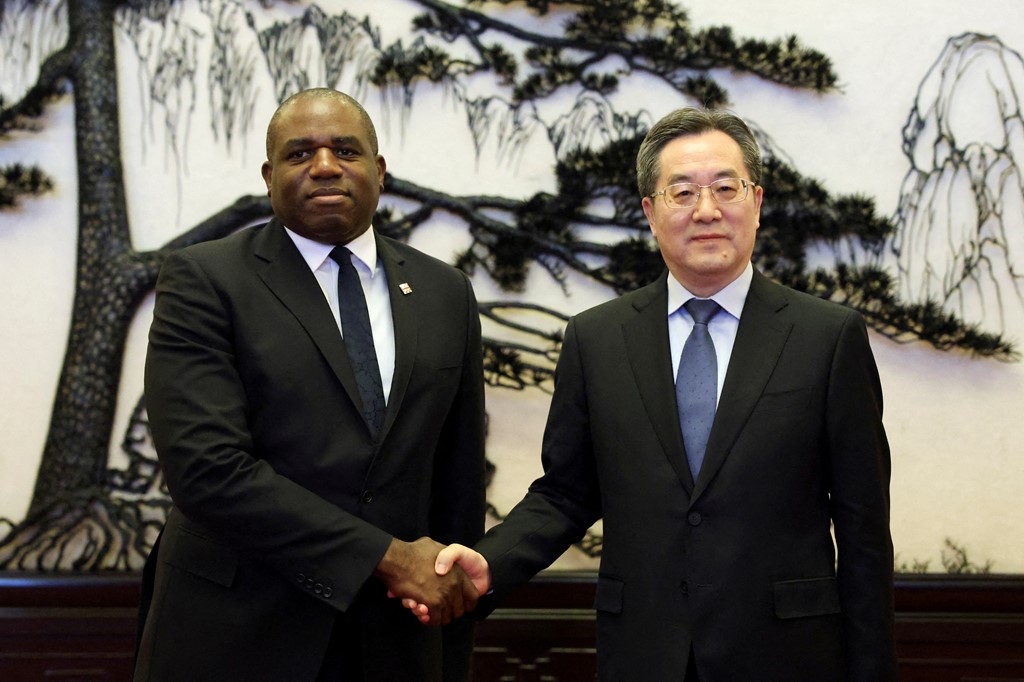

Expanding into Global Relations: David Lammy’s Visit to China

In another realm, UK Foreign Secretary David Lammy’s recent trip to Beijing underscores the government’s approach to intertwining domestic economic growth with international relations. Lammy’s visit, the first of his tenure, signals the importance of a pragmatic stance towards China, particularly in light of its political support for Russia amid ongoing geopolitical tensions.

During meetings in Beijing and Shanghai, Lammy emphasized that the UK’s relationship with China is crucial due to the global economy’s interconnectedness. He stated, “Engagement with China is pragmatic and necessary to support UK and global interests.”

Lammy’s discussions in Beijing aim to address critical global issues, including trade and climate change.

Lammy’s discussions in Beijing aim to address critical global issues, including trade and climate change.

This visit not only aims to enhance economic ties but also serves as a strategic move to challenge China’s support for Russia’s actions in Ukraine. Lammy asserted that dialogues will range from climate issues to pressing foreign policy challenges. The UK’s approach will be, as stated by the Foreign Office, one of “serious, stable and pragmatic reengagement,” recognizing that while cooperation is necessary, there will be disagreements on key issues like democratic freedoms and the situation in Hong Kong.

Balancing Act: Morality and Market Dynamics

As the UK government seeks to navigate its relationship with China, it must also balance domestic economic needs with international diplomacy. The intertwining of these issues highlights a complex balancing act wherein financial stability is paramount yet must align with ethical stances on global crises. Lammy’s insistence on engaging with China pragmatically is indeed reflective of broader economic strategies that acknowledge the hard choices ahead, especially as the UK prepares for the December budget.

As Ozzy Osbourne reminded us during his recent Rock & Roll Hall of Fame induction—where he acknowledged not only his musical journey but also the personal struggles and relationships that defined his career—addressing economic turbulence requires both introspection and external engagement. The critical choices that lie ahead for not just the markets but also the political landscape in the UK will define the country’s growth trajectory in the coming years.

Diverse influences from culture to politics shape the economic discourse in the UK.

Diverse influences from culture to politics shape the economic discourse in the UK.

In conclusion, whether it’s through the lens of more favorable mortgage conditions or Lammy’s pivotal meetings in Beijing, the interconnected nature of today’s globalized economy is evident. The government stands at a crossroads as it makes decisions that will not only shape the financial markets but also the broader socio-political relationships crucial for the UK’s standing on the global stage.

Photo by

Photo by