Budget 2024: What Mortgage Borrowers Need to Know

As the dust settles from this week’s Budget announcement, mortgage borrowers are facing a conundrum: while the Bank of England is expected to announce a base rate cut soon, the broader implications of recent fiscal policies could mean that rates take longer to fall. This confusion is fueled by a predicted rise in inflation threatening to keep interest rates elevated for an extended period.

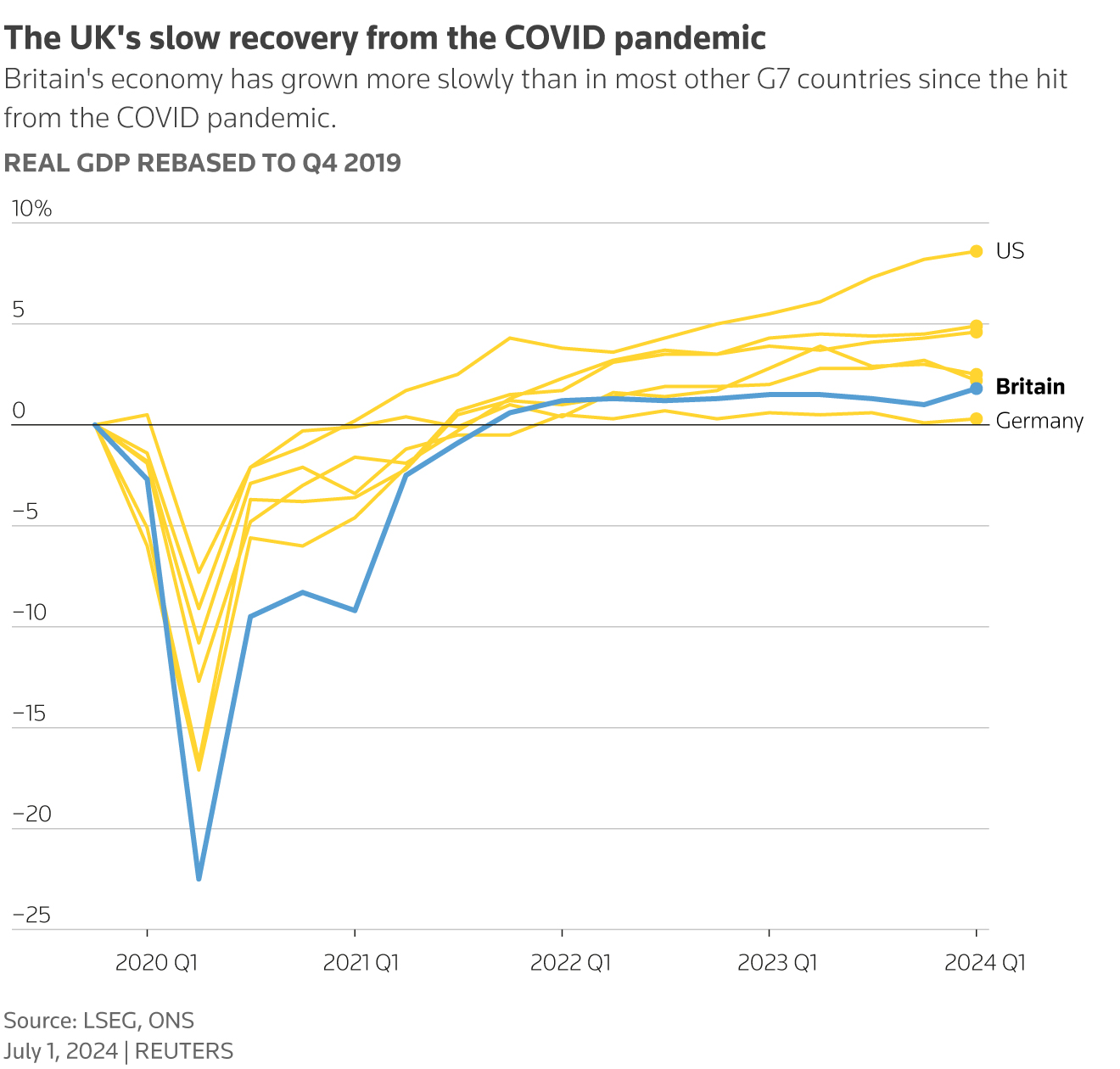

A visual representation of current mortgage trends in the UK.

The Current Economic Landscape

The aftermath of the Budget has provoked jitters within the money markets, raising questions about the viability of forthcoming rate cuts. Under Governor Andrew Bailey’s stewardship, the Bank of England could face pressure to temper expectations if inflation trends upward again. The anticipated rate cut next week may become a solitary drop, with further reductions seemingly pushed to the sidelines, as experts have adjusted their forecasts regarding future cuts.

David Hollingworth, an associate director at L&C Mortgages, articulated the confusion surrounding fixed rates with clarity: “It’s confusing times for mortgage borrowers when expectation is for a base rate cut next week but fixed rates look set to rise.” This statement underscores the uncertainty surrounding the market dynamics that will affect borrowers’ decisions going forward.

Inflation and Its Repercussions

Compounding these concerns is the government’s decision to increase employers’ national insurance contributions, a move likely to drive inflation higher as businesses look to offset increased costs. The Office for Budget Responsibility has revised its inflation forecast for next year from 1.5% to 2.6%, highlighting a significant shift in the economic outlook.

An illustration representing the fluctuations of the UK economy post-Budget.

An illustration representing the fluctuations of the UK economy post-Budget.

The ramifications of this approach are already palpable. The yield on UK government bonds, known as gilts, has surged close to 4.5%, indicating that the government’s borrowing costs are on the rise. As borrowing expenses escalate, so do market anxieties — the pound has encountered its longest streak of weekly losses in six years, a trend that adds to the overall climate of uncertainty.

Chancellor Rachel Reeves, in response to mounting pressures, has assured the public of her confidence in stabilizing the country’s public finances. She stated, “Markets will move on any given day but we have now put our public finances on a firm footing.” Yet, this assertion is met with skepticism — Chief Secretary to the Treasury, Darren Jones, acknowledged lingering fears from previous leadership decisions, suggesting the public and market participants are not quick to forget the turmoil inflicted by Liz Truss’s tenure.

Rating Agencies Weigh In

In light of these developments, credit ratings agency Moody’s has expressed concerns regarding the Chancellor’s approach to borrowing. They caution that the recent fiscal loosening could pose further challenges to the UK’s efforts to mend its public finances. Analysts predict that the UK will experience prolonged periods of subdued economic growth, raising additional red flags for potential future investments.

Investors examining market responses amid budgetary changes.

Investors examining market responses amid budgetary changes.

Future Outlook for Borrowers

As the landscape remains precarious, borrowers contemplating fixed-rate mortgages are urged to act swiftly. The advice comes amidst uncertainty about how long current rates will maintain stability. Market analysts suggest that if rates do not ease soon, we may witness a significant uptick in fixed mortgage rates, forcing potential borrowers to either accept less optimal deals or wait with bated breath for more favorable conditions.

Conclusion

While the immediate future holds the promise of some fiscal relief with anticipated rate cuts, the broader implications of this Budget are complex. The cautionary tales of past government decisions linger heavy in the public’s consciousness, shaping their expectations for both personal finance and national economic strategy. As such, mortgage borrowers find themselves navigating a labyrinth of market variables that could redefine their financial decisions in the coming year.

The advice for borrowers, therefore, is clear: be vigilant, stay informed, and consider securing a fixed-rate mortgage sooner rather than later, amid prevailing market uncertainties.

A conceptual representation of financial planning and decision-making.

A conceptual representation of financial planning and decision-making.